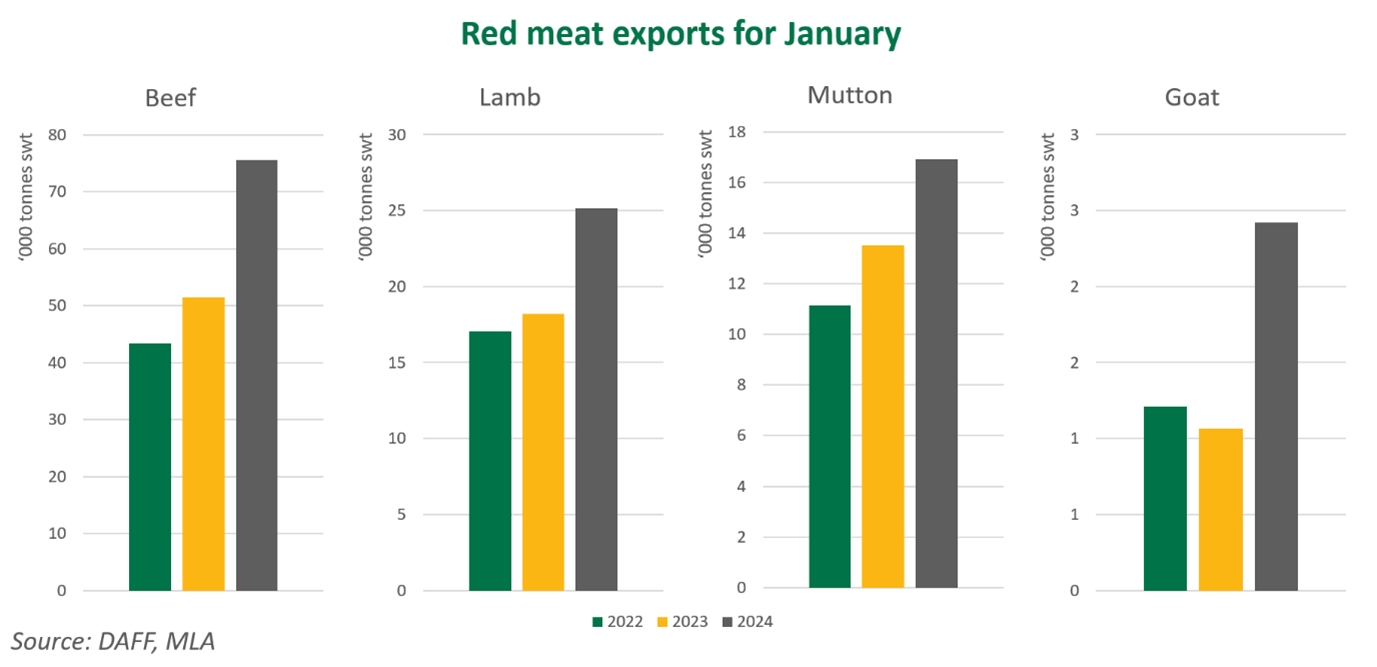

Key points:

- Lamb and mutton exports for January are the highest on record.

- Beef exports are the second highest on record, after January 2020.

- The USA was the largest market for beef, lamb, goat and red meat overall, while China was the largest market for mutton.

Australian red meat exports have started off strong in January, with total red meat exports 41% higher than January 2023 at 133,146 shipped weight tonnes (swt). Relatively high weekly slaughter across December and January has translated into higher export volumes, and lower production in the United States has generated demand for red meat in North America, resulting in export volumes more than doubling.

Beef

Exports of Australian beef lifted by 47% year-on-year to 75,585 swt, the second-highest January export figure on record after January 2020.

While exports lifted in all markets, exports were particularly strong in North America, lifting 127% year-on-year (Y-o-Y) in the USA to 20,308 swt and 380% Y-o-Y in Canada to 1,096 swt. US cattle slaughter for January was down 7% from 2023 and 23% from 2022, and as American slaughter continues to fall it is likely that Australian beef continues to be exported in large volumes to make up the shortfall.

Exports to other major markets lifted markedly. Exports to Japan and China both rose 37% Y-o-Y to 16,331 swt and 16,185 swt respectively, and exports to South Korea rose 15% Y-o-Y to 11,682 swt. Unusually, the Philippines was the fifth largest market for the month, with exports lifting 180% Y-o-Y to 2,343 swt, while Indonesia was the only major market to see a decline in export volumes, with exports falling 81% Y-o-Y to 341 swt as the Indonesian government has not yet provided import permits.

Lamb

Lamb exports rose 38% Y-o-Y to 25,174 swt, the largest January export volume on record. Following record high production in 2023, exports are continuing to rise, especially as weekly slaughter numbers maintain a strong pace.

Most of the lift in volume has come from an increase in chilled exports, a reversal of the trend in 2023, when frozen export volumes tended to lift more. Exports of frozen lamb have lifted by 20% Y-o-Y to 14,008 swt, while exports of chilled lamb have risen by 71% from last year to 11,166 swt and made up 44% of exports over the month, compared to 36% in January 2023.

Mutton

Mutton exports rose by 25% Y-o-Y to 16,912 swt. China remained the largest market, with exports rising 12% Y-o-Y to 6,671 tonnes, but the bulk of the increase came from the Middle East and North Africa (MENA) region, where exports lifted 56% Y-o-Y to 3,569 tonnes. Saudi Arabia remained the largest mutton market in the region, with exports rising 44% Y-o-Y to 1,181 tonnes, but exports grew across the region as a whole, with volumes doubling in Mauritius, quadrupling in Qatar and increasing five-fold in Kuwait. The MENA region remains a key opportunity for Australian red meat exports, as detailed in the recently released .

Looking forward

With a small American cattle herd and a relatively flat outlook from competitor exporters in South America and New Zealand, global red meat demand is likely to be fairly robust over the year and the outlook for Australian exports is strong. Export volumes are rising in both our mature and emerging markets, and 2024 offers a strong opportunity for Australia to build market share around the world.

Attribute content to: Tim Jackson, Global supply analyst

Latest news