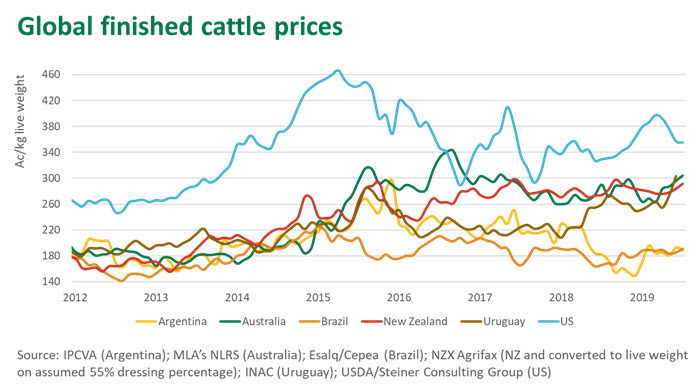

While Australian kill floors continue to run at elevated levels, the limited supply of slaughter-ready cattle, particularly grassfed, and strong demand in key export markets has kept the pressure on finished cattle prices. The national saleyard heavy steer indicator was trading at 310¢/kg live weight (lwt) on Monday. This is the first time it has been above 300¢/kg in a little over two years.

Australian cattle prices typically track between their North and South American counterparts but recent movements have pushed the Australia market closer towards the US. As highlighted below, the Australian heavy steer indicator has closed in on the US choice fed steer since the opening of the year and is now tracking at a narrow 14% discount. This is in comparison to a pre-drought (2010-2012) 25% discount and a whopping 57% discount on November 2014.

In contrast, the Australian market has pulled away from that of Argentina and Brazil, the two South American heavyweights whose cattle have become very cheap by global comparisons due to significant currency depreciation. New Zealand has largely kept pace over the last two years and Uruguay has broken away from its South American neighbours to trade near parity with Australia, due to acute supply shortages.

The US remains Australia’s most significant global beef competitor. It is the world’s largest producer and has the greatest overlap in high value markets with Australia – and the relative increase in Australian cattle prices reflects the strong competition in international markets, particularly Japan and Korea. While the US herd may currently, or soon, be in a contraction, beef supplies are not expected to recede in the next year. Moreover, when Australia has a solid drink and the herd enters a rebuild phase, the cattle market may come under significant upward pressure and approach, or even surpass, the US, as witnessed briefly in 2016.

Insatiable appetite

Meanwhile, Argentina and Brazil will continue pumping large volumes of cheap beef onto global markets. South American suppliers primary overlap with Australia in China but, fortunately, the market has demonstrated an insatiable appetite for beef imports over the last twenty-four months. However, if trade with the world’s largest imported beef market was to slow down, cheap product out of South America could be diverted into other markets where Australia operates, such as South East Asia.

While current finished cattle prices are a blessing for Australian producers with stock to sell – and could move higher with a seasonal break – the decoupling from historical price spreads creates challenges with remaining cost-competitive. This is especially pertinent when considering the relatively high cost of doing business in Australia and the fact that Aussie beef customers are increasingly found in overseas markets.

© Meat & Livestock Australia Limited, 2019

More information

To build your own custom report with MLA’s market information tool click .

To view the specification of the indicators reported by MLA’s ³Ô¹ÏÍøÕ¾ Livestock Reporting Service click .