Key points:

- Cattle export volumes tighten as prices lift off tight supply

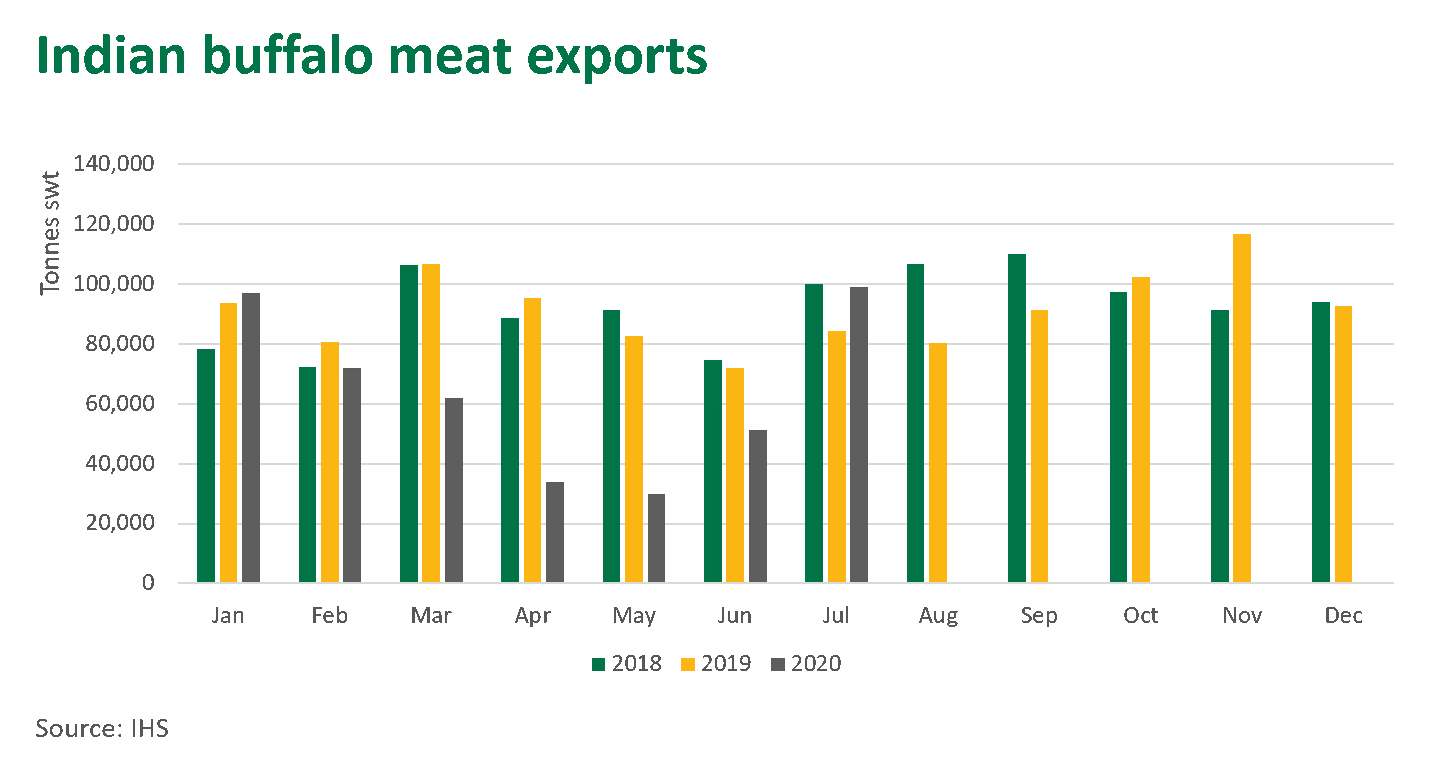

- Rising oil prices, appreciation of the Australian dollar and rising Indian Buffalo Meat competition is challenging markets

- Reduced consumer confidence in Indonesia acting as a handbrake on demand

Australia’s prolonged period of drought followed by significantly improved seasonal conditions has led to a tighter supply of cattle as producers continue to rebuild depleted herds. Consequently, Darwin live feeder light steer prices for export to Indonesia have reached all-time high price levels in 2020, with average prices for September 13% higher than the same period last year.

Live exports tighten

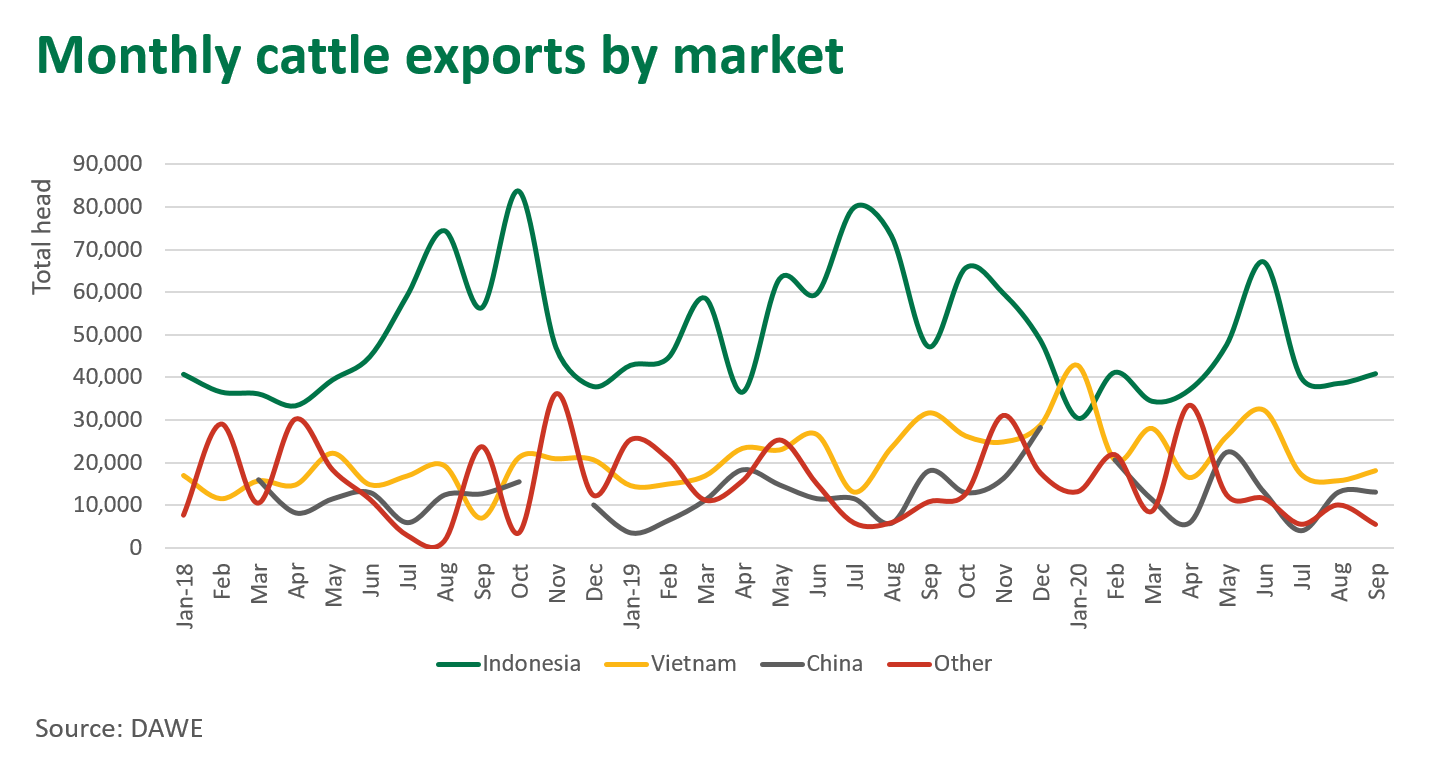

As a result of the constrained supply and high prices, export volumes remain well below year-ago levels. Live cattle exports in September reached 78,000 head, back 28% on the same month last year, and for the year-to-September, volumes are back 12% on 2019 levels.

MLA’s Cattle Industry Projections – October update states that live cattle exports are expected to decline 16% in 2020, largely due to the contracting supply levels in northern Australia.

The net effect of an appreciating Australian dollar and high feeder cattle prices is a challenging export scenario for South-East Asian importers, which is evident in the low export levels seen in recent months. Additionally, a recent resurgence in the price of oil, which directly impacts livestock shipping costs, is also presenting challenges.

Australian live feeder cattle exports to Indonesia were 373,000 head for the year-to-September, down 24% on 2019 levels. While export levels were relatively good through the first half of the year, rising input costs are weighing on import demand. Additional challenges include currency volatility and the increasing presence of Indian Buffalo Meat (IBM).

Cattle exports to Vietnam are up 16% for the year-to-September, reaching 218,000 head. However, shipments have been low in recent months, typical for this time of year. In the lead up to the Vietnamese New Year in February 2021, cattle shipments typically lift as a strong period of holiday demand is expected. However, given the current high prices of Australian cattle, this could present challenges for Vietnamese importers.

Indonesian market under pressure

Mounting COVID-19 impacts were reflected in weaker Indonesian consumer confidence and reduced purchasing power in Q3 2020. In August, Indonesia recorded its lowest inflation rate in two decades. This resulted in consumer prices falling as declining levels of consumption reduced demand for live cattle and boxed meat. Recovery now is expected to be slower than forecast, with the rising number of COVID-19 cases in Indonesia accelerating in September, resulting in additional restrictions.

The COVID-19 pandemic has put a spotlight on the Indonesian Government’s long-standing objectives of being more food-secure and reducing reliance on imports. With the prolonged pandemic and the worsening economic conditions, the government is renewing its efforts to ensure that the public has regular access to essential food commodities at affordable and stable prices.

Prices are regularly monitored across wet markets and the Indonesian Government’s policies on beef pricing limits the capacity to absorb the rising input costs via a lift in retail prices. Live cattle importers are restocking after Eid Fitr, with most feedlots currently maintaining around 50% capacity, however, they remain cautious due the uncertainty regarding the multitude of input costs and soft demand.

Another final consideration for the Indonesian market is the recovery of IBM exports. The Indian processor industry was heavily impacted by the spread of COVID-19, however, capacity has since recovered and export volumes to key markets, such as Indonesia, Vietnam and Malaysia, have recently surged. Given the high prices associated with the live export channel, IBM could serve as a more affordable alternative in the coming months.