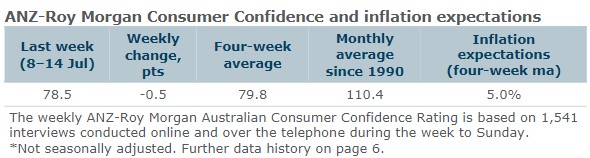

• Consumer confidence fell 0.5pts last week to 78.5pts. The four-week moving average fell 0.5pts to 79.8pts.

• ‘Weekly inflation expectations’ rose 0.2ppt to 5.1%, while its four-week moving average rose 0.1ppt to 5.0%.

• ‘Current financial conditions’ (over last year) were up 1.5pts, while ‘ future financial conditions’ (next 12 months) softened 1.1pts.

• ‘Short-term economic confidence’ (next 12 months) decreased 0.6pts and ‘medium-term economic confidence’ (next five years) dropped 2.8pts.

• The ‘time to buy a major household item’ subindex rose 0.9pts.

ANZ Economist, Madeline Dunk said: “The softness in ANZ-Roy Morgan Australian Consumer Confidence continued last week, with the index declining0.5ptsto 78.5pts. This was the second weakest result since early December2023. Confidence is currently 36pts lower than its pre-COVID five-year (2015-19) average.

While all subindices remain well below their pre-COVID five-year average, the time to buy a major household item subindex is particularly weak, down 62pts. Households are also very concerned about their current financial position, with the subindex down 41pts relative to the pre-COVID five-year average.”