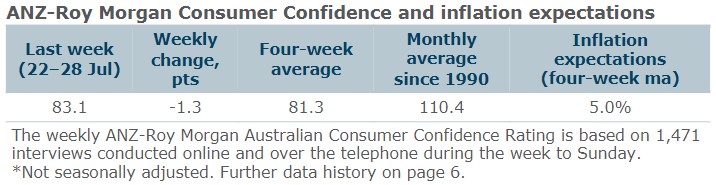

• Consumer confidence eased 1.3pts last week to 83.1pts but is still 4.6pts higher than a fortnight ago. The four-week moving average rose 0.4pts to 81.3pts.

• ‘Weekly inflation expectations’ was unchanged at 5.0%, while the four-week moving average fell 0.1ppt to 5.0%.

• ‘Current financial conditions’ (over last year) decreased 0.6pts, while ‘future financial conditions’ (next 12 months) rose 0.5pts.

• ‘Short-term economic confidence’ (next 12 months) fell 4.4pts and ‘medium-term economic confidence’ (next five years) fell 0.9pts.

• The ‘time to buy a major household item’ subindex declined 1.1pts.

ANZ Economist, Madeline Dunk said: “Despite a small drop last week, ANZ-Roy Morgan Australian Consumer Confidence is up 4.6pts over the past fortnight. The fact that consumer confidence held onto most of last week’s sizeable 5.9pt gain suggests households may be seeing the benefits of the Stage 3 tax cuts. Particularly as the biggest improvement has been in households’ confidence in their own financial situation.

Relative to two weeks ago, households’ confidence in their current financial position has risen 5.1pts, while confidence in their financial position in a year’s time is up 5.8pts. Over this period, confidence has increased most for those who own their homes outright (+6.8pts), followed by renters (+3.1pts) and those paying off a mortgage (+1.6pts).”