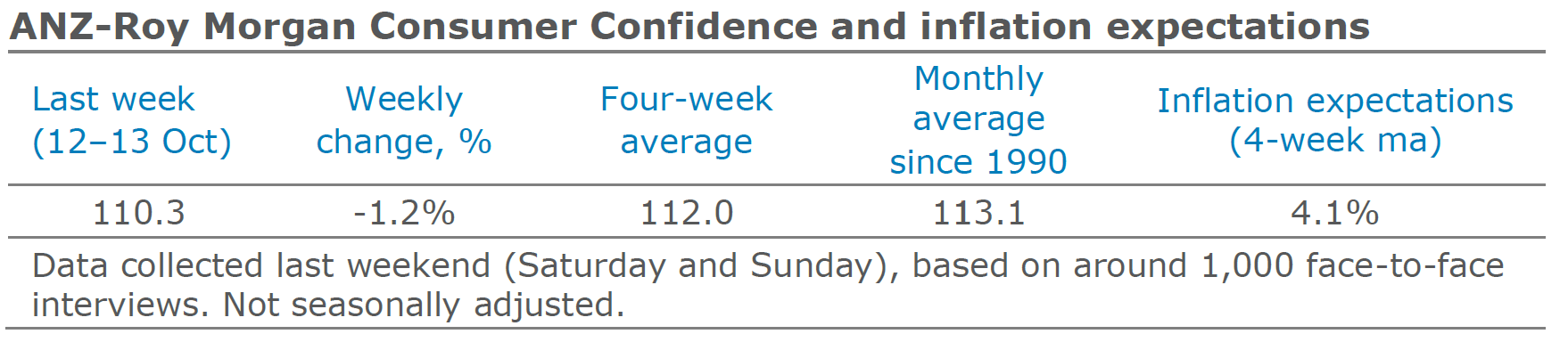

ANZ Roy Morgan index fell 1.2 per cent last week, its second straight weekly loss – ensuring confidence remains below its long-run average.

The financial conditions subindices were positive. Current finances gained 0.2 per cent, while future finances were up 0.7 per cent. These small gains coming after large falls last week.

In contrast weakness in the economic conditions subindices continued for a second week. Current economic conditions fell 1 per cent, while future economic conditions lost 1.7 per cent.

The ‘Time to buy a household item’ measure fell 3.9 per cent after two successive gains. Inflation expectations (IE) remained stable at 4.1 per cent.

“Consumer confidence was down 1.2 per cent last week, despite some positive developments in the US-China trade war. The decline leaves overall sentiment below average,” ANZ Senior Economist, Felicity Emmett, said.

Household perceptions of the economic outlook fell for a second consecutive week and are well below average. It will be interesting to see whether economic sentiment can gain this week as households have more time to consider the news on trade.

In contrast to the negative economic outlook, households remain much more confident about their own financial outlook. This week’s employment data could be important in this regard. Stable inflation expectations, albeit at a low level by historical standards, will be comforting for the RBA.