The High Court of Australia has today dismissed the ACCC’s application for special leave to appeal from the Full Federal Court’s decision that Pacific ³Ô¹ÏÍøÕ¾’s acquisition of the Acacia Ridge terminal from Aurizon (ASX: AZJ) would not be likely to substantially lessen competition.

The dismissal of the ACCC’s application for special leave means that t, and Pacific ³Ô¹ÏÍøÕ¾ can proceed with its acquisition of the Acacia Ridge Terminal.

“The ACCC sought special leave to appeal to the High Court because we considered that this case raised important issues about the application of Australia’s merger laws,” ACCC Chair Rod Sims said.

“This case also involved important markets. We considered that Pacific ³Ô¹ÏÍøÕ¾’s acquisition of the Acacia Ridge terminal would likely have a significant impact on competition in intermodel rail, with flow-on effects for consumers and the wider economy.”

“The ACCC’s case centred around the proposed acquisition of the Acacia Ridge intermodal terminal in Brisbane. With the acquisition set to proceed, Australia will be left in the position where the dominant intermodal rail linehaul services provider will also own the critical infrastructure that potential competitors need to access in order to compete,” Mr Sims said.

“The ACCC faces challenges in contested merger cases where a forward looking merger test is applied. The nature of the test, and the inherent uncertainties in predicting the future, make it difficult to prove that a change in the market structure after the merger will substantially lessen competition in the future.”

“This task is further complicated by the need to prove that competition is likely to be substantially lessened compared to a hypothetical future in which the acquisition did not occur,” Mr Sims said.

“These challenges raise important issues for the consideration of whether Australia’s current merger laws are fit for purpose.”

Note

Pacific ³Ô¹ÏÍøÕ¾ is by far the largest provider of intermodal rail freight services in Australia.

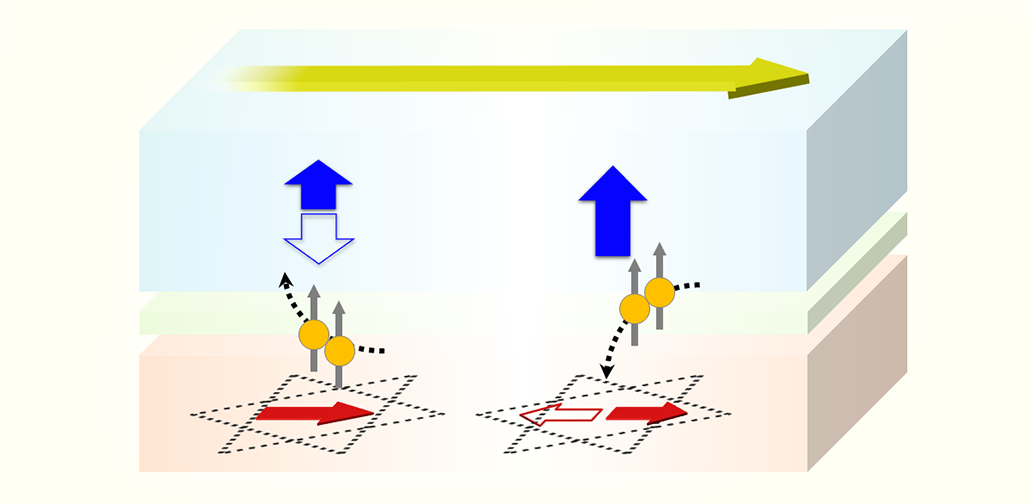

The term ‘intermodal’ freight is used to describe the carriage of general freight usually in a container using two or more modes of transportation, such as truck and rail. ‘Intermodal rail linehaul’ refers to the rail leg of the movement of intermodal freight.

An intermodal terminal, such as the Acacia Ridge Terminal, is a piece of infrastructure with a connection to a rail line where containers can be transferred between transportation modes.

Background

The ACCC on 18 July 2018 alleging that Pacific ³Ô¹ÏÍøÕ¾’s acquisition of the Acacia Ridge Terminal from Aurizon would have the likely effect of substantially lessening competition in contravention of section 50 of the CCA.

The ACCC was concerned that the proposed acquisition of the Acacia Ridge Terminal would deter a new entrant from providing interstate rail linehaul services in competition with Pacific ³Ô¹ÏÍøÕ¾.

The ACCC commenced a public investigation of Aurizon’s proposed exit plans, including the proposed acquisitions by Pacific ³Ô¹ÏÍøÕ¾ of the Acacia Ridge Terminal and Queensland intermodal business on 27 October 2017. The ACCC on 15 March 2018.

The ACCC succeeded in obtaining an interlocutory injunction from the Federal Court restraining Aurizon from the announced closure of its Queensland intermodal business. That business was subsequently purchased by Linfox.

Following a lengthy hearing, the Federal Court on 15 May 2019, finding that, given Pacific ³Ô¹ÏÍøÕ¾’s access undertaking accepted by the Court, the acquisition of the Acacia Ridge Terminal by Pacific ³Ô¹ÏÍøÕ¾ would not be likely to substantially lessen competition.

The ACCC on 27 June 2019. On 6 May 2020, the .

The ACCC applied for special leave to appeal to the High Court on 26 June 2020.