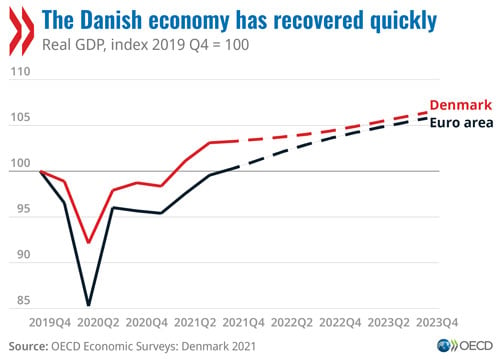

16/12/2021 – Denmark’s economy is enjoying one of the quickest post-COVID recoveries of OECD countries. While it is important to stay vigilant to further virus outbreaks, policy can now focus on advancing the country’s climate ambitions and expanding employment opportunities for low-skilled, foreign-born and female workers, according to a new OECD report.

Danish economic activity rebounded rapidly in 2021, exceeding pre-pandemic levels by mid-year. The latest projects GDP growth to remain solid, easing back to 2.4% in 2022 and 1.7% in 2023. The strong recovery has been coupled with widespread labour shortages, particularly in construction, manufacturing and hospitality, and is likely to be associated with a more enduring increase in inflation in 2022 and 2023.

Danish economic activity rebounded rapidly in 2021, exceeding pre-pandemic levels by mid-year. The latest projects GDP growth to remain solid, easing back to 2.4% in 2022 and 1.7% in 2023. The strong recovery has been coupled with widespread labour shortages, particularly in construction, manufacturing and hospitality, and is likely to be associated with a more enduring increase in inflation in 2022 and 2023.

Efforts should therefore focus on reducing barriers to jobs for youths and migrants, many of whom have been hit hard by the crisis, and making it easier for mothers to remain in work, the Survey says. Ramping up investment in green technology and infrastructure will be key for Denmark to continue its progress in cutting greenhouse gas emissions and fulfil its ambition to achieve net zero emissions by mid-century.

“Denmark’s policy response to the pandemic helped underpin a rapid economic recovery,” OECD Secretary-General Mathias Cormann said. “Macroeconomic policy must now find a balance between sustaining the recovery and tackling further virus outbreaks. Denmark must also focus on the ambitious economic, social, technological and industrial transformations needed to deliver on its climate goals.”

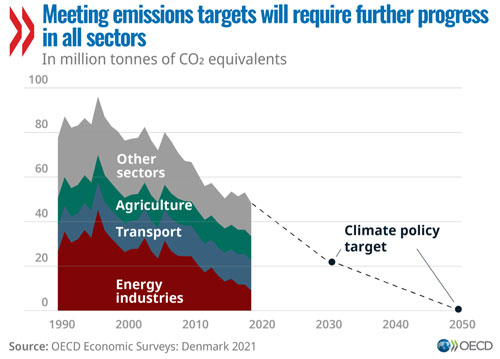

Denmark is at the forefront of global efforts to reduce greenhouse gas emissions and is directing 60% of its COVID-19 recovery spending towards environmental goals – a high share by international comparison. Denmark also demonstrated in the three decades before the COVID-19 crisis that it is possible to significantly cut emissions without hurting growth, jobs or living standards.

Progress in wind generation has led to the development of an important export industry. Nevertheless, Denmark has set itself ambitious emissions targets, and meeting them will require further progress across all sectors, particularly in agriculture and transport.

Progress in wind generation has led to the development of an important export industry. Nevertheless, Denmark has set itself ambitious emissions targets, and meeting them will require further progress across all sectors, particularly in agriculture and transport.

For example, because increased car use has pushed up transport emissions despite the introduction of greener vehicles, more will need to be done to encourage a shift to electric cars, including with incentives to build recharging stations in remote areas. In electricity generation, where the share of renewables has surged from less than 10% in the mid-1990s to over 80% in 2020, a reliance on woody biomass needs to be reduced.

More broadly, a more uniform pricing of emissions, structural reforms and regulatory measures will be necessary across economic sectors, with revenue from emissions pricing and green taxes used to offset adverse consequences through reduced taxation of renewable energy, means-tested support to affected households and help for workers reallocated to low-emission activities. Denmark’s “flexicurity” job system should also help to protect such workers by offering a safety net and support for developing new skills and job seeking.

The high levels of investment planned in energy infrastructure and transport will require fiscal space. Denmark’s robust public finances withstood the impact of the COVID-19 crisis better than in many other countries. Cautiously relaxing the 0.5% structural budget deficit limit to around 1% of GDP would provide space to address investment needs and the long-term challenges of an ageing population without threatening the sustainability of public finances or the capacity for active fiscal policy. Plans to index retirement ages to life expectancy should be fully implemented, and efforts should continue to rebalance the tax system to shift from high taxes on income, which can stifle entrepreneurship, towards taxes on housing and environmental harm.

While the peg of the Danish Kroner to the Euro has served Denmark well, attention should nonetheless be paid to potential macroeconomic imbalances. This includes lower interest rates than would befit economic conditions in Denmark, which are contributing to rapid rises in house prices and increased household debt. It may be necessary to tighten mortgage regulation if risks continue to build, the Survey says.

with key findings and charts (this link can be used in media articles).