As it marks the first-year anniversary of investment scam disruption, ASIC announced today the takedown of more than 7,300 phishing and investment scam websites that seek to swindle consumers out of their information.

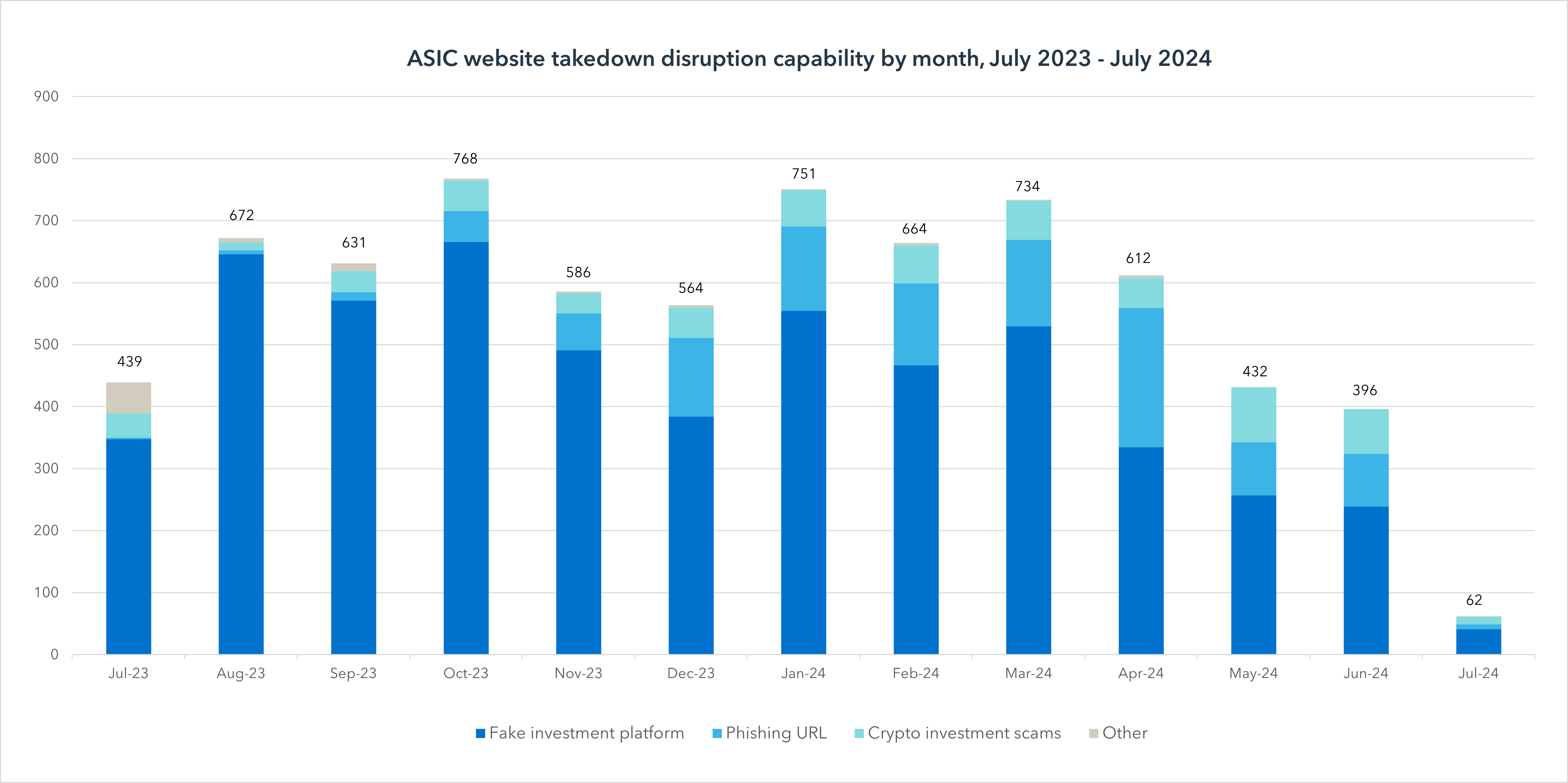

Since July 2023, ASIC has coordinated the removal of over 5,530 fake investment platform scams, 1,065 phishing scam hyperlinks and 615 cryptocurrency investment scams.

Investment scams remain the leading type of scam impacting Australians, resulting in . ASIC reminds all consumers to remain vigilant to social media hyperlinks that promote online trading and cryptocurrency investments.

Today’s announcement follows ASIC’s warning about fake news articles and deepfake videos of public figures that endorse , particularly on social media. Investment trading platform scams accounts for the largest component of ASIC’S website takedowns.

Scammers use digital platforms, including social media, to lure unsuspecting consumers, directing them to scam websites. Shutting down these websites disrupts the transmission of the scam and breaks the link between scammers and their potential targets.

Deputy Chair Sarah Court said: ‘Australians are still losing billions of dollars each year to scams. Scammers are criminals targeting the hip pockets of hard-working Australians – they don’t discriminate, and they use sophisticated techniques to steal information and money.

‘The scams landscape is rapidly evolving. Innovative technology developments may improve how we live and work, however they also provide new opportunities for scammers to exploit.

‘Every day an average of 20 investment scam websites are taken down. The quick removal of malicious websites is an important step to stop criminal scammers from causing further harm to Australians.

‘Scammers will continue to adapt and find new ways to lure consumers, and ASIC remains proactive in detecting and disrupting investment scams,’ Ms Court added.

ASIC regularly issues consumer warnings and conducts targeted surveillance to combat scams. Its close partnership with the ³Ô¹ÏÍøÕ¾ Anti-Scam Centre has included sharing data and intelligence and implementing disruption action as demonstrated by the recent investment scam fusion cell. ASIC is working with the ³Ô¹ÏÍøÕ¾ Anti-Scam Centre to make Australia a harder target for scammers.

Background

Scams are a core strategic priority for ASIC

Combating and disrupting investment scams is a core strategic priority for ASIC. Our investment scam and phishing website takedown disruption capability is part of the government’s Fighting Scams initiative to disrupt scams and protect Australians from financial harm.

ASIC works with other government agencies and industry to coordinate scam disruption strategies including through the ³Ô¹ÏÍøÕ¾ Anti-Scam Centre (NASC) and co-leading the first NASC Fusion Cell, focused on Investment Scams. The NASC’s 2023 targeting scams report reported a drop in overall losses from investment scams from $1.5 billion in 2022 to $1.3 billion in 2023. The downward trend in losses correlates to several key government and industry initiatives such as ASIC’s investment scam website takedown capability.

How the takedown capability works

ASIC refers suspicious websites to a third-party company specialising in cybercrime detection and disruption. Once evidence of malicious activity is confirmed, the takedown process begins, including identifying relevant parties who can help to take the attack offline. The types of websites targeted include fake or imposter entities offering investment scams to Australians through fake investment trading platforms and cryptocurrency investment scams.

Examples of investment scam websites taken down

Quantum AI: ASIC’s takedown disruption capability interrupted scammers who used celebrities and high-profile Australians to promote fake investment trading platforms, such as Quantum AI, claiming to use AI technology and quantum computing to generate high returns for investors. Fake celebrity endorsements, including from people such as Chris Hemsworth and Elon Musk, are used in these scams to entice consumers to enter into investments with low initial costs and unrealistic returns. View the and the .

Cryptocurrency investment scam takedown – Dexa Trade Markets: ASIC received an investment scam report from an Australian consumer about falling for an online cryptocurrency investment scam that falsely claimed it was internationally regulated, had billions in trading volume and millions of investors. Take-down occurred an hour after ASIC referred the website to the takedown provider. Other potential investors were warned by ASIC issuing a warning through its investor alert list. View the .

Helping consumers stay informed about scams

ASIC publishes and through its consumer website, , information on investment scams. Moneysmart provides detailed information on investment scams and how they work, including impostor bond scams, superannuation scams, and cryptocurrency scams.

There are steps consumers can take to minimise the risk of being scammed, including:

- check ASIC Moneysmart’s to help keep you informed about investments that could be fraudulent, a scam or unlicensed.

- go to ASIC Moneysmart’s to see how you can check if the company or person is licensed or authorised to offer the investment.

ASIC’s Moneysmart investor alert list helps to inform consumers about investments that could be fraudulent, a scam, or unlicensed. It also includes ‘impostor’ entities who impersonate or falsely claim to be associated with a legitimate business (impersonation scam).

Consumers should remember to:

STOP – Don’t give personal information or act on investment advice you have come across on social media. Don’t feel pressured to invest. If you have any doubts, stop communicating with them.

CHECK – Ask yourself if you really know what you are investing in. Scammers can create fake news and reviews to make an investment seem legitimate. Do an internet search to see if there are warnings about this investment scam, including if a well-known public figure has warned about being impersonated. And check ASIC’s website to confirm if the person or entity offering the investment is licenced or authorised to do so.

REPORT – Act quickly if something feels wrong. If you have shared financial information or transferred money, contact your bank immediately. Help others by reporting scams to Scamwatch.