Tough times for savers

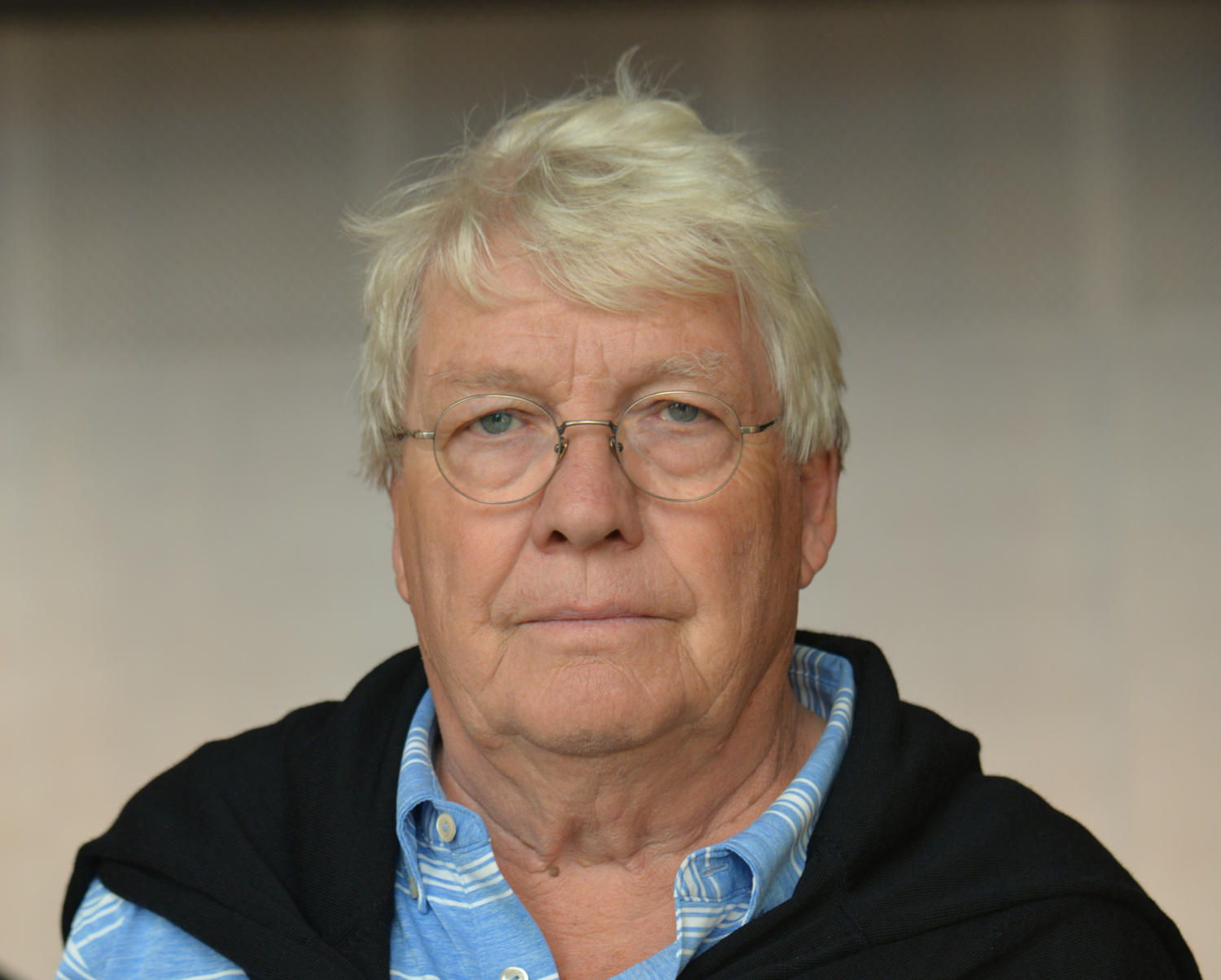

Most of the major banks have passed on the 0.25 percentage points increase in the cash rate target to their deposit rates, but it’s still not a great proposition for savers, according to Pete Wargent, co-founder of Australia’s first national marketplace for buyer’s agents and residential lending solutions, BuyersBuyers.

Mr Wargent said, “interest rates on savings accounts have fallen consistently from above 5 per cent per annum in 2011 to record low levels through the pandemic”.

Figure 1 – Retail deposit rates 2004-2022

“Interest rates are now expected to rise from here, of course, which will provide some respite. And it is possible to get rates of around 3 per cent or above for those with the required savings and ability to use 2-year term deposits”.

“The problem is that after tax and headline inflation of above 5 per cent and rising, you’re still going backwards”.

“Even the less volatile underlying measures of inflation have been running at an annualised pace of over 4 per cent over the past six months of reported figures”.

Figure 2 – Underlying inflation in Australia

“We can see that there has been a huge uplift in the popularity of mortgage offset facilities, underscoring the significant challenges facing savers” Mr Wargent said.

Seeking an inflation hedge

BuyersBuyers CEO Doron Peleg said that traditionally investors look to hard assets during times of elevated inflation, such as gold, precious metals, or farmland.

Mr Peleg said, “we have certainly seen a recent trend in enquiries from investors seeking a hedge against in inflation”.

“Some are choosing to look at industrial or other commercial real estate assets, where the net yields are strong enough to pay down the mortgage debt over time”.

“Others are looking the tight residential property markets, such as Adelaide or some of the regional property markets, where rents are expected to rise by 10 to 20 per cent this year”.

“We are already seeing rents in many locations rising at a double-digit pace this year, which will encourage more investors into the market, with yields of 4 per cent or higher achievable in many parts of the country” Mr Peleg said.

Transitory or not?

Pete Wargent of BuyersBuyers said economists will be watching closely for signs as to whether the present burst of inflation is transitory or likely to persist for longer than previously expected.

Mr Wargent said, “there are many unpredictable variables around the world at the moment, including the Ukraine war, and lockdowns disrupting supply chains in China”.

“Locally the government and Reserve Bank will be looking to take the pressure of the rising cost of living, but some of the global drivers of inflation aren’t directly within our control”.

“Property investors are expecting to see mortgage rates rise over the coming year, but many are choosing to take a medium-term view, with population growth likely to return towards 350,000 per annum by the end of 2024, and a chronic shortage of rental properties likely to drive rental prices higher” Mr Wargent said.