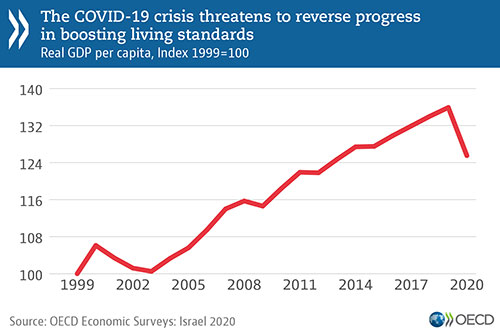

After a decade of robust growth that lifted employment and well-being, the COVID-19 pandemic has thrust Israel, like most countries into a severe economic shock, adding to long-standing challenges, according to a new OECD report.

In its latest , the OECD says government support to cushion people and businesses from income losses should continue and adapt as the health and economic situation develops. Training and job-search assistance would help those who have lost jobs to find new ones while improving education and infrastructure and boosting competition would strengthen the recovery.

“The global coronavirus crisis hit just as Israel’s economy was performing well. In the 10 years since joining the OECD, Israel has halved its unemployment rate, raised living standards and reduced public debt,” said OECD Chief Economist Laurence Boone. “Israel needs to keep up its efforts to protect people and firms, revive growth and avoid the crisis aggravating key challenges of high inequalities and productivity disparities between high-tech and traditional sectors.”

“The global coronavirus crisis hit just as Israel’s economy was performing well. In the 10 years since joining the OECD, Israel has halved its unemployment rate, raised living standards and reduced public debt,” said OECD Chief Economist Laurence Boone. “Israel needs to keep up its efforts to protect people and firms, revive growth and avoid the crisis aggravating key challenges of high inequalities and productivity disparities between high-tech and traditional sectors.”

With uncertainty over the virus still high and global demand weak, the Survey projects only a gradual recovery of GDP growth to 2.9% in 2021, after a drop of 6% in 2020. Unemployment is set to remain above pre-crisis levels at the end of 2021.

To strengthen the recovery, it is important to accelerate efforts to tackle underlying challenges. These challenges include Israel’s severe disparity in adult skills, with low-skilled workers outnumbering those with outstanding skills. This contributes to a marked labour market duality, with high-wage jobs in the high-tech sector and low-quality, poorly-paid jobs elsewhere. Low-paid jobs are concentrated among the Haredi and Arab-Israeli populations, exacerbating the country’s socio-economic divide and income inequalities between different municipalities.

The Survey recommends improving the education system by reducing differences between education tracks and attracting the best teachers to disadvantaged schools and poorer regions. Additional support is needed for poorer municipalities mainly through higher compensation from wealthier ones to help them finance adequate public services for their residents. Enhancing public transport will help connect people to jobs.

The Survey says tax reforms can make growth more inclusive and greener. Further expanding in-work benefits can help reduce poverty among those in work. Congestion charges and a more consistent pricing of carbon, while protecting the most vulnerable, would help reduce traffic flows and carbon emissions and improve air quality and well-being.

To boost competition and productivity growth, improving business regulations, particularly in the agricultural sector, further lowering barriers to foreign trade and investment, and streamlining trade procedures should be priorities.

See an with key findings. (This link can be included in media articles.)