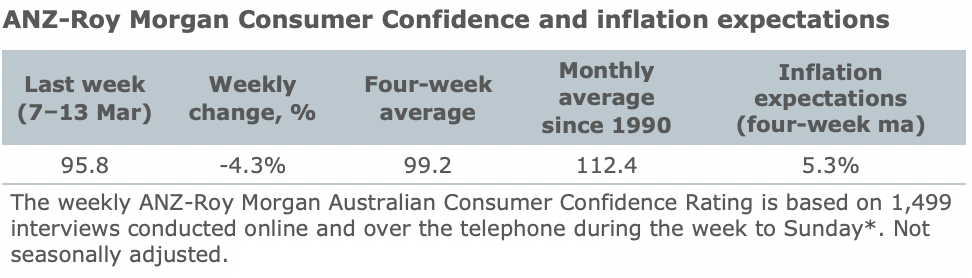

‘Weekly inflation expectations’ rose 0.4ppt to 5.6 per cent amid rapidly rising petrol prices. Its four-week moving average rose 0.1ppt to 5.3 per cent.

Consumer confidence dropped 4.3 per cent last week, falling well below the neutral level of 100. Confidence declined in all the states except for WA.

All the confidence subindices registered losses. ‘Current financial conditions’ decreased by 5.2 per cent and ‘future financial conditions’ fell 4.0 per cent.

‘Current economic conditions’ declined 3.9 per cent, falling 13.9 per cent over the past four weeks. ‘Future economic conditions’ dropped 5.2 per cent.

‘Time to buy a major household item’ decreased by 3.4 per cent.

“Household inflation expectations jumped to 5.6 per cent last week, its highest level since November 2012.” ANZ Head of Australian Economics, David Plank said.

“Rapid gains in petrol prices are likely the key reason for the lift. Households are certainly noticing the effect of higher prices on their finances, with overall confidence dropping 4.3 per cent and all sub-indices lower.”

“Confidence is well below neutral, at its lowest level since October 2020 and is below neutral in all states. The surge in inflation expectations heightens the risk of a shift in the ‘psychology’ of inflation that requires more aggressive action from the RBA. Though, if the recent fall in oil prices is sustained, we would expect inflation expectations to ease.”