while services growth slows

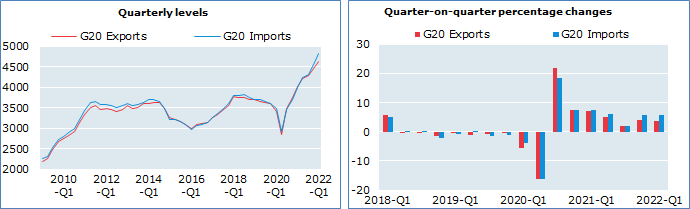

24 May 2022 – Following six quarters of sustained growth, the value of international merchandise trade for the G20 reached a new high in Q1 2022. Exports and imports increased by 3.6% and 5.8%, as compared to Q4 2021 and measured in current US dollars. The increase is largely explained by rising commodity prices, as the war in Ukraine and COVID-19 containment measures in East Asia placed further pressure on the prices of traded goods and on already strained supply chains.

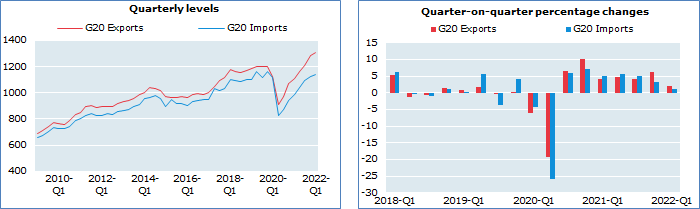

Growth in exports and imports of services for the G20 are estimated at around 2.0% and 1.1% in Q1 2022, respectively, compared to the previous quarter and measured in current US dollars. The preliminary estimates are well below the rates of 6.2% and 3.1% recorded in Q4 2021 for exports and imports, reflecting weaker trade in the transport sector in East Asia and a general slowdown in services trade across most of the G20 economies for which data are available.

G20 merchandise trade

Based on figures in current prices (billion US dollars), seasonally adjusted

Visit the to explore these data further

Source:

G20 trade in services

Based on figures in current prices (billion US dollars), seasonally adjusted

Visit the to explore these data further

Source: and national sources.

Note: The Q1 2022 trade in services values are preliminary estimates based on available data, covering about 60% of exports and imports for the G20 aggregate.

Growth in merchandise exports from North America slowed in Q1 2022. Following 7.1% growth in the previous quarter, the United States recorded a 2.4% increase in exports, driven by energy and chemicals (including pharmaceuticals and fertilisers). Imports rose sharply (up 9.6%), boosted by computers and parts, telecommunication equipment as well as apparel and other consumer goods. Canadian exports increased by 4.2%, pushed by energy, forestry and record shipments of fertilisers (potash) at the onset of the Russian invasion of Ukraine. Imports grew moderately (up 1.3%), due to slower purchases in the automotive sector. In Mexico, exports and imports expanded by 5.2% and 6.9%, respectively, with energy and vehicles and parts accounting for higher exports.

Merchandise exports continued to grow in East Asia, while the pattern for imports varied across countries. Due to chip shortages weighing on shipments of vehicles and parts, total exports increased by only 0.8% in Japan, while energy and raw material prices boosted imports (up 7.0%). Electronics, COVID-19 testing kits and e‑cars continued to fuel exports growth from Korea (up 3.8%), while energy products drove an increase in imports (up 6.1%). Exports from China expanded by 4.7%, fuelled by strong sales of steel and plastic products as well as steady shipments of electronics. However, Chinese imports stagnated (up 0.3%), as purchases of energy were partially offset by a decline in imports of iron ores. Exports from India fell by 0.9% in Q1 2022, while imports grew by 4.6%.

Soaring energy purchases boosted import growth across most economies in Europe. Exports and imports expanded by 3.0% and 5.0%, respectively, in the European Union. Exports from France grew by 3.2%, driven by aeronautics and ships, while imports increased by 4.3% due to chemicals and metals. Merchandise exports (up 5.5%) and imports (up 7.9%) also picked up in Italy, with the strongest growth recorded in exports of intermediate goods. As geopolitical tensions weighed on shipments of machinery and chemicals, German exports declined by 0.1% while imports increased by 3.0%. Similarly, exports from the United Kingdom contracted (down 1.6%), but imports soared (up 18.8%) due to machinery, transport equipment and energy.

Rapidly rising prices boosted the value of merchandise trade for the leading commodity exporters in the G20. Australia’s exports grew by 7.8% in Q1 2022, due to rising sales of cereals, coal and metals. Also driven by cereals, merchandise exports increased by 11.5% in Argentina. Despite a slowdown in metal ores, Brazilian exports jumped by 20.2%, driven by mineral fuels and by a surge in shipments of soybeans. Similarly, Indonesia and South Africa recorded robust export growth in Q1 2022 (up 6.1% and 7.7%, respectively).

Services trade slowed in North America. Exports and imports grew by 2.3% respectively in the United States in Q1 2022, with robust business services and financial services offsetting weak transport and computer services. Canada’s exports (down 1.3%) declined slightly across all categories, most notably travel. Imports increased by 2.3%, with transport and travel recording robust growth (up 7.5% and 6.2%).

Following several quarters of sustained growth, a slowdown in transport weakened services trade in East Asia. In Japan, exports continued to weaken (down 4.4%), due to a decrease in transport, computer and business services, and imports increased by 2.3%. Korean exports saw a moderate increase (up 1.6%), as solid business and transport services were partially offset by lower sales of computer services and construction. Korean imports were flat. In China, exports of services grew by 4.1%, the slowest rate in six quarters, while imports rose by 3.5%. The lifting of mobility restrictions in Australia led to an uptick in services trade. Exports grew moderately (up 1.5%), while imports soared (up 9.5%), driven by transport and travel.

Services trade slowed in most European countries. Services exports in Germany and Italy grew by 1.1% and 1.8% respectively, while imports remained stagnant (up 0.4% for Germany and down 0.8% for Italy). In the United Kingdom services exports declined by 1.3%, and imports contracted sharply (down 11.5%). By contrast, with travel receipts up by 14.0%, servicesexports rose by 4.9% in France, while imports grew by 2.0%. Turkey recorded double-digit growth for exports (up 22.8%) and imports (up 15.1%), reflecting strong passenger travel and transport services.