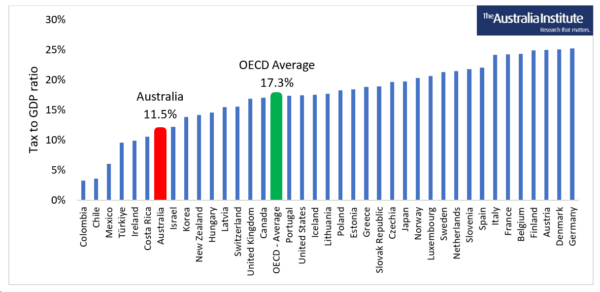

Australia ranks 9th lowest for all taxes and, when adjusted for social security contributions (SSCs), 7th lowest for income taxes out of the 38 nations in the Organisation for Economic Co-operation and Development (OECD).

Key Findings:

- Australia is a low tax country. An additional $105 billion in revenue would be collected each year if, as a nation, we simply taxed at the average rate of the OECD.

- Social security contributions (SSCs) are levied by all countries in the OECD except Australia and New Zealand to assist in funding a wide range of social benefits.

- SSCs are categorized as taxes on labour income by the OECD and reduce the take-home pay of workers and are therefore effectively an income tax.

- Assertions that Australia needs to reduce its reliance on income tax misguidedly exclude the impact and role of SSCs.

- Australia appears to be an income tax-reliant simply because other things are taxed so poorly:

- While income tax in Australia as a proportion of GDP is just 11.5%, it represents more than a third (39%) of total tax collected each year.

- For comparison, income tax in Belgium as a proportion of GDP is very similar at 11.3%, but represents only 26.7% of total tax collected in that country.

Figure 1: OECD Countries ranked by Tax to GDP Ratio

(Taxes on income, profits, and capital gains for individuals plus SSCs as a proportion of GDP in 2021)

“Australia is a low taxing nation,” said Matt Grudnoff, Senior Economist at the Australia Institute.

“The claim Australia is over-reliant on income tax is based on a semantic trick about what ‘income tax’ really is. While it doesn’t stand up to scrutiny, blindly accepting this premise now seems to be the cost of entry to the tax debate in this country.

“Indeed if we raised our level of tax merely to that of Japan or Canada – nations hardly regarded as high taxing – the government could raise an extra one hundred billion dollars every year.”

“Community support for the Government’s changes to the Stage 3 show Australians are up for a genuine conversation about how revenue is raised. Reforming the Petroleum Resource Rent Tax (PRRT) and cutting tariffs subsidies? for fossil fuel companies would raise billions without increasing the tax levied on everyday Australians.”