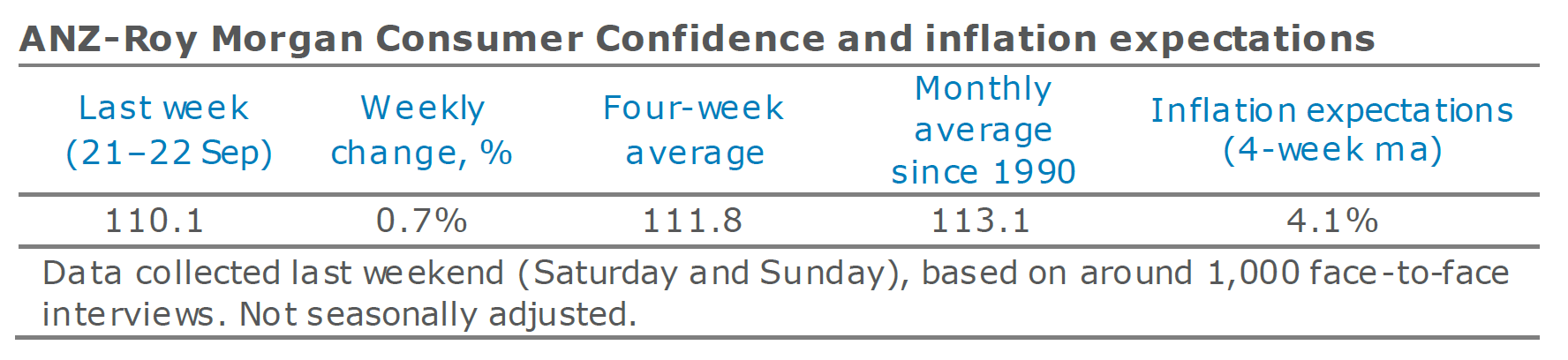

ANZ-Roy Morgan Australian Consumer Confidence gained 0.7 per cent last week after losing 3.5 per cent in the previous reading. Strength was relatively broadly based across the subindices, although the ‘time to buy a household item’ index dropped a sharp 3.8 per cent and is now at its lowest level in ten years.

Current financial conditions gained 1.9 per cent and remain above the long run average, while future financial conditions gained 1.6 per cent.

The economic conditions subindices also rose, with current economic conditions up 3.6 per cent and future economic conditions up 1.0 per cent. Both economic subindices remain well below their long run averages.

The four-week moving average for inflation expectations remained stable at 4.1 per cent.

“The modest rise in confidence leaves it well below its long run average,” ANZ Senior Economist Felicity Emmett said. “The weakness in the time-to-buy-a-household-item index is particularly disappointing, given that tax cuts should be supporting this measure.”

“Rising concerns over the impact of the stimulus, combined with the lift in the unemployment rate in August and ongoing global easing in monetary policy settings, suggest to us that the RBA will likely cut rates again in October.”

“So far, though, consumers seem impervious to both fiscal and monetary stimulus, and the combination of weak wage growth and high levels of debt may prove to be the more dominant driver of confidence and spending.”