Key points:

- Dry conditions sustain herd contraction during 2019

- Cattle slaughter remains elevated compared to year ago levels

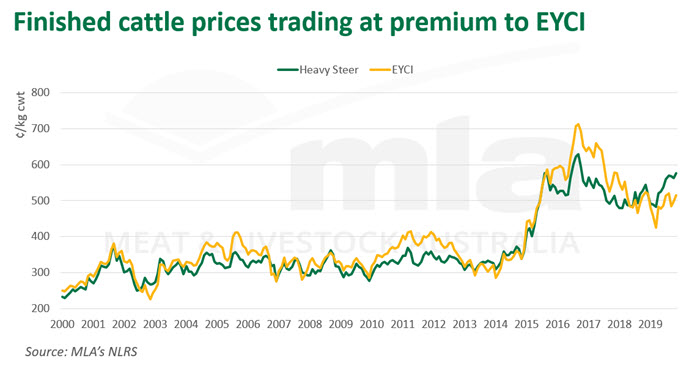

- Finished cattle have maintained premium over the EYCI during 2019.

It has been an unprecedented year for the cattle industry, with prolonged drought resulting in critical feed shortages and declining water availability, as the national herd remained in contraction. Cattle prices have shown a level of durability despite such challenging conditions, largely driven by global demand for Australian beef in key overseas markets.

On 12 March, the Eastern Young Cattle Indicator (EYCI) was recorded at 385.25¢/kg carcase weight (cwt), its lowest point since December 2014. The decline in the indicator was largely due to the lack of restocker demand in the north, given the poor pasture availability heading into Autumn. Some useful rainfall across parts of the eastern states, and in particular Victoria, towards the end of March saw the EYCI lift to over 500¢/kg in subsequent weeks.

The difficulty in finishing cattle on pasture has provided strong margins for specialist feeders, and they have been the driving force across the eastern states during 2019, trading at an average premium of 28¢ to processors and 39¢ to restockers. NSW purchased the largest number of feeder cattle this year, followed by Queensland then Victoria. Of the well conditioned young cattle sold through eastern states saleyards this year, NSW have accounted for 52%, with Queensland contributing 42% and the remaining 6% from Victoria.

In recent months, the store market has been buoyed by southern restockers and processors looking to take advantage of robust global beef prices. However, finished cattle prices have outperformed the store market for the entire year.

Since January, the national heavy steer indicator has been operating at an average premium of 49¢ to the EYCI, and in October recorded the largest premium of 65¢. Strong finished cattle prices seen in 2019 have been supported by surging demand in China (underpinned by the ongoing African Swine Fever epidemic) and a favourable Australian dollar.

A key indicator of the strength of the international market, the US imported 90CL beef prices, are trading at record levels of 928 A¢/kg, just below its November peak of 968 A¢/kg.

³Ô¹ÏÍøÕ¾ cattle slaughter for the year-to-October (latest available ABS data) totalled 7.1 million head, an increase of 7% year-on-year. Victoria and WA recorded the largest increases in slaughter, both increasing 12% from the same period in 2018, while NSW increased 7%.

Queensland remained the largest contributor of national slaughter with 3.3 million head, up 5% from 2018, while Tasmania and SA recorded year-on-year increases of 4% and 1%, respectively.

Elevated female slaughter throughout 2019 has been a key driver of the herd contraction, with females accounting for a record 58% of national slaughter from March to June. In October, female slaughter contributed 50% of total adult cattle slaughter, a decline from the peak seen earlier in the year, however an indication of the herd remaining in a period of contraction. Adult cattle slaughter is forecast to exceed 8.5 million head for 2019.

Cattle on feed numbers hit record levels in 2019, as the lot feeding sector played an important drought mitigation role for cattle producers. For the June quarter, a record 1,147,393 head were reported on feed, before a seasonal decline led by WA, saw numbers ease through the September quarter. In line with the aforementioned dry conditions and robust international demand for high quality grainfed beef, cattle on feed have been sustained in excess of one million head since the beginning of 2018. Cattle on feed numbers can be expected to remain at historically high levels next year.

As we transition into 2020, the domestic and international landscape provides a variety of scenarios for the cattle industry. Domestically, cattle supplies are expected to tighten, with or without widespread rainfall. Internationally, the trading environment centres around China and their need to fill a sizeable protein deficit.

© Meat & Livestock Australia Limited, 2019

To build your own custom report with MLA’s market information tool click .

To view the specification of the indicators reported by MLA’s ³Ô¹ÏÍøÕ¾ Livestock Reporting Service click .