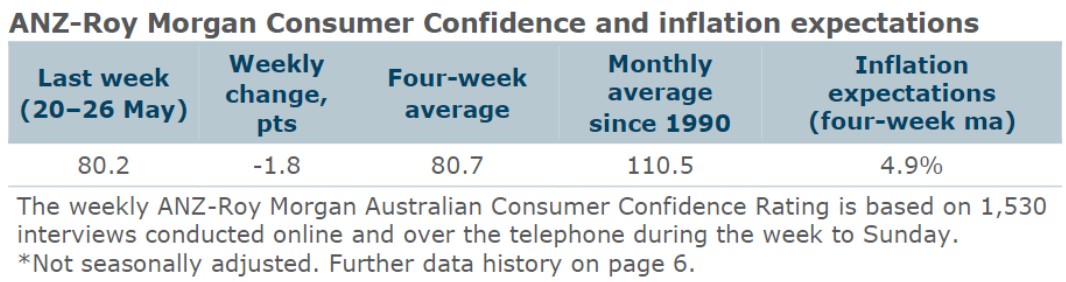

• Consumer confidence decreased 1.8pts to 80.2pts last week. The four-week moving average fell 0.2pts to 80.7pts.

• ‘Weekly inflation expectations’ rose 0.1pts to 4.9%, while the four-week moving average was down 0.1pts to 4.9%.

• ‘Current financial conditions’ (over last year) increased slightly by 0.1pts, while ‘future financial conditions’ (next 12 months) declined 4.1pts.

• ‘Short term economic confidence’ (next 12 months) fell 5.4pts and ‘medium term economic confidence’ (next five years) increased by 1.0pt.

•The ‘time to buy a major household item’ subindex softened 0.7pts.

ANZ Economist, Madeline Dunk said: “ANZ-Roy Morgan Australian Consumer Confidence was unable to hold onto the prior week’s gains, with the series falling 1.8pts last week. This takes the level of confidence back to a 2024 low of 80.2pts. While confidence is currently running modestly higher than the series’ 2023 average of 78.0pts, it is more than 30pts below the long-run average.

Household confidence in the 12-month outlook for the economy declined by 5.4pts-the largest weekly fall since February 2023. Short term economic confidence is now at its lowest level for 2024. Households were also more wary about the 12-month outlook for their finances, with the subindex falling 4.1pts.”