Key points:

- American domestic beef consumption is forecast to rise to 12.7 million tonnes in 2024.

- Imports are forecast to rise to 1.89 million tonnes.

- The US dollar has appreciated 50% in value against the Japanese Yen since 2021.

Last Friday, the US Department of Agriculture (USDA) published the April Livestock and Poultry: World Markets and Trade report, which included updated forecasts of US beef imports and exports.

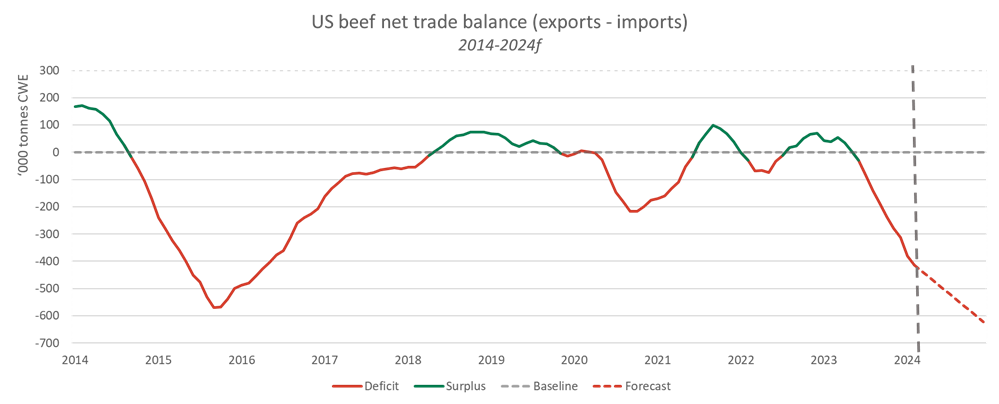

The forecasts show a substantial shift in prospective US trade flows. Although US export forecasts have been revised up slightly, US imports have been revised up by 184,000 tonnes carcase weight equivalent (cwe) to 1.89 million tonnes cwe. This means that the net trade balance for 2024 (exports minus imports) has been revised down 175,000 tonnes to minus 622,000 tonnes, the largest deficit since 2008.

Source: USDA ERS, USDA FAS, MLA

US production

American production has remained stubbornly high over the past two years, despite falling substantially from peaks in late 2022.

Previous climate models that predicted El Niño conditions for several years, which would have created the environment necessary for a substantial decline in beef production, have not come to pass.

The American │į╣Ž═°šŠ Oceanic and Atmospheric Administration (NOAA) is currently estimating an 85% chance that El Niño will collapse in the April-June period, and a 60% chance of La Niña developing by August. If this comes to pass, it will slow down any potential US herd rebuild, and lead to higher production levels than we would otherwise expect.

As such, the 2024 production forecast was revised up a further 157,000 tonnes cwe to 12.06 million tonnes, a 2% decline from 2023 levels. Although a considerable decline, this is smaller than previously expected, and means that the US herd rebuild will start from a lower base and take longer than previously understood. At this point, it is likely that the US herd will reach its smallest size this year, and a sustained rebuild will only begin in 2025.

Domestic consumption

Despite the uptick in forecast production, imports are still forecast to rise considerably. This is because of a 343,000 tonne cwe increase in the domestic consumption forecast, which domestic production will not be able to meet.

US domestic beef demand remains robust, and with a growing population and solid economy, that’s expected to continue. In fact, the US is currently growing at around twice the rate of the next-best member of the G7, and inflation is below most other peer countries.

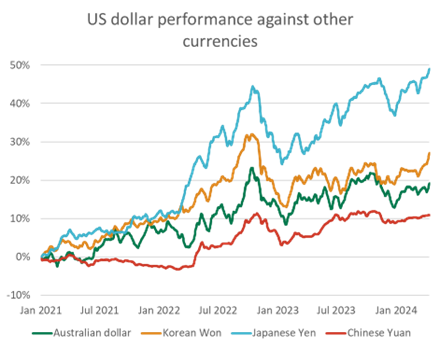

Source: XCED, MLA

This, combined with a sharper lift in interest rates than other countries, has strengthened the US dollar against other countries. Since the start of 2021, the US dollar has appreciated by about 11% against the Chinese Yuan, 20% against the Australian dollar, 27% against the Korean won and 50% against the Japanese Yen.

This effectively pulls beef towards the US, both by reducing the value of US exports and making US imports cheaper. The increase in domestic consumption is likely to come by directing exports away from other markets, and into the US.

Given this, regardless of the US herd rebuild, export volumes to the US are likely to continue rising. As American production continues to fall, this effect will become more pronounced, but any delay in herd rebuilding ultimately only drags out the period of depressed production for longer.

Attribute content to: Tim Jackson, Global Supply Analyst

Latest news