Surging inflation is driving record increases in government tax revenue while simultaneously pushing down workers’ real wages, according to new Australia Institute analysis of Treasury forecasts released today.

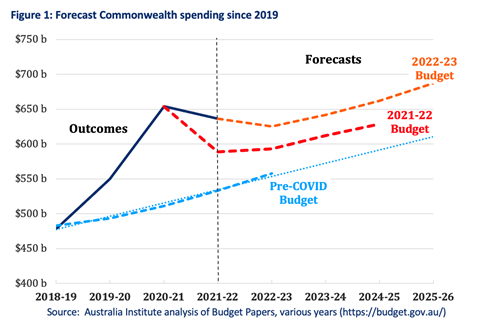

As the figure below shows, Treasury forecasts of Commonwealth spending are well above the spending forecasts made pre-covid and, more significantly, well above the levels forecast in last year’s Budget.

“While both the Prime Minister and Treasurer repeatedly claim their covid stimulus was ‘temporary and targeted,’ in reality it was significant and sustained,” said Dr Richard Denniss, chief economist at the Australia Institute.

“Some forms of spending like the JobSeeker supplement help people cope with rising costs, while some forms of spending like free childcare help to actually lower the costs of living. Meanwhile other forms of spending like $7 billion for new dams simply push up the cost of construction for everyone else in the economy.

“Unfortunately, the Federal Government has chosen to abolish the spending programs that actually help Australians with the cost of living, and introduce new spending that will likely push up inflation and interest rates higher.

“Ironically, while high inflation might be bad news for working families, it is good news for Commonwealth revenue. Higher prices lead to a direct increase in GST revenue, and when there is 5 percent inflation and only 3 percent wage growth, many workers will wind up in higher tax brackets even though their real wages have declined.

“It’s not just the amount of public spending that matters, but what the Government is spending it on. The Federal Government has emerged from the pandemic with much higher levels of spending, but the bad news for most Australians is the shape of that new public spending is helping to fuel further inflation rather than help with the cost of living.”