Global trade remained challenging for global exports in 2021 as the COVID-19 pandemic continued to create supply chain and logistical issues. Lower production also compounded the impact on Australian exports as herd rebuilding continued.

However, increased prices across international markets kept export volumes high relative to production. As a result, exports represented 72% of total red meat production over the year. In total, Australia exported 1.45 million tonnes of red meat, a 10.4% decline from 2020 levels.

Beef

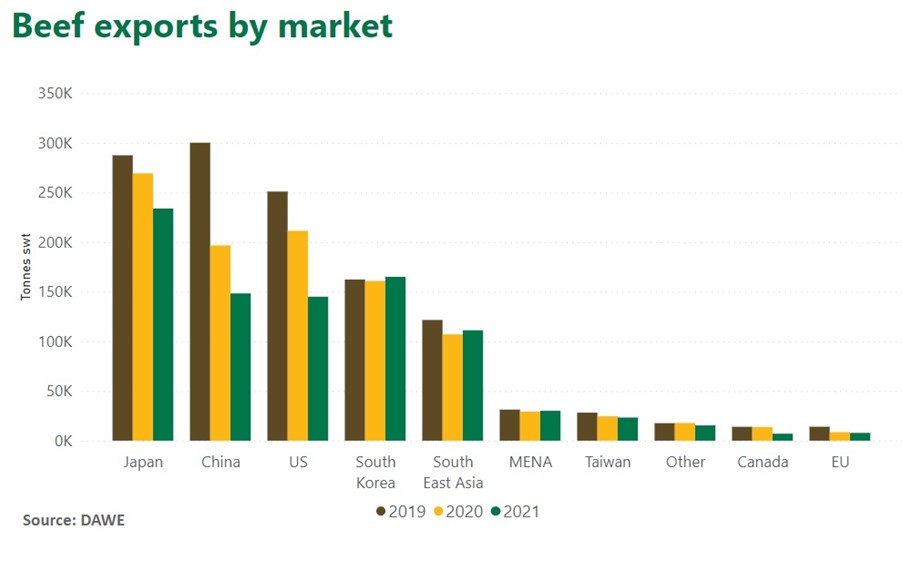

Beef and veal exports declined by 14.6% to total 887,682 tonnes. Japan was Australia’s largest customer in 2021, importing 216,000 tonnes of Australian beef, a 13% decline from 2020. This decline was due to several factors. Firstly, beef imports dropped overall by 2.6% as local production increased and the food service sector remained depressed as a result of COVID-19 related disruption. Secondly, large increases in export volumes from Canada, New Zealand and Mexico ensured that demand was met. Finally, price increases in Australian beef also placed downward pressure on demand.

Of Australia’s other major trading partners, South Korea was the only market to import slightly more beef in 2021, importing 165,000 tonnes compared to 161,000 tonnes in 2020. This was largely due to significant increases in frozen grainfed beef, which rose by 27% to 42,769 tonnes to contribute to 24% of the total Australian beef exports. At the same time, frozen grassfed beef, which made up 58% of exports in 2020, dropped by 10% in 2021. This shift in the export mix – alongside the overall increase in volume – meant that the value of beef exports to Korea rose to AU$1.7 billion, an 18% increase on 2020 value.

The US imported 145,024 tonnes of Australian beef in 2021, a 32% decline on 2020 and by far the largest decline among Australia’s major trading partners. American domestic production reached a record 12.7 million tonnes cwe. This is unlikely to continue into 2022 with the USDA projecting that production will fall by 2.8% this year as US cattle stocks continue their downward trajectory which began in 2019.

On the value front, Australian beef and veal exports averaged AU$9.36 per kg over 2021, a 7.6% increase on 2020 prices. However lower volumes saw an overall decline in total value of beef exports of 5.1% to $9.1 billion through the year.

Lamb and mutton

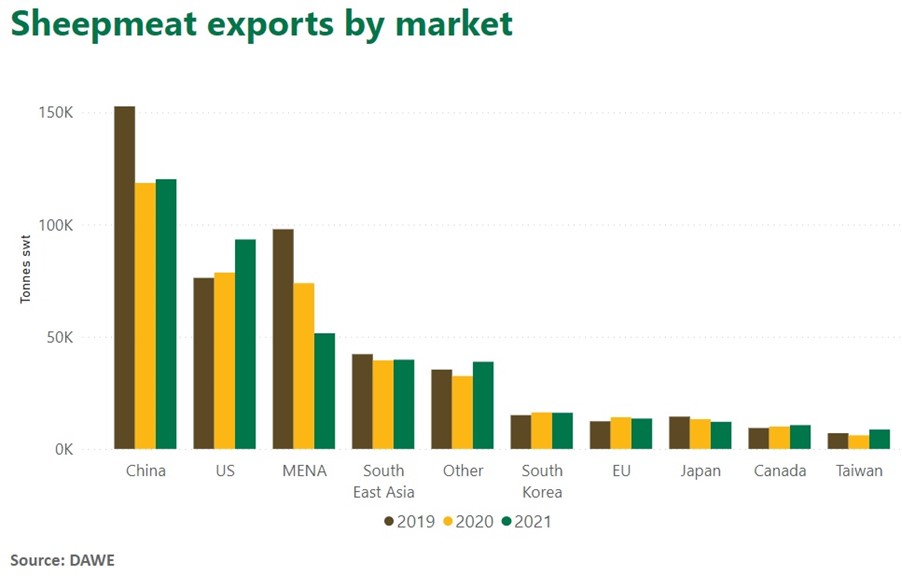

Australia exported 265,000 tonnes of lamb and 140,000 tonnes of mutton in 2021, overall remaining steady from 2020. The US saw the largest increase in sheepmeat sales, from 78,000 tonnes in 2020 to 93,000 in 2021. Lamb continues to dominate the export mix into the US, but mutton sales increased by 27% to make up 24% of the total export mix.

The Middle East and North Africa (MENA) region imported 31,000 tonnes of Australian lamb and 15,000 tonnes of mutton in 2021, a 33% drop in total exports for the year. The biggest factor for this was the increased air freight costs due to the pandemic impacts on reduced international flights during most of the year, coinciding with record high sheep prices in Australia. Another contributing factor was the ending of subsidies on Australian lamb imports by the Government of Qatar. These factors combined saw Australian chilled lamb exports to Qatar fall 70.3% in 2021 year-on-year and some uptick in frozen sheepmeat exports to the region.

The combined unit value and volume increase meant that the total value for sheepmeat exports rose by 10.5% to AU$4.05 billion over 2021. The US import price was AU$12.83/kg compared to the global average of $9.24 – meaning that the increased import volume dragged up prices globally, as was confirmed by the FAO meat price index.

Goat

Goat exports increased by 35% in 2021 to 19,000 tonnes. Combined with an 13% increase in the unit price of Australian goat, total export value was 52% higher in 2021 than 2020 at AU$242 million. Already the largest market, the United States imported 12,500 tonnes, a 47% increase year-on-year and 66% of Australian goat exports. South Korea also saw a 91% increase to 2,100 tonnes and Canada imported 1,300 tonnes, a 35% volume increase.

On the horizon in 2022

Australia enters 2022 in a strong position to capitalise on high prices and relatively constrained supply. Production is projected to rise in Australia as the restock continues to mature, while global demand is expected to outpace increases in supply. Supply chain constraints are already easing and are expected to attenuate considerably in the third quarter of 2022. Meanwhile, production is projected to decline in the United States – the other major beef exporter to Japan and Korea – throughout 2022.

Latest news