Key points:

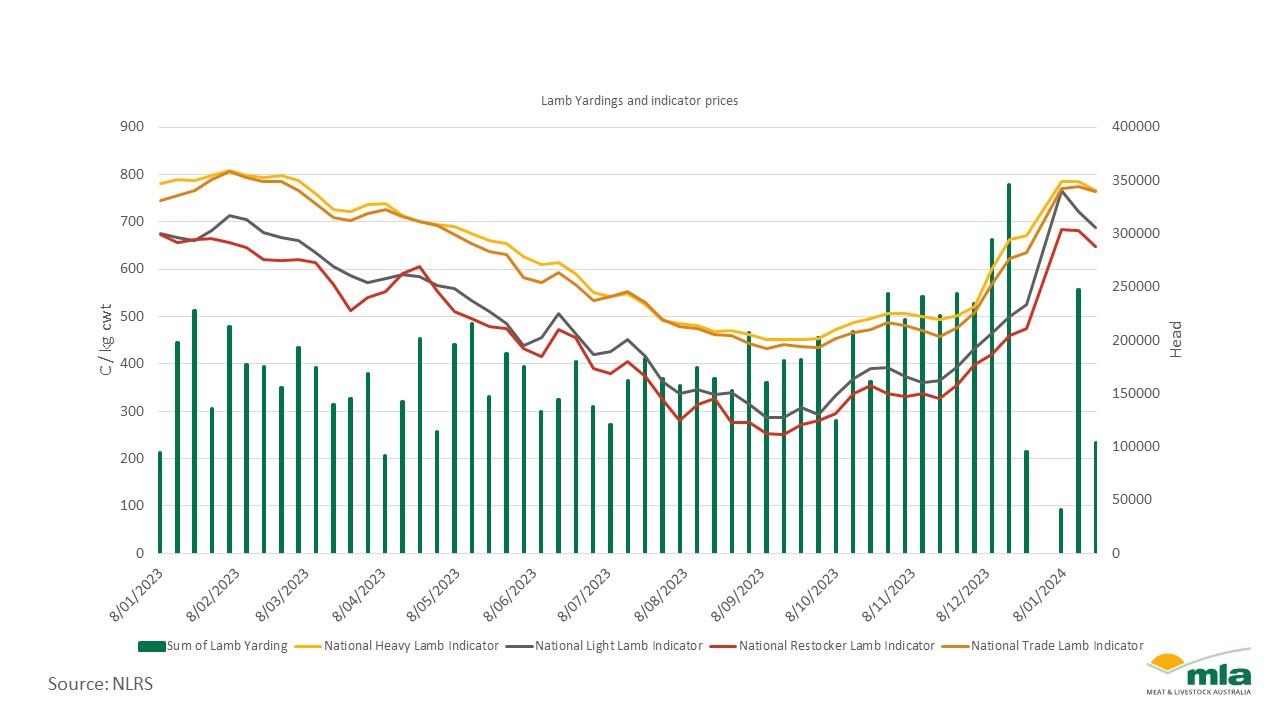

- The lamb market has been reactive during January, with current prices up nearly 20% from December 2023.

- The strongest indicators are the heavy and trade lamb indicator hovering at about 700c/kg carcase weight (cwt).

- Over 2023, hoggets fetched an average 33% price premium over mutton in saleyards, with high variability week to week.

The current lamb market

The Australian sheep flock is the largest since 2007, currently sitting at 28.75 million head due to historically large numbers of breeding ewes and high marking rates. In 2023, prices eased over eight months of the year, then started to recover from October. In 2023the restocker lamb indicator fell by 62% to September and lifted by 158% to now [when is the 158% lift from?]. This trend has been seen across all indicators.

Over these last months, the lamb market has been volatile and reactive with current prices up nearly 20% from December 2023. This is with January on track to have the highest lamb yardings since 2019. These high prices and high supply illustrate a greater shift in market confidence. With record rainfall over the summer prompting producer confidence, prices have almost returned to January 2023 levels.

In the current market, the strongest indicators are the heavy and trade lamb indicator hovering at about 700c/kg cwt. The heavy and trade lamb indicators have a 63% premium over mutton. The mutton discount has led to producers considering their options when their lambs age out of the lamb market.

High supply though a hogget lens

Saleyard throughput has put pressure on producers to provide a quality, finished animal in order to remain competitive in a buyers’ market. If producers are unable to compete with quality stock, or prices are not sufficient to sell, there is a risk that lambs may miss their window for the market (under 12 months and with no permanent teeth wear).

This has possibly caused an increase in lamb retention and higher hogget numbers looking for a market (i.e. castrated male and female sheep with no ‘ram-like’ characteristics and up to two permanent teeth).

Currently, producers with hoggets have few options, either sell into the mutton market at a discount price to lamb, or hold onto stock and possibly put pressure on land capacity.

What are hoggets doing now?

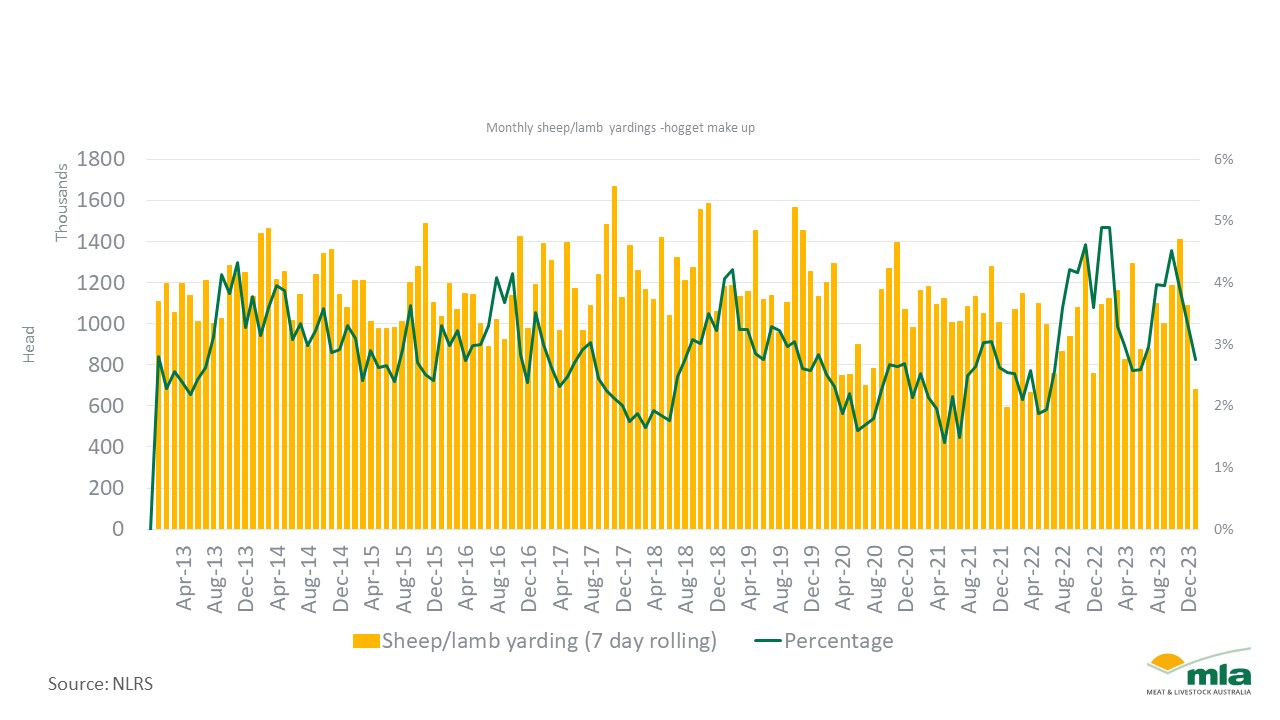

MLA does not have a hogget indicator. MLA Livestock Market Operators (LMOs) enter certain characteristics into the ³Ô¹ÏÍøÕ¾ Livestock Reporting Service system at different levels of detail, and some include when stock is in the hogget category. The information in the charts below should not be taken as complete coverage of the hogget market through saleyards, though it provides a representation of where the market lies.

Over 2023, hoggets were fetching on average a 33% premium over mutton in saleyards, however, there was significant variability from 118% to -2%. As seen below, the proportion of hogget yardings in total sheep and lamb yardings tends to go up during periods where producers would be more interested in destocking during drier periods.

In 2024, hogget prices have started strong in comparison to mutton prices and received an average premium of 86% through saleyards. Despite high throughput of sheep this year, the hogget proportion of sheep yardings has dropped from 13% last month, to 10% this year to date.

Attribute to:

Erin Lukey, Senior Market Information Analyst

Emily Tan, Market Information Analyst

Latest news