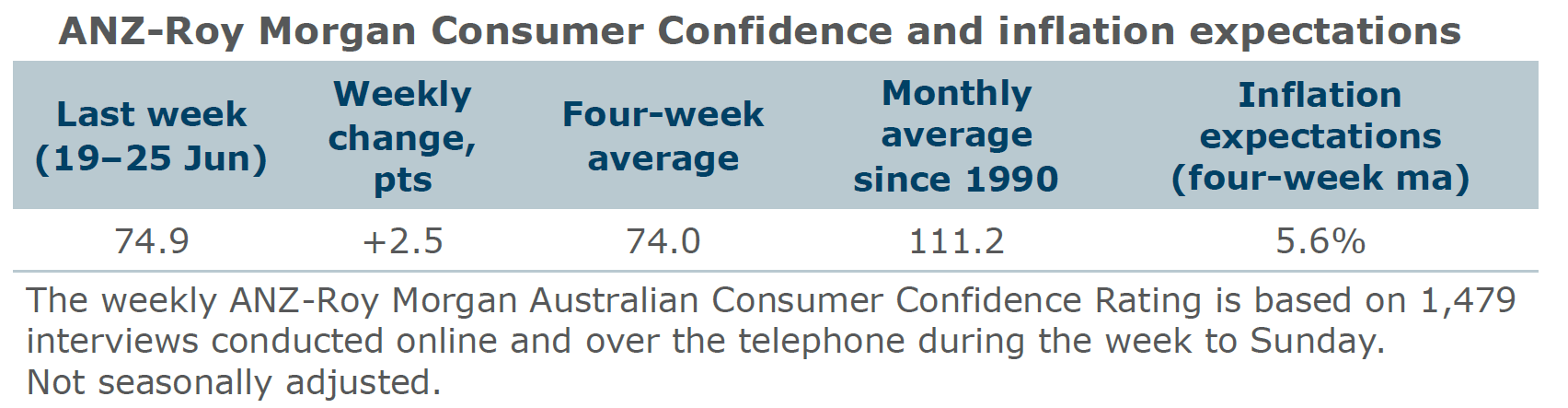

Consumer confidence increased by 2.5 points last week. Among the mainland states, confidence rose in New South Wales and Queensland, but fell in Victoria, South Australia and Western Australia.

‘Weekly inflation expectations’ jumped 0.4 percentage points to 5.9 per cent, its highest since mid-March. Its four-week moving average rose from 5.5 per cent to 5.6 per cent.

‘Current financial conditions’ jumped 6.8 points after a cumulative 10.6 points decline over the previous four weeks. ‘Future financial conditions’ softened 0.4 points and remained below 90 for a fourth straight week.

‘Current economic conditions’ rose 1.4 points. ‘Future economic conditions’ lifted 5.1 points, rising above 90. ‘Time to buy a major household item’ decreased by 0.5 points.

“Consumer confidence rose last week but was still below 80 for the 17th straight week, the longest it has been this low since the 1990-91 recession,” ANZ Senior Economist Adelaide Timbrell said.

“Confidence in ‘future financial conditions’ fell to its weakest since March 2020, ahead of the Reserve Bank of Australia July meeting, which we expect will include a cash rate increase.

“Perhaps related to shaky financial confidence, inflation expectations jumped 0.4 percentage points to 5.9 per cent, its highest since mid-March. But ‘future economic conditions’ confidence was at its highest in four weeks.

“Confidence fell among those paying off their homes, who continue to have much lower confidence than renters and outright owners (the highest-confidence cohort).”