Professor Hans Hendrischke

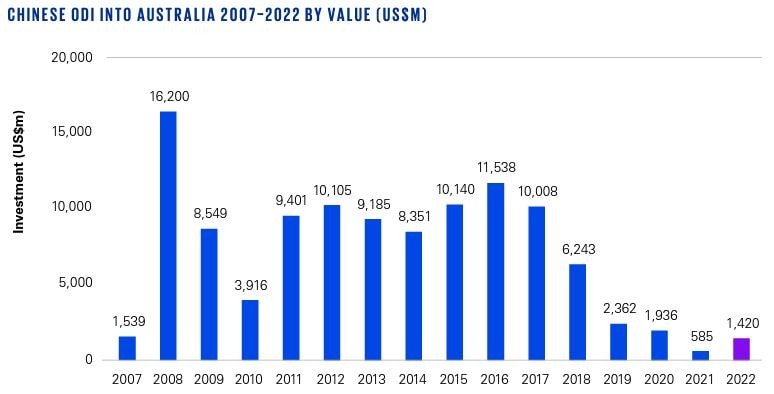

The annual report, , covers investments into Australia made by corporates from the People’s Republic of China. The 2022 report shows relatively stable investment of around US$10 billion a year between 2011 to 2017, before falling consistently and considerably year-on-year to a low of US$0.6 billion in 2021.

The 170 percent rise in 2022 comprised of 11 completed transactions and was dominated by one large iron ore deal of over $1 billion, resulting from a long-established partnership between Rio Tinto and Baowu Steel Group.

Mining accounted for 86 percent of total investment inflows, including projects in iron ore, gold and lithium, while renewable energy accounted for 12 percent.

The remaining two percent was split between commercial real estate and technology investment.

Experts believe investment is unlikely to return to the consistently high levels seen between 2011-2017. Source: University of Sydney/KPMG

Report co-author , Professor of Chinese business and management at the University of Sydney Business School, said Chinese investment in Australia was consistent with global trends.

“China’s official statistics for outward direct investment in 2022 show a 2.8 percent lift, so Australia is benefiting amid a gradual recovery from the lows of the years dominated by COVID-19.

“We expect to see that continue to increase with the lifting of China’s COVID-zero policy, but there are several factors preventing a return to the high-volume years.

Dr Wei Li

“While the Australian Government is focused on repairing the damaged relationship with China, tougher investment scrutiny and Beijing’s concern about capital flight remain significant hurdles.”

Report co-author said East Asia had the biggest inflow of Chinese investment last year, with Indonesia second only to Saudi Arabia in investment received.

“China has also shifted major investment projects toward countries in the Middle East, Latin America and Asia, in line with its Belt and Road Initiative – a crucial component of Xi Jinping’s foreign policy,” Dr Li said.