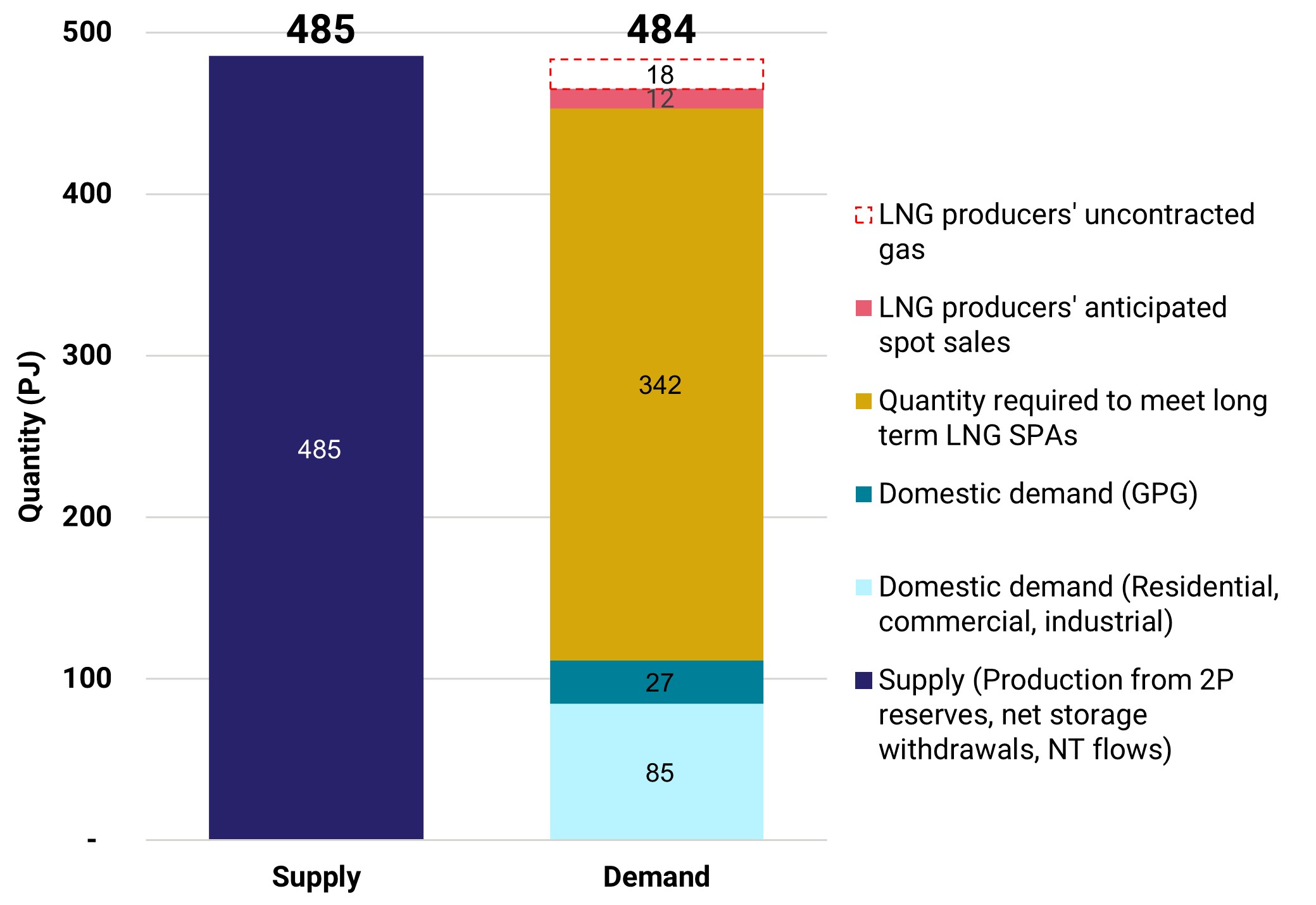

Australia’s east coast gas market should have a 1.4 petajoule (PJ) surplus in the first quarter of 2024, even if the LNG producers export all their uncontracted gas, the ACCC’s September 2023 shows.

The report forecasts the supply and demand balance for the east coast market for wholesale gas between January and March next year, which is a period of high LNG export demand and reduced residential gas heating demand due to warmer weather.

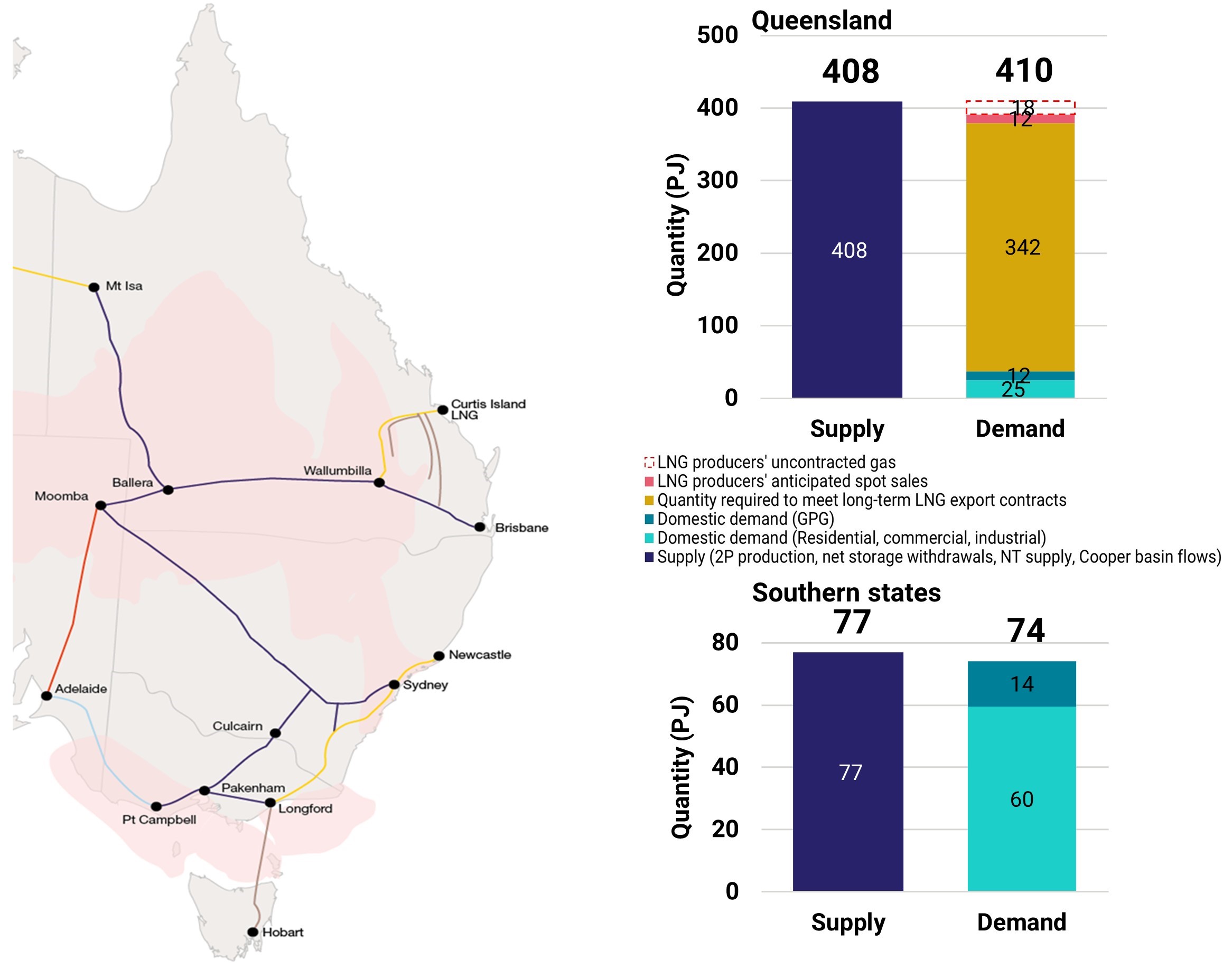

On a regional basis, Australia’s southern states are forecast to have about a three PJ surplus to meet local demand, but Queensland will need about one PJ of additional gas to meet its local demand if the LNG producers export all their uncontracted gas.

“We expect gas swap arrangements will play an important role in balancing gas supply needs across 2024,” ACCC Commissioner Anna Brakey said.

“The LNG producers have entered into gas swap arrangements with other gas businesses to access additional gas for export during the summer months. Under these arrangements, they will then return the gas to market in higher demand periods, such as the winter months.”

Recent investments in key pipeline infrastructure have also made it easier to transport gas between northern and southern states, and additional upgrades currently underway are expected to be completed by winter next year.

Chart 1: Quarterly supply demand outlook for quarter 1 2024 (PJ)

Source: ACCC analysis of data obtained from gas producers in June 2023 and of the domestic demand forecast (Orchestrated Step Change scenario) from AEMO, Gas Statement of Opportunities (GSOO), AEMO, April 2023. Note: may not sum due to rounding.

Chart 2: Regional supply outlooks for quarter 1 2024 (PJ)

Source: ACCC analysis of data obtained from gas producers in June 2023 and of the domestic demand forecast (Orchestrated Step Change scenario) AEMO, GSOO, April 2023. Note: may not sum due to rounding.

Note

The data in this report was collected before the mandatory Gas Market Code was finalised, which means the forecast does not reflect any supply commitments that gas producers have made under the Code’s exemptions framework.

The ACCC’s gas inquiry reports forecast the supply and demand balance for the east coast gas market, based on information provided by gas industry participants. Actual gas supply and demand in the forecast period may differ due to several factors, including changes in gas production and weather conditions, which influences demand for gas powered electricity generation.

This report relates to the near-term outlook for the first quarter of 2024 only. The ACCC’s most recent long-term outlook in its January 2023 interim report forecast that shortfalls would be likely from 2027 unless production was expanded. The ACCC will continue to examine the long-term outlook in its December 2023 interim report.

Background

In 2017, the Australian Government directed the ACCC to conduct a into the supply of and demand for natural gas in Australia, and to publish regular information on the supply and pricing of gas. The ACCC will conduct the inquiry until 2030 after the Government extended it in 2019 and again in 2022.

The ACCC’s next full report on the supply-demand outlook will be published in December 2023.