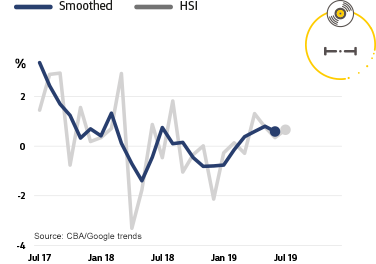

The outlook for Australian consumer spending may be improving, according to CBA’s Household Spending Intentions Series.

Latest data from the highlights the outlook for consumer spending in Australia may be improving as the tax refunds flow into bank accounts and on the back of the interest rate cuts by the Reserve Bank of Australia.

CBA’s HSI series offers a forward-looking view by analysing actual customer behaviour from CBA’s transactions data, along with household spending intentions from Google Trends search data. This combination adds to insights on prospective household spending trends in the Australian economy.

CBA Chief Economist Michael Blythe says the levelling out of recent HSI readings offers some encouraging, albeit tentative, signs that the tax rebates now being paid to households are boosting disposable income and flowing through to spending intentions.

“HSI measures provide a glimmer of hope that the outlook for consumer spending is slowly improving. The improvement is modest, but the switch from downward signals to something that is more flat-to-up offers some hope that the second half of 2019 will be better for the consumer than the first half of the year,” Mr Blythe said.

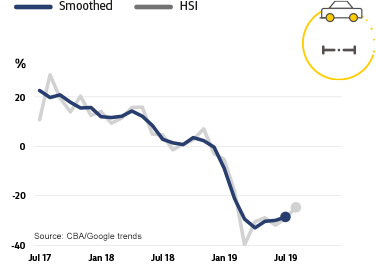

The spike in Google search activity on “tax refunds” in July 2019 was the largest recorded in the last five years (since July 2014). “The levelling out in HSI readings for retailing and vehicle purchases offers some encouraging, albeit tentative, signs that the rebates are working,” Mr Blythe said.

“Much will depend on the impact of the tax rebates that households are receiving. Many of these payments are large and are flowing into CBA customer accounts right now. The value of tax refunds in July was 49 per cent above “normal” levels.

“The turn in the housing market is also helping. The drag on consumer spending from a negative “wealth effect” should be receding as dwelling prices stabilise or lift,” Mr Blythe added.

Household Spending Intentions – August 2019 results

CBA obtains an early indication of spending trends across seven key household sectors in Australia. Apart from home buying, the series covers around 55 per cent of Australia’s total consumer spend across; retail, travel, education, entertainment, motor vehicles, and health and fitness.

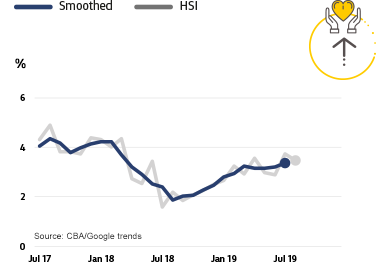

Retail | |

|  |

| Travel | |

|  |

| ³Ô¹ÏÍøÕ¾ Buying | |

|  |

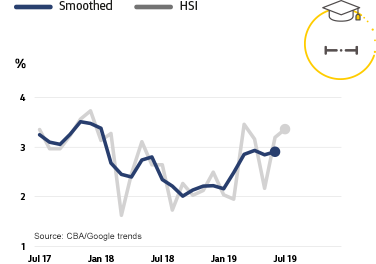

| Education | |

|  |

| Entertainment | |

|  |

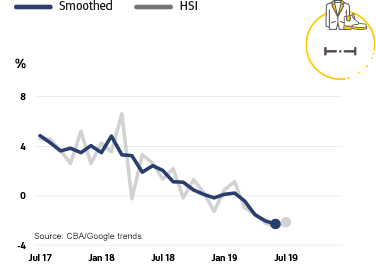

| Motor Vehicles | |

|  |

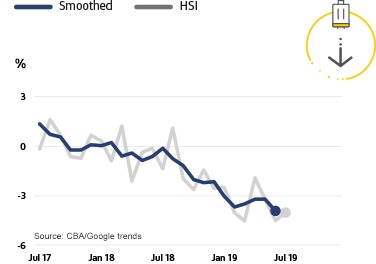

| Health & Fitness | |

|