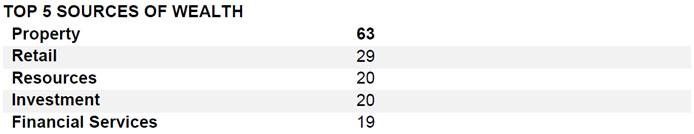

• Property remains top source of wealth despite the housing slump

• Technology is the fastest way to grow wealth

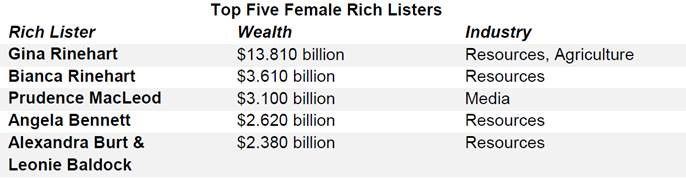

• 26 women on the 2019 Rich List, up from 17 in 2018

• Cut-off for the Rich List is $427 million, up from $387 million in 2018

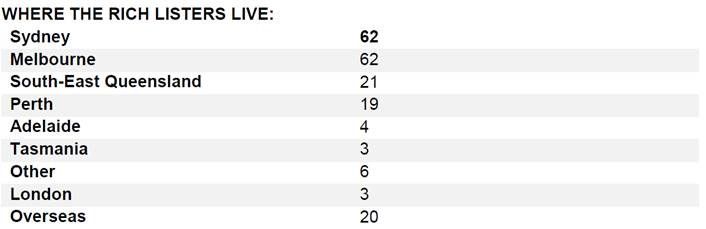

• Sydney and Melbourne tied for where most Rich Listers live

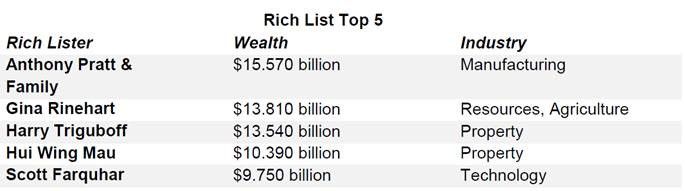

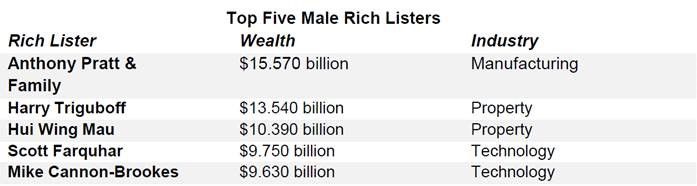

The pre-eminent survey of wealth in Australia, Financial Review Rich List, has named paper and packaging magnate Anthony Pratt as Australia’s richest man with wealth tracking at $15 billion.

The Rich List has tracked Australia’s wealthiest people since 1983 when it was first published in BRW and limited to 100 people. It expanded to 200 people the following year when the total value of Australia’s wealthiest individuals and families was just $7 billion – and now that figure exceeds $330 billion, up from $282 billion in 2018.

The elite “ten-digit club” – those with wealth exceeding $10 billion – has grown to four members to include Mr Pratt, iron ore magnate Gina Rinehart, apartment development veteran Harry Triguboff and a new member, Chairman of Shimao Group, Hui Wing Mau.

“The Financial Review Rich List is the most long-standing, credible and comprehensive stocktake of the nation’s most affluent wealth creators,” said Financial Review editor-in-chief, Michael Stutchbury. “It’s the biggest exercise in business journalism in the country and this year we’ve made it bigger by revealing the 50 people who almost made the list of Australia’s richest 200 people.”

Based on the Financial Review’s unrivalled and constantly updated database, the 2019 Rich List includes a record 91 billionaires, including Australia’s “mystery billionaire” Vivek Seghal, an Indian-born manufacturer who obtained citizenship in 1996 and is worth $5.5 billion. Seven individuals and families have seen their fortunes swell in the last 12 months to be inducted into the billion-dollar club, including Merivale Group owner Justin Hemmes, whose wealth now tracks at $1.06 billion.

Despite the fall in residential property prices in Australia’s largest cities, property remains the top source of wealth for Rich Listers. All of the property developers increased their wealth, led by Harry Triguboff (3) whose fortune rose from $12.77 billion to $13.54 billion.

Technology is the fastest way to wealth, with the 2019 Rich List containing a record 14 tech entrepreneurs including the founders of Atlassian, who are in the top 10 for the first time: Scott Farquhar is fifth, worth $9.75 billion, while Mike Cannon-Brookes is in sixth position with a $9.63 billion fortune.

The Rich List has 17 debutants including:

• Peter, Andrew and Lex Grensill (75th) from Bundaberg in Queensland, who invested money from their family’s watermelon farm into a supply chain financing business that has increased their wealth to $1.21 billion.

• Zeljko Ranogajec (164th), a gambling partner of MONA founder David Walsh who is worth $600 million.

• Ian Malouf (159th) who founded Dial A Dump in the 1980s, which in February was sold to Bingo Industries for $500 million.

“With more billionaires than ever before, more technologists and the ascension of the Murdoch family, the 37th annual Financial Review Rich List is a fascinating insight into the wealth of Australia, with some fascinating trends starting to take shape,” Rich List editor Michael Bailey said.

“The impact of US President Donald Trump can be felt, causing division at the top of the Rich List. His slashing of the corporate tax rate and granting of instant write-offs for business investment has bolstered the bottom line of Anthony Pratt.”

The Rich List issue of AFR Magazine includes exclusive interviews with founder of Iflix Patrick Grove, Hungry Jack’s owner Jack Cowin, groundbreaking entrepreneur Imelda Roache and property developer Lang Walker.

For the first time, the Rich List has also revealed the valuations of the 50 people who came closest to making it, including many former members who have been overtaken and some up-and-comers who appear destined to become Rich Listers themselves.

The Rich List is calculated by the Rich List editors and a team of researchers. Valuations are minimum estimates calculated by using publicly available data and confidential consultation with those on the list. Listed company valuations are a three-month average calculated in the first week of April while valuations of private companies are typically determined using profit margins and price-earnings ratios of comparable publicly listed companies. Taxation and debt levels are also taken into account, with any assumptions based on the age, history and industries of the Rich List member.

The Rich List issue of AFR Magazine will be available for $4.95 from select newsagents throughout June. The Rich List is also available on .