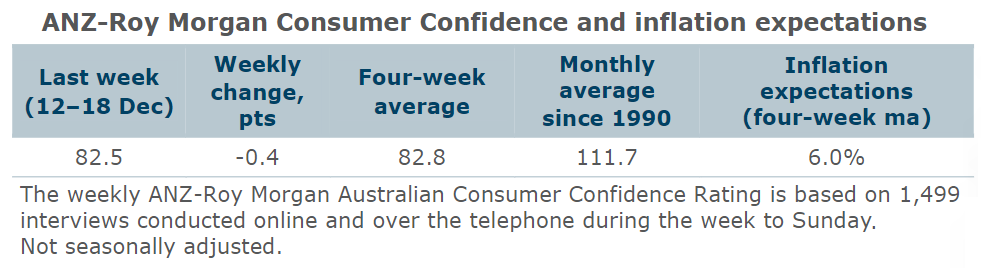

Consumer confidence eased by 0.4 points last week to 82.5, finishing 2022 well below the neutral level of 100.

Weekly inflation expectations were unchanged at 5.9 per cent, while the four-week moving average fell 0.1 percentage points to 6.0 per cent.

‘Current financial conditions’ gained 0.5 points, rising by a total of 3.2 points over the past two weeks. ‘Future financial conditions’ lost 0.5 points after a 2.6-point gain the week before.

‘Current economic conditions’ dropped 3.5 points, partially reversing its 4.3-point rise the week before, while ‘future economic conditions’ rose by 1.1 points.

‘Time to buy a major household item’ saw a slight gain of 0.2 points.

“Consumer confidence declined by 0.4 points last week to 82.5, ending 2022 almost 30 points below the long-term average,” ANZ Senior Economist Catherine Birch said.

“Over the past four weeks, confidence has steadied within a narrow range in the low-80s. Last week’s decline was largely driven by a 3.5-point drop in the ‘economic conditions next year’ subindex.”

“The persistent weakness in sentiment now appears to be weighing on household spending. ANZ-observed data suggest spending lost momentum early in the holiday season, which could signal the beginning of a cyclical slowdown.”

“In 2023, we’ll be watching how confidence responds to the combination of falling inflation and rising nominal wage growth. It’s possible we’ll see a sustained improvement, even under the burden of higher rates.”