Investor activity in the property market grew in 2023, with the number of new housing loans to investors 10.4 per cent higher than 2022 and 37.3 higher than 2021, according to the latest lending data from the Australian Bureau of Statistics.

Monthly loan figures peaked at 2,211 in November, the highest on record.

REIWA CEO Cath Hart said it was positive to see greater investor participation in the market.

“WA lost a significant number of rental properties from the market post-COVID,” she said.

“Our tight rental market needs every property it can get, so it is good to see investor loans increasing.

“Unfortunately, despite the increase, our data does not yet show an increase in the number of rental properties, so the significant imbalance between supply and demand in the rental market remains.”

Ms Hart said while the loan figures didn’t tell you where the investors were located, REIWA members reported strong activity from Eastern States investors in 2023.

“They’re drawn by the value our market is offering,” she said.

“Despite increases over the past few years, our property prices are much more affordable than the east coast and we’ve had significant rent price growth. This means properties have the potential for very good yields.”

There was a strong investor focus on construction, with the number of loans for land rising 21.0 per cent and the number of loans for building rising 52.7 per cent in 2023.

“Builders and developers have also been reporting strong sales to Eastern States investors,” Ms Hart said.

“This is good news and will boost rental supply in the longer term as these houses are completed.”

Owner occupiers

While loans to investors rose, the total number of new owner occupier loans was 12.2 per cent lower than in 2022.

Lending for building fell 20.5 per cent, while lending for existing dwellings decreased 11.9 per cent. The number of loans for land declined 10.9 per cent.

Ms Hart said the number of loans for building had been declining since the end of the State and Federal Government COVID building incentives.

“The incentives saw a massive spike in construction loans to owner occupiers in 2020 and the first three months of 2021, which was initially good news for the building industry and housing supply,” she said.

“However, the resulting building boom saw construction costs rise and completion times blow out significantly.

“Confidence in the building industry fell and people focused more on the established homes market.

“You can see this in the change in the proportion of loans for building and existing dwellings. The proportion of loans for building was 22 per cent in 2021, with 63 per cent of owner occupier loans being for existing dwellings. Compare this with 13 per cent for building and 71 per cent for existing dwellings in 2023.

“This lack of investment in new builds is concerning as WA desperately needs more new homes.”

The average loan size for owner occupiers rose 3.5 per cent to $509,275 over the year to December 2023. The national average rose 3.3 per cent to $624,383.

First home buyers

The number of new loans to owner occupier first home buyers fell 12.0 per cent to 15,604 in 2023.

Despite the decline, first home buyers still represented 35 per cent of new owner-occupier loans.

“Comparing the number to shortly before the pandemic, this is fairly normal representation,” Ms Hart said.

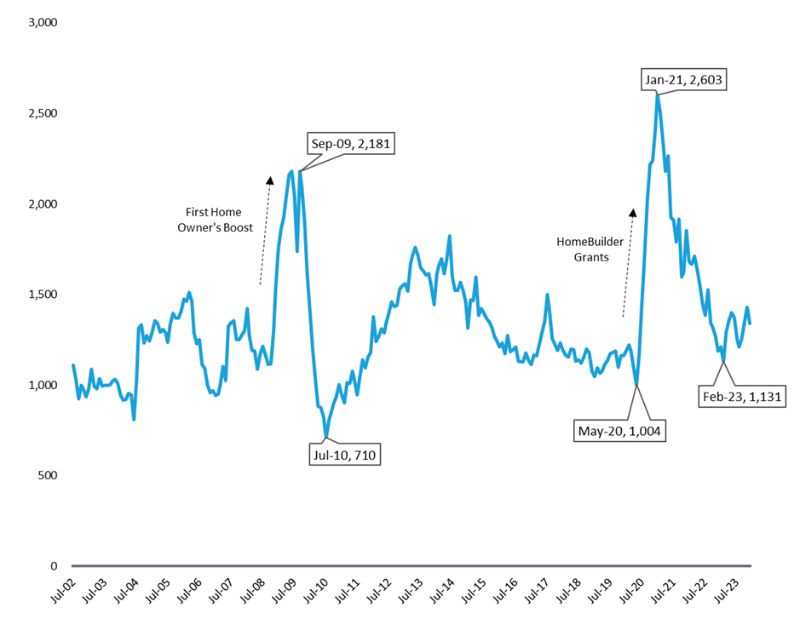

“The building incentives, combined with low interest rates, saw a massive spike in first home buyer activity, with the proportion of owner occupier loans to first home buyers peaking at 43.2 per cent in early 2021.

“We saw a similar effect during the First ³Ô¹ÏÍøÕ¾ Owner’s Boost period when they peaked in 2009 at 44.9 per cent, before plummeting to 27.9 per cent after the grants had ended.”

New Loan Commitments to First ³Ô¹ÏÍøÕ¾ Buyers (WA)

Source: ABS, REIWA.