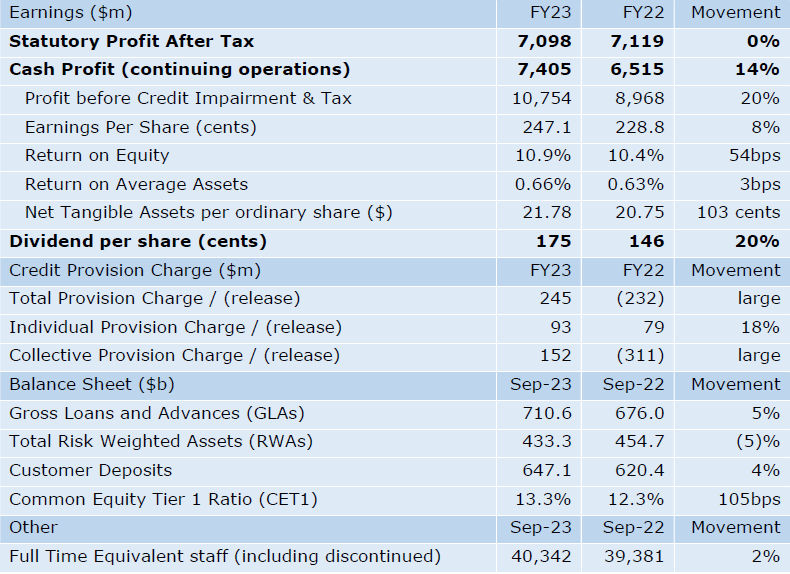

ANZ today announced an audited[1] Statutory Profit after tax for the full year ended 30 September 2023 of $7,098 million, flat on the previous year.

Cash Profit[2] from continuing operations was $7,405 million, up 14% when compared with the prior year.

ANZ’s Common Equity Tier 1 Ratio was 13.3% and Cash Return on Equity was 10.9%. The proposed 2023 Final Dividend is 94 cents per share (cps), comprising an 81cps dividend partially franked at 65% and an additional one-off unfranked dividend of 13cps.[3]

GROUP FINANCIAL INFORMATION

ANZ Chief Executive Officer, Shayne Elliott, said: “This is a strong annual result, with record revenue[2] and cash profit following several years of transformation, enabling us to continue to support our customers and improve their banking experience.

“We continued to strengthen our balance sheet and closed the year with provisions for potential credit losses higher than prior to the pandemic, and with more capital than ever before. This is critical as we enter a period of continued high interest rates, rising costs and geopolitical tensions.

“While our first half was stronger, the second half delivered an outstanding revenue and profit result, demonstrating the benefits of our diversified franchise.”

“We carefully managed costs to partially offset the high inflation environment, while continuing to invest in initiatives that will set us up for sustainable long-term success. These investments include our Institutional payments platforms that supported $164 trillion in transaction flows through the year, the continued migration of services to the cloud and our new retail business ANZ Plus.

“Importantly, each of our core divisions contributed positively to the result. They all have a clear strategy and a funded roadmap to deliver sustainably better outcomes for customers, in line with our purpose.

“In Australia Retail, our ongoing investment in home loan processing supported consistent turnaround times which, coupled with ongoing digitisation for deposit account opening, resulted in high-quality growth in our retail balance sheet. Investments to protect customers from scams and fraud continue. Pleasingly, we detected and prevented more than $100 million of potential customer losses, up 38% from last year.

“Just 18 months since launching, ANZ Plus has become one of the fastest growing digital banking platforms in Australia. As of today, it has attracted more than 500,000 customers and over $10 billion in deposits. The cost of operating ANZ Plus is materially lower than our existing retail business and we are seeing high levels of customer engagement and satisfaction. Importantly, the advanced security measures on ANZ Plus resulted in one of the lowest incidences of digital fraud in the industry.

“This month we have released our new ANZ Plus digital home loan refinance product to eligible customers, designed to make home lending faster and simpler for Australian homeowners.

“Australia Commercial is our highest returning division and delivered 11% revenue growth in the year. Lending grew to a record high of $62 billion. Deposits also grew, showing the underlying resilience of our SME customers. We were pleased to have supported over 1,000 small businesses through our online unsecured lending platform, GoBiz, which like ANZ Plus delivers better customer outcomes at lower cost.

“Our Institutional Division produced record financial results, reflecting the benefits of long-term investment and transformation. For the first time, all three of its core businesses, Transaction Banking, Corporate Finance and Markets, generated more than $2 billion each in revenue. “Transaction Banking recorded its highest ever annual revenue, servicing some of the world’s largest companies and financial institutions.

“The strength of our New Zealand Division was once again evident as we maintained our leading market position in home loans, retail deposits, business banking, agriculture and funds management. ANZ New Zealand delivered consistent financial results while helping customers navigate a difficult environment due to continued inflation, high interest rates and extreme weather events.

“Overall, this is a strong result reflecting the benefits of our consistent strategy and a well-diversified portfolio of businesses,” Mr Elliott said.

CREDIT QUALITY

The total credit provision result for the full year on a cash continuing basis was a net charge of $245 million comprising:

- a collective provision (CP) charge of $152 million

- an individually assessed provision (IP) charge of $93 million

There was a small release of $11 million in CP in the second half, which combined with an IP charge of $123 million resulted in a second half net credit impairment charge of $112 million.

CP overlays for increased risks associated with rising inflation, higher interest rates as well as increased geopolitical tensions have been largely retained. As a result, our CP balance at 30 September 2023 was $4,032 million.

ANZ Banking Group’s capital position remains strong, with a Common Equity Tier 1 Ratio of 13.3%, an increase of 16 basis points since March 2023. This includes capital being held for the proposed acquisition of Suncorp Bank.

The proposed 2023 Final Dividend is 94cps, partially franked at 56%. This comprises an 81cps dividend partially franked at 65%, and an additional one-off unfranked dividend of 13cps.

The level of franking reflects the geographically diverse nature of our business, as well as the timing of the proposed Suncorp Bank transaction. The Board recognised that lower franking may not have been anticipated by some shareholders. In recognition of this, and given our strong performance, the Board agreed that the one-off unfranked dividend was appropriate.

SUNCORP BANK

In July 2022, we announced plans to acquire Suncorp Bank to add scale to our Retail and Commercial businesses and enable ANZ to more effectively compete in the Australian market. In August this year, the Australian Competition and Consumer Commission (ACCC) announced its decision not to grant authorisation.

ANZ has filed an application with the Australian Competition Tribunal for review of the ACCC’s decision, and a decision is expected in February 2024. If ANZ’s application is successful, completion would then remain subject to approval from the Federal Treasurer and the passage of legislative amendments by the Queensland Parliament. We continue preparations to integrate Suncorp Bank into ANZ Group, subject to these conditions being met.