Key points:

- COVID-19 is having a profound impact on the South-East Asia (SEA) tourism and foodservice sectors

- Domestic consumption will remain the key to boosting demand growth as the global economy struggles to recover

- Evolving consumer interest in enjoying food at home presents opportunities to grow demand for Australian red meat in SEA.

Budget-conscious consumers

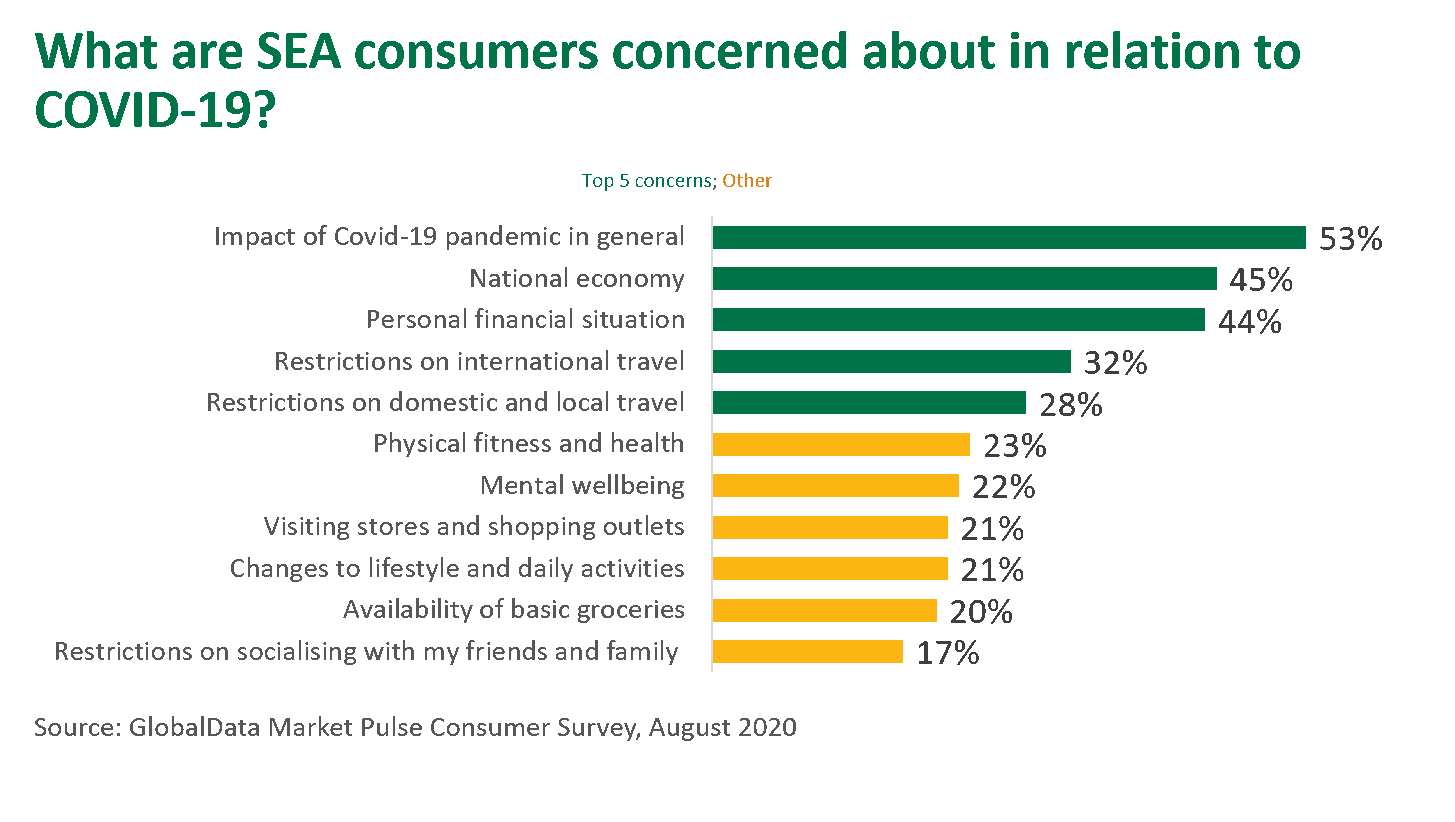

SEA is experiencing a profound economic impact due to COVID-19 disruptions. The larger economies such as Singapore, Malaysia and Thailand saw double-digit GDP contraction in the second quarter of 2020, as a result of stringent movement restrictions and border closures beginning in March. Tens of millions of workers have reportedly been impacted by the pandemic, making job security one of the top concerns.

Tourism, which is a significant contributor to SEA’s GDP, is among the most affected industries, with Thailand anticipated to be one of the countries that may suffer the largest economic hit to this as a result of this. A sharp fall in global demand and other COVID-19 disruptions such as travel restrictions, logistics and supply of raw materials have all also negatively affected the SEA economy.

The Asian Development Bank’s newly released economic projection for September predicted SEA’s aggregate GDP for 2020 to contract 3.8%, but also a strong rebound in 2021 at 5.5%, underpinned by domestic stimulus and global recovery. However, global uncertainties may keep a lid on the extent of economic recovery in the region.

Domestic consumption has fallen as more consumers tighten their budgets due to concerns about future income and job prospects. Some 45% of the region’s consumers surveyed said they have spent less than usual as a result of the COVID-19 pandemic, and 54% say it is their ‘top priority’ or ‘more important’ to align their food and beverage spending with their total shopping budget.

Continued efforts beyond takeaway and home delivery services are key for foodservice operators

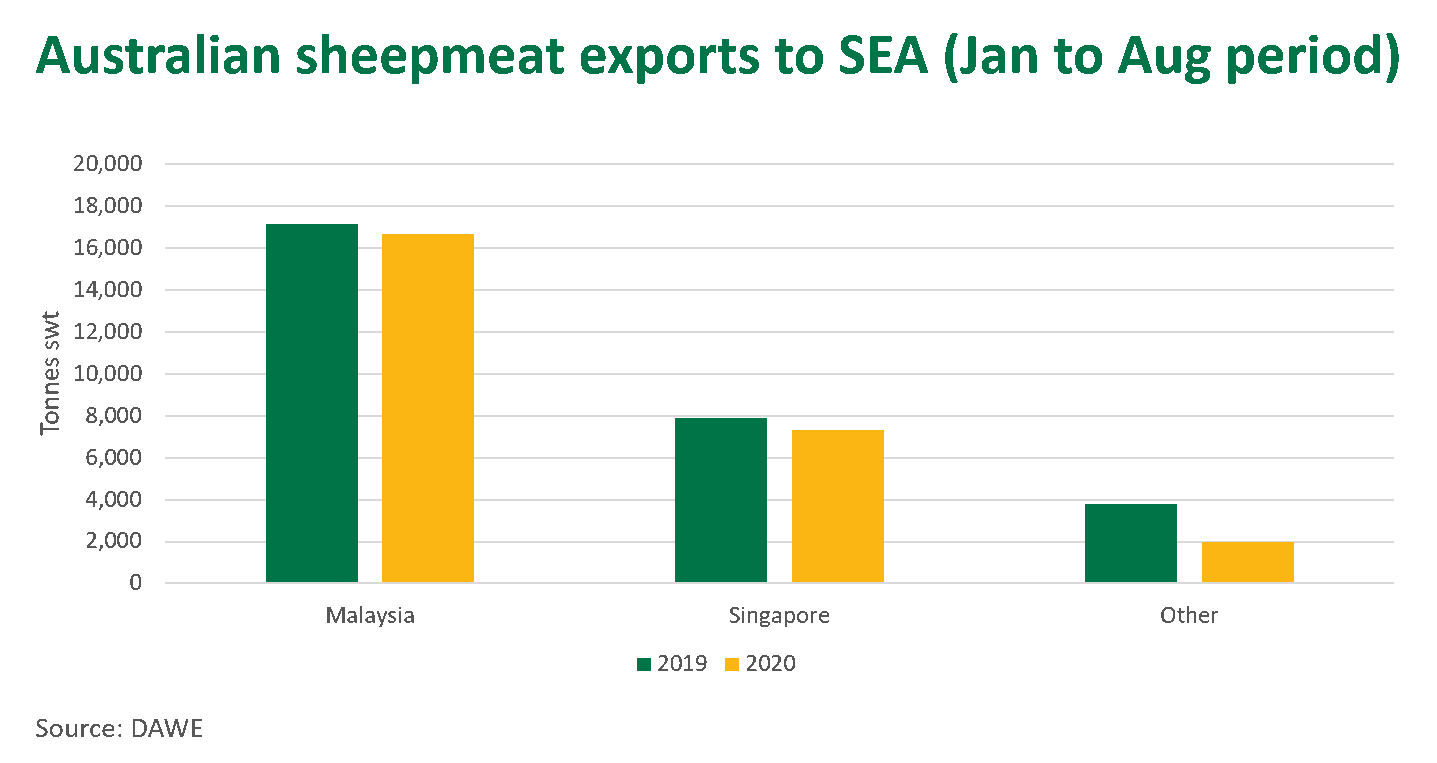

International border shutdowns and domestic travel restrictions, along with low local demand due to consumers’ fears over the virus and budget constraints, have resulted in profound losses in the foodservice sector, which subsequently impacts demand for Australian red meat, particularly boxed beef and sheepmeat.

COVID-19 has also resulted in a shift in consumers’ dining-out habits, with more using takeaway or home delivery services. Over half of SEA survey respondents said they had increased their use of food delivery services, with e-commerce channels enabling much of this growth across Singapore and Malaysia.

Domestic consumption will remain the key to boosting growth in the SEA foodservice sector, as the reopening of international tourism remains uncertain. However, restaurant operating capacities are reliant on local governments’ adjustment to COVID-19 containment measures.

SEA foodservice operators have been actively adjusting their businesses in a number of creative ways to stay afloat during this difficult time. Thai Airways, for example, has introduced a pop-up airplane-themed restaurant in their headquarters in Bangkok to cater to ‘travel craving’ consumers in early September.

Growing importance of health in food purchase decisions

COVID-19 has caused some shifts in SEA consumers’ eating habits and preferences. Health was already one of the top priorities for SEA consumers, but has become of even greater importance since the pandemic, as consumers seek to protect themselves from infection. The region is seeing increasing consumer interest in an array of health claims, from boosting immunity and improving gut health to sleep quality promotion and antioxidant benefits. Natural, risk-free guaranteed and transparent information about the source of product ingredients are important elements that SEA consumers look for when they buy food in the wake of COVID-19.

³Ô¹ÏÍøÕ¾ cooking has become a new norm in SEA as a result of movement restrictions and concern about COVID-19 infection in public places. Many consumers prefer to cook and eat at home than to go out, despite eased restrictions and availability of takeaway or home delivery options.

Top three attributes SEA consumers find appealing about cooking at home

Singapore | Malaysia | Indonesia | Thailand | Philippines | Vietnam |

Greater awareness/ control over ingredients | Tailored to my individual needs and preferences | Greater awareness/ control over ingredients | Tailored to my individual needs and preferences | Enjoy cooking/ preparing food at home | Greater awareness/ control over ingredients |

Value for money | Value for money | Tailored to my individual needs and preferences | Value for money | Greater awareness/ control over ingredients | Tailored to my individual needs and preferences |

Tailored to my individual needs and preferences | Greater awareness/ control over ingredients | Enjoy cooking/ preparing food at home | Enjoy cooking/ preparing food at home | Value for money | Enjoy cooking/ preparing food at home |

Source: GlobalData Market Pulse Consumer Survey, August 2020 | |||||

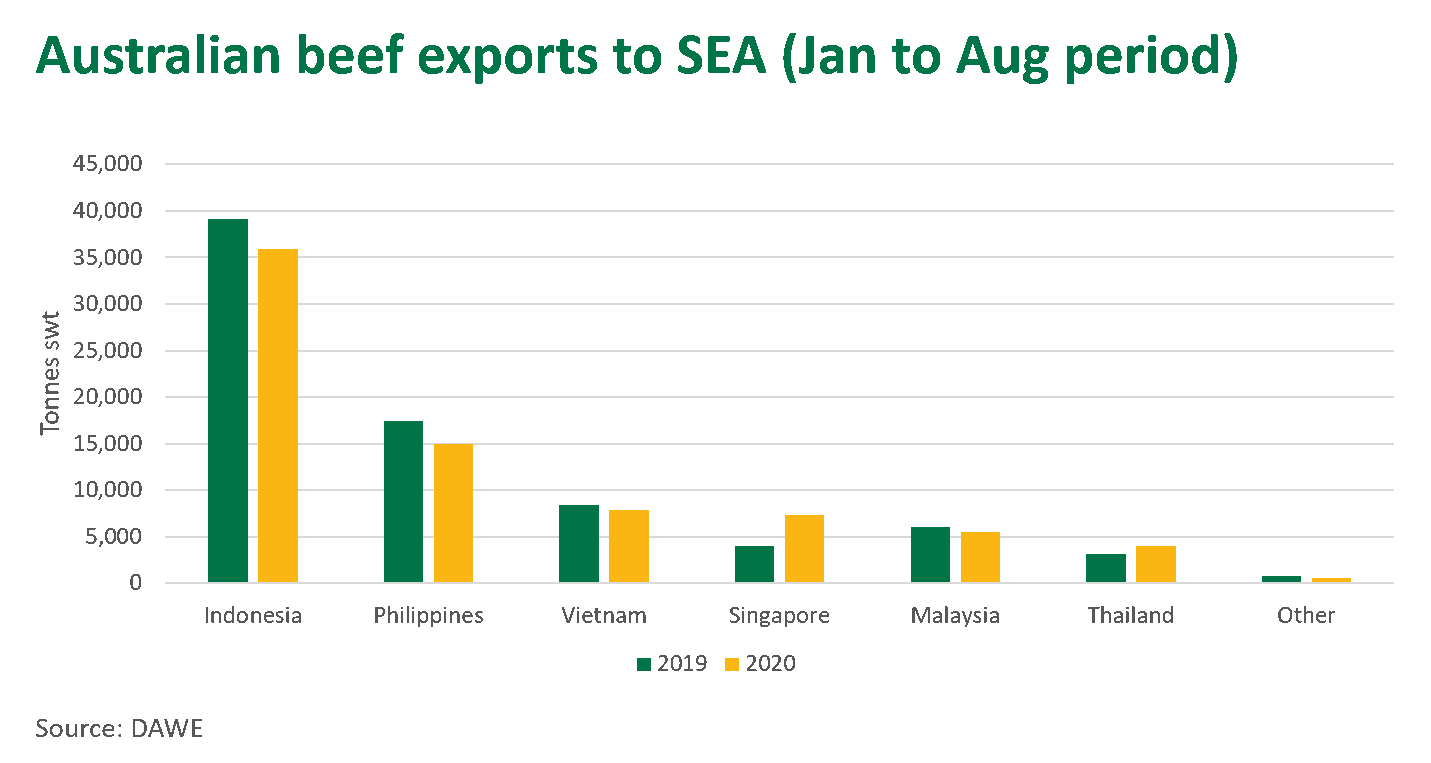

Increased consumer interest in home cooking has offset some losses in the foodservice sector for Australian beef exports. Since the outbreak, there has been strong growth in Australian exports to Singapore and Thailand for boxed beef, and to Vietnam and Malaysia for live cattle. Boxed beef exports to Singapore and Thailand in the year-to-August 2020 grew by 82% and 27% year-on-year, respectively, while live cattle exports to Vietnam and Malaysia increased 28% and 31%.

The ccontinued spread of COVID-19, weakened purchasing power and increasing costs have resulted in a sharp drop in Australian live cattle and boxed beef exports to Indonesia and the Philippines. For the year-to-August, live cattle and boxed beef exports to Indonesia declined 27% and 8%, respectively, while those to the Philippines dropped 4% and 15%, respectively.

MLA’s response to changing consumer needs

With health and well-being as top priorities for SEA consumers during the COVID-19 pandemic, MLA’s consumer campaigns have focused strongly on promoting Australian red meat’s ‘safety’ credentials and the health and nutritional benefits of red meat. For example, MLA is currently running the ‘Beef Up’ campaign in Indonesia, Malaysia and Singapore, targeting mums and young professionals. The campaign focuses on delivering nutritional messages, recipes, cooking tips and tricks that makes it easy and convenient for families to incorporate beef into their daily menu repertoire. Leveraging the TrueAussie brand, the Beef Up campaign aims to keep Australian red meat as an ideal and trusted protein choice for consumers to get through this tough time.

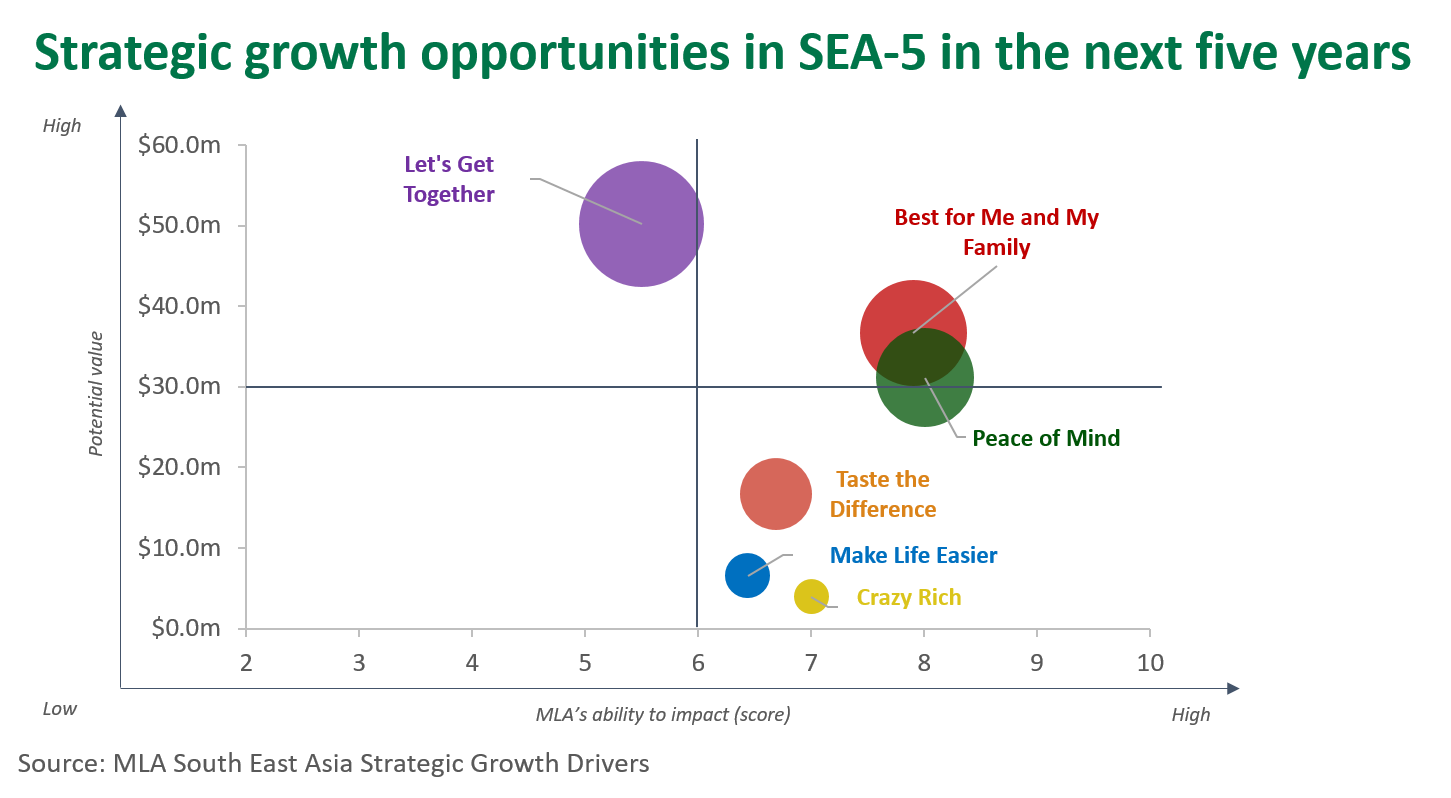

Despite COVID-19 challenges, the SEA region has solid fundamentals for consistent growth in the next five years, . The region also has a youthful and digitally connected population that is becoming more informed and more conscious about their food and lifestyle choices.

MLA has identified six strategic growth opportunities within the key SEA markets. The key focus for next five years is to use targeted campaigns and activities to incrementally unlock these opportunities.

© Meat & Livestock Australia Limited, 2020

To build your own custom report with MLA’s market information tool click .

To view the specification of the indicators reported by MLA’s ³Ô¹ÏÍøÕ¾ Livestock Reporting Service click .

Latest news