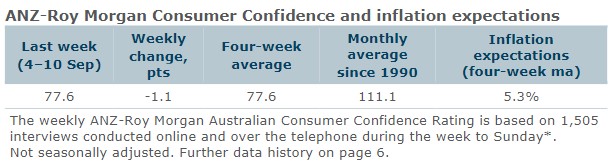

Consumer confidence decreased by 1.1pts. Among the mainland states, confidence rose in NSW, Queensland and WA but fell in Victoria and SA.

‘Weekly inflation expectations’ fell 0.1ppt to 5.2%. Its four-week moving average was unchanged at 5.3%.

‘Current financial conditions’ declined 0.8pts. ‘Future financial conditions’ were up 2.2pts, partially offsetting the 3.0pts decline the week before.

‘Current economic conditions’ gained 1.2pts, while ‘future economic conditions’ dropped 4.7pts.

The ‘Time to buy a major household item’ subindex decreased by 3.3pts.

ANZ Economist Madeline Dunk said: “The recent upswing in ANZ-Roy Morgan Consumer Confidence has hit a roadblock, with the index falling 1.1pts last week. This is despite the RBA keeping the cash rate on hold at its September meeting, and the Q2 GDP data suggesting that Australia is on track for a soft landing.

“Confidence has now printed below 80pts for six months in a row – the longest stint on record. There was a sharp fall in confidence amongst renters last week. And while consumer confidence remains lowest for those households with a mortgage, confidence amongst this group has lifted to its highest level in five months.”