Key points:

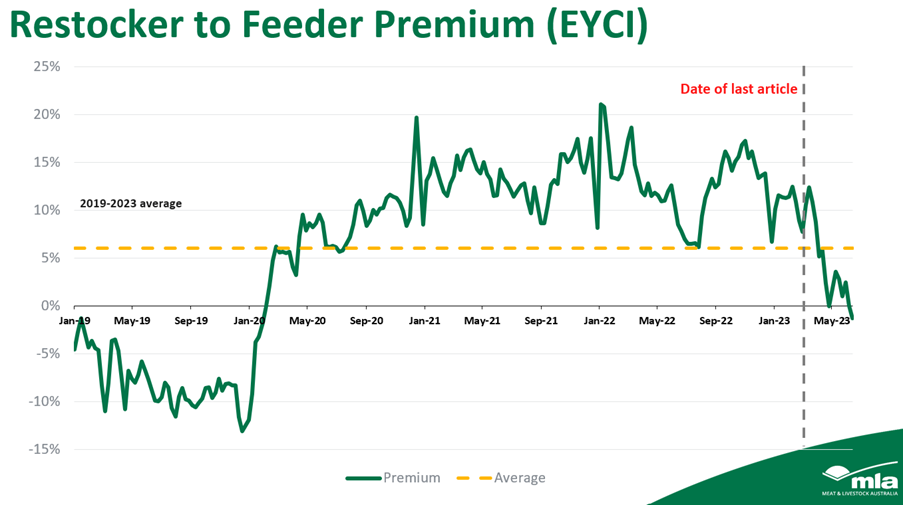

- In March, MLA’s Market Information team forecast feeder prices to operate at a premium to restockers in the Eastern Young Cattle Indicator (EYCI).

- Last week, the restocker to feeder price dynamic saw restockers operate at a discount to feeders for the first time since February 2020.

- This discount for restocker cattle may continue.

In March, MLA’s Market Information team forecast in that the restocker to feeder premium for EYCI-eligible cattle would switch to restocker cattle prices and operate at a discount to feeders in the coming months.

Last week, this forecast was realised, with the restocker to feeder price dynamic leading to restockers operating at a discount to feeders for the first time since the week beginning 16 February 2020.

As MLA’s Market Information team has forecast for some time, the herd rebuild has been significantly stronger than many expected and, as a result, the demand for young restocker cattle continues to soften (Figure 1).

Higher numbers of young cattle on-farm and seasonal conditions that support above-average stocking rates (particularly in southern Australia) have resulted in saleyard prices for restocker cattle being the most affected since October 2022. Over time, the significant premiums restockers were willing to pay for young cattle at the saleyards has eroded.

Figure 1. Restocker to feeder price dynamic falls to a discount for the first time since February 2020

Looking ahead

As per the , this price dynamic is determined by seasonal conditions and rainfall, which both influence restocker interest.

As the herd growth and cattle cycle reaches its maturity phase, numbers of young cattle will continue to increase – this may place pressure on restocker prices as demand remains subdued.

Conversely, as feedlot capacity continues to grow and utilisation rates remain low, demand for feedlot cattle will most likely improve over time.

In MLA’s industry analysts forecasted that the Feeder Steer indicator would reach 302¢/kg liveweight (lwt) by 30 September.

With prices expected to remain firm on current rates, attractive prices for lot feeders and an ever-improving capacity may drive higher demand and therefore improved feeder prices in the EYCI as restocker demand remains low.

Thus, feeders may continue to operate at premium prices to restockers in the EYCI moving forwards.

Latest news