The spread of Covid-19 rattled stock markets around the world last week and managed money went looking for safe havens. Global economic growth forecasts have been revised lower as news of fresh virus outbreaks in Italy and Iran, and further cases in the likes of Japan and South Korea, led many to conclude the disruption will extend well-beyond China.

While the rest of the world grapples with how to deal with Covid-19, China is showing some signs that business activity is recovering. Meanwhile, fuelled by much-needed rain, Australian cattle, lamb and sheep prices aren’t reflecting the uncertain global outlook as they venture into record territory.

China gridlock reflected in exports

February business activity slumped in China, which is typical post lunar new year, but was more pronounced and prolonged, driven by employee travel restrictions preventing plants and workplaces from re-opening, and the freight-logistics network grinding to a halt.

Consumer demand in China – which usually peaks in the lead up to and during the lunar new year and then eases – has also been subdued. Bricks-and-mortar retail (for non-necessities), foodservice, tourism and hospitality have been particularly hard hit, as consumers study and work at home due to fear and movement restrictions. However, demand has boomed for digital and e-commerce-based services, with home-delivery meal and grocery businesses struggling to keep up with orders.

One of the biggest challenges for Australian beef and sheepmeat in China has been getting product through under-staffed port bottlenecks. In 2019, 60% of Australian beef exports to China went through Shanghai port, followed by Tianjin port at 16%. Australian sheepmeat exports were more geared towards Dalian port, which accounted for 47% of shipments, with Shanghai accounting for just 4% of Australian sheepmeat in 2019.

The subdued demand in China flowed through to shifts in Australian red meat exports last month. Total Australian beef exports eased 2% year-on-year in February, amid tightening slaughter cattle supplies, with shipments to China dropping 12% versus year-ago. The decline in beef trade to China comes following a 29-month run of year-on-year growth, through which China emerged as Australia’s largest export market. Likewise, Australian sheepmeat exports in February were steady year-on-year but shipments to China almost halved, after what had been a stellar 31-month run of year-on-year growth.

Fortunately, while still needing to process large volumes of containers, China’s ports have begun kicking back into gear, as port staff return to work and China’s lorry drivers begin the massive task of distributing product through to inland cities.

The ongoing difficulty for Australian red meat exporters (and all major selling of meat to the China market) is the global imbalance of reefer (refrigerated) containers. As reefers have built up in China’s ports, many have remained un-emptied. Even as ports begin to process containers and product is distributed throughout China, it may be weeks before reefers return to global circulation – until that happens, reefer freight rates will remain elevated.

Other markets

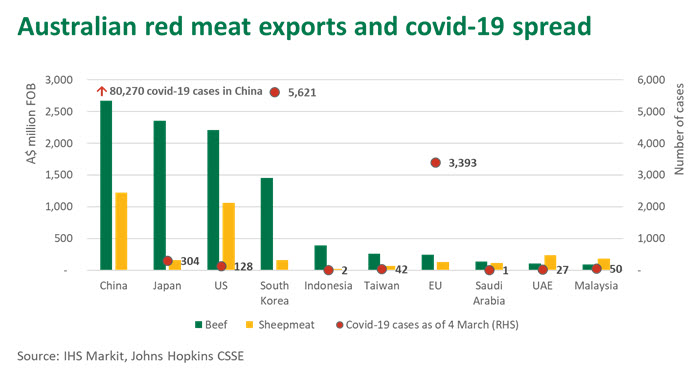

The spread of cases outside of China presents a growing risk to populations and challenge for policy makers around the world. While conditions remain fluid, there is also reasonable demand-side risk to the Australian red meat industry. With about three-quarters of Australian beef and sheepmeat consumed in overseas markets, access to free and open trade is critical.

Japan and Korea – two key beef markets for Australia – have recorded an increase in covid-19 cases in the last fortnight. As beef shipments to China cooled in February, beyond the expected seasonal lull, Japan and Korea picked up some of the slack. However, as the number of covid-19 cases grow it has potential to disrupt demand and the ability to distribute product through these North Asian markets.

Australian sheep and cattle prices rising despite uncertainty

Regardless of this increased uncertainty, and have recorded an incredibly strong rally in the last month, thanks to decent rainfall in key livestock regions. While rising prices are positive news for Australian producers with stock to sell, it does make competing in global markets in these uncertain times particularly challenging.

At the close of Wednesday’s markets, the Eastern Young Cattle Indicator was at record a 741.75¢/kg carcase weight and the National Trade Lamb Indicator, at 943¢/kg carcase weight, was approaching the previous ceiling.

In contrast, US and South American cattle and New Zealand lamb prices have weakened over the last week, reflecting the uncertain global outlook. For their part, is far more exposed to the China market than Australia.

© Meat & Livestock Australia Limited, 2020

To build your own custom report with MLA’s market information tool click .

To view the specification of the indicators reported by MLA’s National Livestock Reporting Service click .