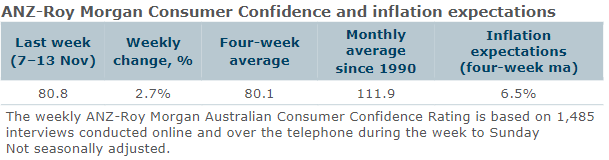

• Consumer confidence rose 2.7 per cent after a 10.4 per cent decline over the previous six weeks. Among the mainland states, confidence increased in NSW and Queensland, dropped in SA and WA and was unchanged in Victoria.

• ‘Weekly inflation expectations’ dropped 0.3ppt to a still elevated 6.5 per cent last week. Its four-week moving average rose 0.1ppt to 6.5 per cent.

• The subindex results were mixed. ‘Current financial conditions’ fell 0.8 per cent, having fallen in seven of the past nine weeks. ‘Future financial conditions’ climbed 4.9 per cent.

• ‘Current economic conditions’ jumped 8.5 per cent, more than offsetting the 7.2 per cent decline over the previous three weeks. ‘Future economic conditions’ gained 3 per cent after a 4.8 per cent fall the week before.

• ‘Time to buy a major household item’ dropped 1.9 per cent, falling to its lowest since April 2020 during the early months of the COVID lockdowns.

ANZ Head of Australian Economics, David Plank, commented: “Consumer confidence edged up 2.7 per cent last week, its first weekly increase since late September. The subindices that capture the prospects over the next year drove the increase, with 31 per cent (+1.3ppt) of respondents expecting to be ‘better off’ financially this time next year and 8 per cent (+1.4ppt) expecting ‘good times’ for the economy over the next year. The subindex related to whether it is a ‘good time to buy a major household item’ bucked the improvement and has fallen five times over the past six weeks, for a cumulative loss of 13 per cent.

“The lift in confidence doesn’t change the fact it remains at a level not matched since the early 1990s recession, putting aside the early pandemic period. But it also remains the fact that household spending has held up despite the weakness in sentiment. Whether this disconnect can continue is a central issue for policy maker.”