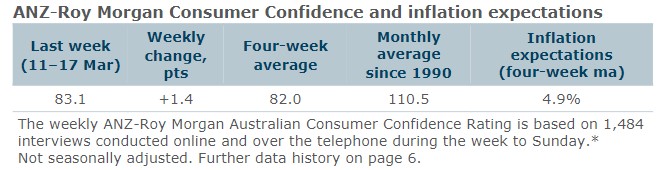

• Consumer confidence rose 1.4pts last week to 83.1pts. The four-week moving average was stable at 82.0pts.

• ‘Weekly inflation expectations’ rose 0.3ppt to 5.1 per cent, while the four-week moving average was steady at 4.9 per cent.

• The financial conditions subindices improved. ‘Current financial conditions’ and ‘Future financial conditions’ both rose by 3.2pts.

• ‘Short term economic confidence’ (about the economic outlook over the next 12 months) declined 1.1pts. ‘Medium term economic confidence’ (about the economic outlook over the next five years) rose 2.1pts.

• The ‘time to buy a major household item’ subindex moderated a touch.

ANZ Economist, Madeline Dunk said: “ANZ-Roy Morgan Australian Consumer Confidence rose 1.4pts last week after the RBA shifted its language in a more dovish direction and labour market data surprised to the upside, with employment rising by over 100k in February.

Recent progress in inflation expectations hit a roadblock, with the series rising 0.3pts to 5.1%. Confidence amongst renters lifted 7.1pts to its highest level since early January. Despite this, renters remain the least confident amongst the three housing cohorts. Confidence is currently 3pts lower for renters compared to households paying off a mortgage.”