Property investment isn’t limited to the residential property market, the commercial market also offers excellent opportunities.

With that in mind, REIWA Research has reviewed the data for the industrial, office and retail property markets in Perth, with the industrial market the top performer in the year to May 2024.

These are preliminary figures and are likely to increase as more sales settle. It is also a broad overview of the Perth commercial market. If you’re currently investing in commercial property, it is worth speaking to a REIWA commercial agent to get an on-the-ground update on the conditions for your investment.

REIWA’s Commercial Network Committee also share their advice for people considering investing in the commercial market here.

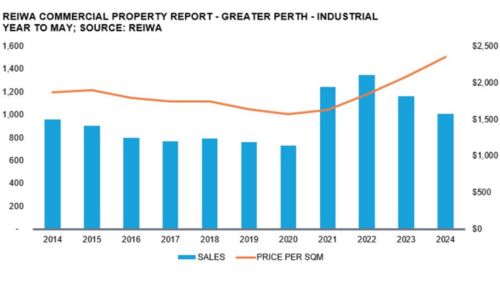

Industrial

The industrial market is currently the standout performer in the commercial market. Broadly speaking, there is demand for larger industrial lots but a shortage of developed land. As a result, prices have been rising and this is currently expected to continue.

Over the past few years, the number of sales has been higher then pre-COVID levels and prices have now exceeded the figures seen before the economic downturn.

There were 1,005 industrial sales recorded so far in the year to May 2024. This is 13.4 per cent lower than in the 12 months to May 2023.

The annual median sale price per sqm at the end of May was $2,353, which is 13.3 higher than the year before.

Across Perth, 8.7 per cent of industrial sales were priced between $100,000 – $250,000, 25.0 per cent between $250,000 – $500,000, 19.8 per cent between $500,000 – $750,000, 10.6 per cent between $750,000 – $1 million, 30.4 per cent between $1 million – $5 million and 5.5 per cent over $5 million.

Perth’s South East sub-region had the most sales, with 258. The Inner sub-region had the highest annual median sale price per sqm at $2,968.

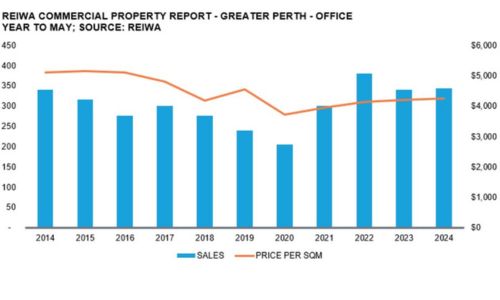

Office

The office market has been softer than the industrial market. While the number of sales is higher than before the pandemic, prices are lower, However, they have been rising slowly.

Office vacancy rates have been fairly stable. According to the Property Council, the Perth CBD has defied the national trend by recording the only decrease in the office vacancy rate among all capital cities. It fell from 15.9 per cent in July 2023 to 14.9 per cent in January 2024, which was the lowest vacancy rate since 2015.

At the time of writing, there were 344 office sales in the 12 months to May 2024. This is 1.2 per cent higher than the year before.

The annual median sale price per sqm was $4,239 at the end of May, which is just 0.8 per cent higher than May 2023.

Across Perth, 21 per cent of office sales were priced between $100,000 – $250,000, 34.6 per cent were between $250,000 – $500,000, 21.6 per cent were between $500,000 – $750,000, 8.3 per cent between $750,000 – $1 million, 13.6 per cent between $1 million – $5 million, and 0.9 per cent over $5 million.

The Inner sub-region had the most sales at 145 sales. The North West sub-region had the highest annual median sale price per sqm at $4,652.

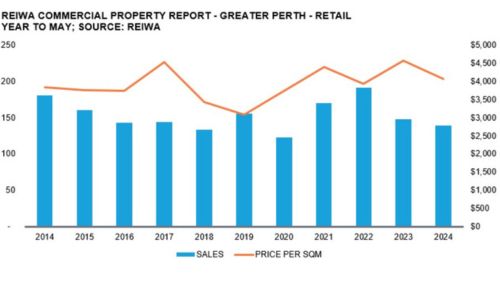

Retail

The retail market has shown more price and sales volatility than the industrial and office markets.

The retail market is more greatly affected by consumer sentiment than the industrial or office markets. When house prices are rising, people feel more wealthy and are more likely to shop. When interest rates rise, discretionary spending declines and it becomes harder for retailers. Although property prices are rising, mortgage holders and buyers are feeling the pinch of 13 interest rate rises which have seen mortgage repayments increase by about 50 per cent, as well as the overall rise in the cost of living.

There were 139 retail sales in the 12-months to May 2024. This is 6.1 lower than in the previous year.

The annual median sale price per sqm at the end of May was $4,059, which is 11.1 per cent lower than 12 months prior.

Across Perth, 8.1 per cent of retail sales were priced between $100,000 – $250,000, 31.6 per cent between $250,000 – $500,000, 23.5 per cent between $500,000 – $750,000, 5.9 per cent between $750,000 – $1 million, 27.2 per cent were between $1 million – $5 million, and 3.7 per cent over $5 million.

Perth’s South West sub-region had the most sales, with 34. The Inner sub-region had the highest annual median sale price per sqm at $7,333.