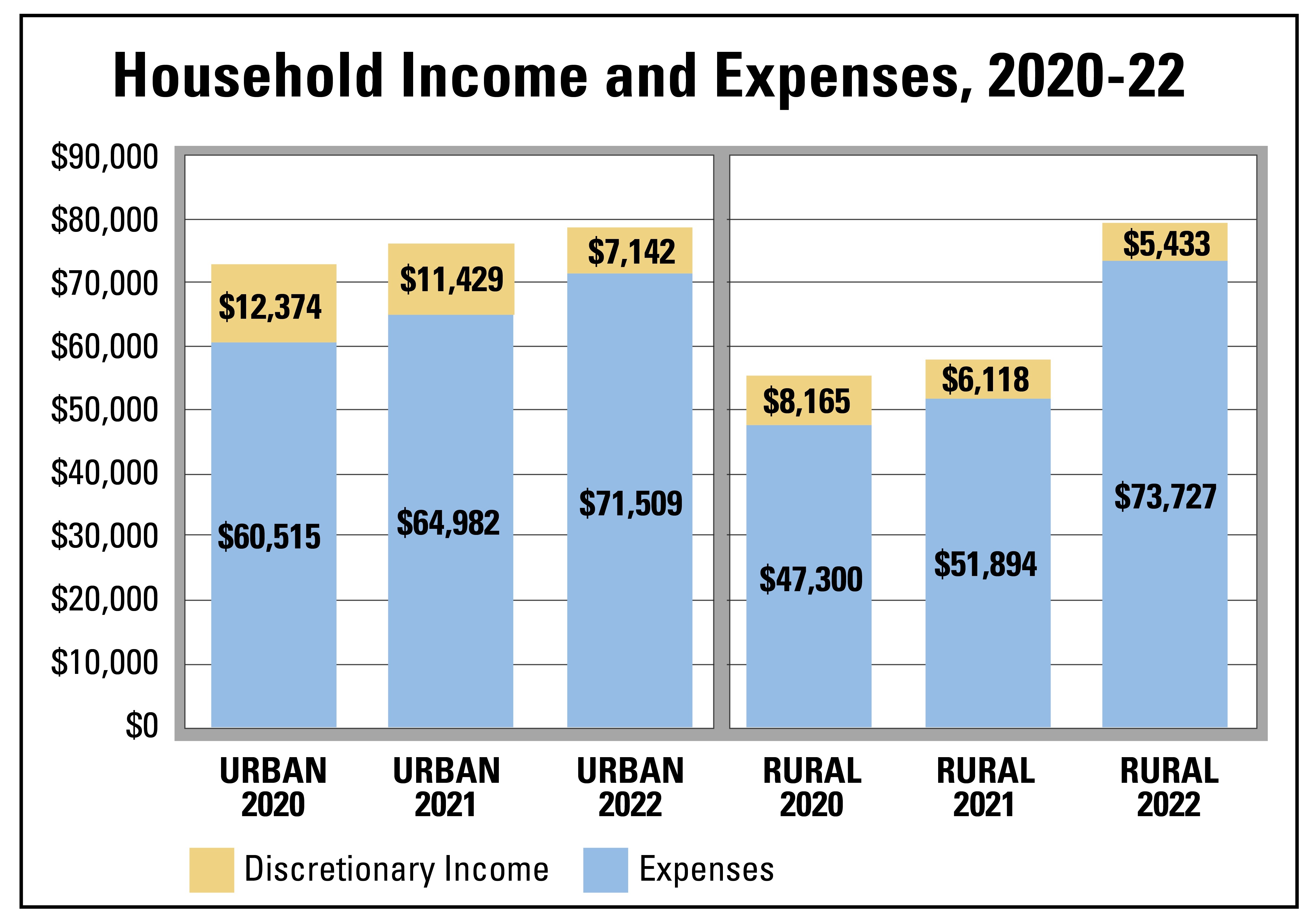

An analysis by Iowa State University sociology professor David Peters shows the average discretionary income dropped in all U.S. households from 2020 to 2022, but the decrease has been worse in rural areas. . Graphic by David Peters and Deb Berger/Iowa State University.

AMES, Iowa – Inflation took a bigger bite of rural household budgets throughout much of 2022, but its effects were similar in rural and urban areas by the end of the year, according to a report by an Iowa State University professor.

The widely cited inflation data released monthly by the U.S. Bureau of Labor Statistics (BLS) is the common benchmark for tracking price changes. It’s a crucial gauge that swings financial markets and drives policy decisions. But as a national measurement, that data – called the consumer price index (CPI) – has some limitations. While it breaks out inflation rates for nine geographic areas, it doesn’t account for rural prices. The surveys used for CPI calculations are only conducted in urban areas.

So when people asked David Peters how hard inflation was hitting rural Iowa, he didn’t have a ready answer beyond anecdotes. Now he has at least a rough idea. Peters, a professor of sociology and a rural sociologist for ISU Extension and Outreach, combined CPI rates for various goods and services with urban and rural spending patterns from the BLS consumer expenditure survey to estimate how rising prices have affected households in both types of living areas. After releasing an initial version in July 2022, Peters updated the .

Peters’ analysis shows that rural households were paying an extra $300 per month because of inflation in 2021, but the urban-rural gap in additional expenses was modest, fluctuating between about $15 per month either way. But when transportation costs shot up starting in early 2022, largely due to higher gas prices, rural households felt it more. For the first two-thirds of the year, inflation cost rural households at least an extra $450 per month – between $60 and $90 more than urban households.

“People who live in rural areas drive everywhere, so they’re impacted more by higher gas and diesel prices,” Peters said.

Rural life typically involves more driving because jobs, schools, stores and services are spread out farther, he said. Alternatives such as public transportation and car pools are far less available, and vehicles tend to be older and less fuel efficient. The BLS data used for the analysis defines rural as living in neither a city with a population above 2,500 nor a county that’s part of a metropolitan area.

The urban-rural gap began shrinking in the back half of 2022 as gas prices trended down and urban areas saw larger increases in housing and utility costs. Rural households in December 2022 saw an expense increase over December 2021 ($285) that was about $10 lower than the increase for urban households.

Rising prices have been a potent drag on all household budgets but especially in rural areas, where expenses over the two-year period ending in December increased by $8,120 (compared to $7,480 for urban households). Strong farming revenue helped drive rural income up over that time, but not enough to keep pace with expenses. From 2020 to 2022, discretionary income in urban households fell from $12,374 to $7,142. In rural areas over the same period, discretionary incomes fell from $8,165 to $5,433, leaving about $450 free per month.

“Even though inflation has backed off a bit, the situation is much the same for rural households. They have less of a financial cushion,” Peters said.

Though price increases are slowing, inflation has a cumulative effect, he said. Higher prices usually stay high, making it harder to take on spending that was delayed as expenses were rising sharply.

“Bills and needs stack up when budgets get tight. I think a lot of people feel like they haven’t crawled out yet, and there’s still a lot of uncertainty,” Peters said.

Peters said he plans to continue tracking the rural impact of inflation, as needed. Concerning trends moving forward include rising health insurance costs – the second-highest source of additional expense for rural households in 2022, with an increase of more than $600. Pricier premiums for health plans sting more in rural areas because employee-subsidized coverage is less common, he said.

Assessing how inflation affects rural households is important in part due to their lower discretionary incomes, Peters said. With little financial wiggle room, rural families are more vulnerable to unexpected misfortunes such as medical emergencies and vehicle and home repairs.

“When there’s not enough discretionary income to cover those big-ticket bills, that’s what leads to debt,” he said.