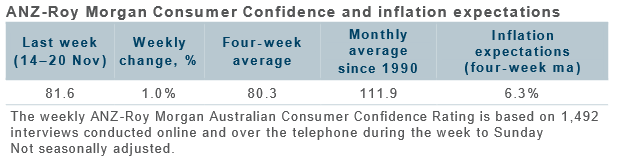

• Consumer confidence gained 1 per cent, its second consecutive weekly gain. Among the mainland states, confidence declined in NSW and Queensland, while it increased in Victoria, SA, and WA.

• “Weekly inflation expectations” dropped 0.2ppt to 6.3 per cent, while its four-week moving average rose 0.1ppt to 6.6 per cent.

• Three of the five sub-indices declined. “Current financial conditions” fell 3.6 per cent, dropping to its lowest since the start of the pandemic in late March 2020. ‘Future financial conditions’ lost 2.2 per cent after a 4.9 per cent gain the week before.

• “Current economic conditions” dropped 2.5 per cent, after an 8.5 per cent jump the week before. ‘Future economic conditions’ gained 4 per cent.

• “Time to buy a major household item” rebounded 9.2 per cent, after a cumulative decline of 13 per cent over the previous six weeks.

ANZ Head of Australian Economics, David Plank, commented: “Consumer confidence increased 1 per cent last week, likely boosted by solid employment growth in October and a further easing in inflation expectations. Household inflation expectations (IE) eased to 6.3 per cent, but this is the sixth consecutive week with IE above 6 per cent.

“Despite the consecutive gains, sentiment remains close to levels last seen during the early weeks of the COVID lockdowns. Critically, though, ANZ-observed spending data suggests that consumer spending has stayed strong, with spending momentum similar to pre-pandemic levels. The jump in whether “it is a good time to buy a major household item” may signal sentiment regarding purchases on Black Friday this week.”