NAB has today announced its lowest ever fixed home loan rate, with rates starting from 1.98% per annum for a four-year fixed term. Rate changes will be effective from 10 November 2020 for new fixed rate loans.

NAB, Australia’s leading bank for businesses, will also cut 200 basis points from the rates on its QuickBiz Loan for the next three months. These rates will be effective from 6 November until the end of January 2021.

NAB’s fixed home loan rate changes, for owner occupiers on the NAB Choice Package paying principal and interest (new loans) include1:

- 10 bps cut to 1-year Advertised Fixed Rate to 2.19% p.a.

- 10 bps cut to 2-year Advertised Fixed Rate to 2.09% p.a.

- 20 bps cut to 3-year Advertised Fixed Rate to 2.09% p.a.

- 81 bps cut to 4-year Advertised Fixed Rate to 1.98% p.a.

NAB Group Executive Personal Banking Rachel Slade said: “These changes are designed to provide certainty to our customers with our lowest fixed rates ever, boost confidence and support credit recovery.

“This is the sixth reduction in the cash rate during the past 18 months. With interest rates at record lows we are doing what we can to support homebuyers and business owners through COVID-19, while also balancing the impact on our deposit and savings customers.

“Australia has had our support from the beginning of this pandemic and we will continue to help our customers through to the other side.”

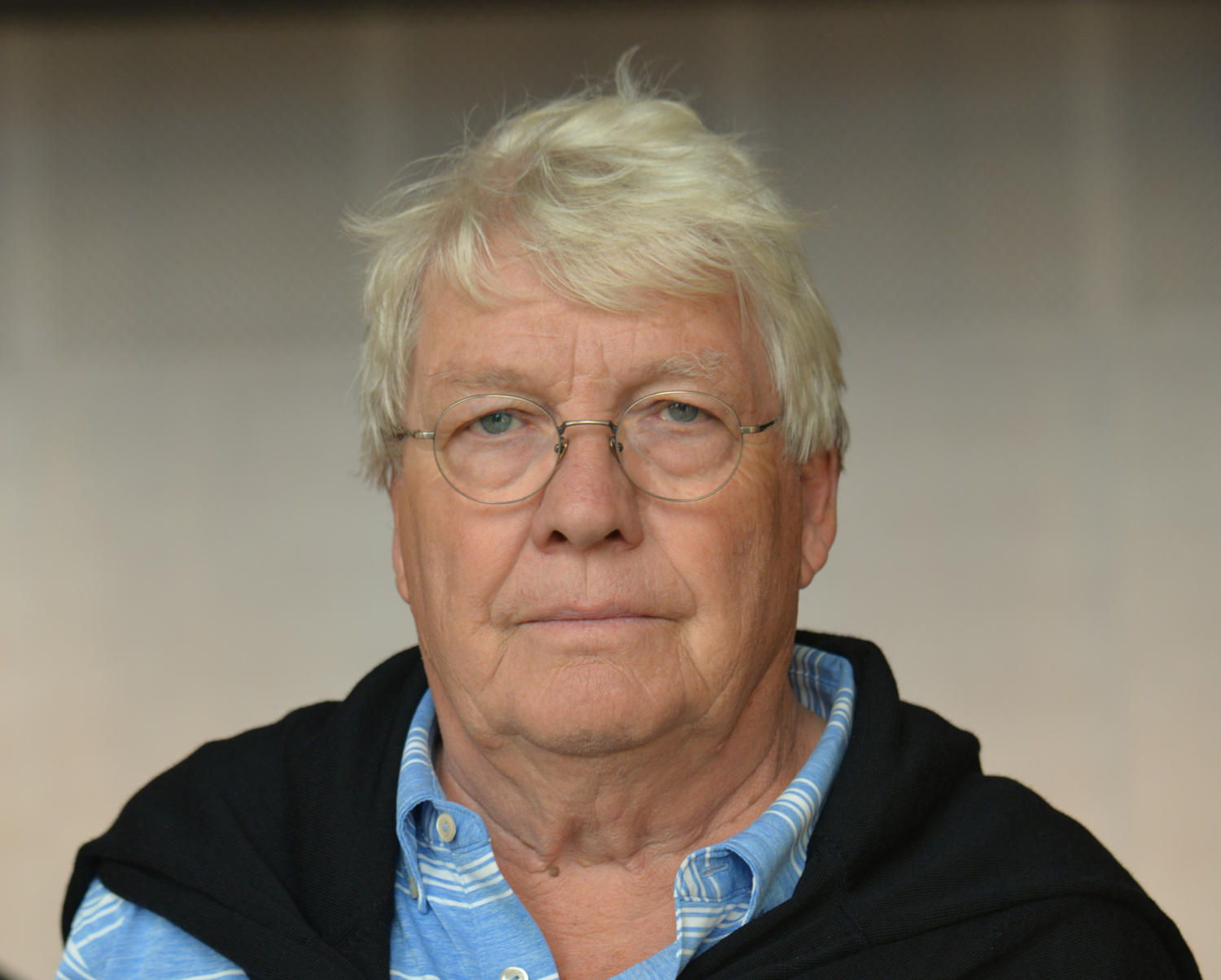

NAB Group Executive Business and Private Banking Andrew Irvine said businesses would drive Australia’s economic recovery.

“We want to support businesses by continuing to lend at competitive rates and providing the service and products they need. This includes supporting fast access to credit for small business customers by reducing QuickBiz interest rates by 200 basis points, which comes on top of a reduction of 200 basis points in March 2020 at the onset of COVID-19,” Mr Irvine said.

“We have also recently introduced a number of initiatives to help businesses recover, including the introduction of automatic merchant choice routing, simplified merchant pricing and the introduction of Pollinate to bring powerful digital sales analytics to our customers.”

The majority of NAB business customers have market linked loans, with their loan rates based off the Bank Bill Swap Rate. The actions from the RBA has seen this rate drop by approximately 0.90% in the past twelve months which has resulted in more than $700 million of lower interest costs for NAB customers.

NAB customers wanting more information on these changes are encouraged to get in touch with us to discuss the options available to them. Personal banking customers can book a home loan appointment online at nab.com.au.

Background:

- Every month, NAB lends, on average, $4 billion for customers to buy, renovate or refinance their home.

- The NAB Business Support Loan has been designed to be part of the Federal Government’s SME Guarantee Scheme providing up to $1 million with no repayments required in the first six months.

- Small Business customers can also access instant unsecured loans of up to $250,000 for existing customers and $100,000 for new customers with NAB’s QuickBiz.

- NAB is the second bank to join the Pollinate network, together with NatWest. The platform was launched by NatWest as Tyl in the UK in September 2019. Likened to internet banking for merchants, Pollinate provides sales analytics to SMEs at their fingertips. Businesses will be able to view their sales data, track average transaction value, compare day periods and even filter by payment type.

Important information

1The actual rate that will apply will be the effective fixed rate as at the day of drawdown unless the customer takes out Rate Lock. This means that applications submitted prior to Tuesday 10 November 2020 will be eligible for the new rate. Please note that customers are not entitled to a refund of the Rate Lock fee even if they receive a lower interest rate at drawdown.

Fixed rate loans may be subject to significant break costs. NAB’s fixed home loans are not eligible for interest offset arrangements, and you cannot redraw any additional repayments you’ve made during the fixed rate period.

The above home loan fixed rate changes do not impact existing loans.

NAB may change rates, including any special rate offer, at any time without notice.

Terms and Conditions, and Fees and Charges apply to all NAB products and are available on application. NAB lending criteria applies. ³Ô¹ÏÍøÕ¾ Australia Bank Limited ABN 12 004