Premium Australian beef such as Australian Wagyu has an opportunity to tap into the demands of increasingly affluent consumers in key Asian markets where conspicuous consumption is on the rise, and the popularity of Japanese and Korean cuisine is growing.

That was the message MLA International Business Manager – Japan and Korea, Andrew Cox, delivered to producers and stakeholders at the 2019 Wagyu Edge conference in Adelaide earlier this month.

Mr Cox said while growing household incomes and demand for Australian beef in the region is on the rise, Australian Wagyu must differentiate itself from global competitors.

“Global beef demand is growing much faster than we can supply, but trade is increasingly volatile and we operate in an increasingly competitive environment,” Mr Cox said.

“South American exports are shifting to Asia, particularly China, and US exports are returning to pre-BSE levels in Japan and Korea.

“Australia is very reliant on Asia – 73% of our boxed beef and offal export volumes in 2018 went to Asia.

“Beef is becoming more affordable for many consumers, particularly in China and South East Asia (SEA).

“Households earning a disposable income above US$35,000 in SEA is forecast to nearly double by 2023. The number of even higher income households is also set to grow – that is, households earning a disposable income above US$75,000.”

MLA market research has found affluent consumers have stronger awareness and associations toward Australian beef and spend more on beef and eat Australian beef more often than the mainstream.

“Wagyu is the most popular and is believed to have the best quality,” Mr Cox said.

“MLA has identified five key cities out of 30 across eight countries in SEA where household incomes are rising, offering significant growth opportunities for Australian beef exports – Singapore, Kuala Lumpur, Jakarta, Ho Chi Minh city, Bangkok and Manila.

“However, each market requires a different strategy for premium beef such as Australian Wagyu.”

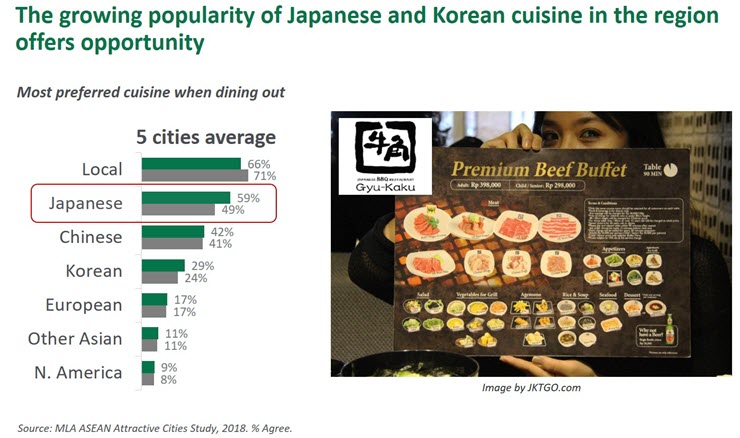

Mr Cox said the growing popularity of Japanese and Korean cuisine in the region particularly offers opportunity for Australian Wagyu.

“The number of Japanese restaurants in the region more than doubled between 2013 and 2015, and have probably doubled again since then, and that growth has occurred outside of Japan,” Mr Cox said.

“Japanese cuisine is the second most preferred cuisine when dining out, just behind local cuisine, and well ahead of European and North American cuisine.

“When affluent consumers in Asia seek to have Japanese cuisine, they seek to have the best quality and that is where Australian Wagyu comes in.”

Mr Cox said to further capitalise on the premiumisation boom, Australian Wagyu needs to have a point of difference in relation to rival prime beef such as US Prime, long-fed Angus, and Wagyu from other countries.

“Confusion is the enemy of success. We have a wide range of quality specifications in Australian Wagyu and the product is sold by combination of country of origin and breed, so we need to build equity around that.”