86% of all Western Australians – everyone who pays tax in the state – will receive a tax cut as a result of the changes, with almost $200 million in additional tax cuts flowing to the state.

Key Figures:

- 446,949 Western Australian taxpayers (28% of the state’s taxpayers) who earn between $18,200 and $45,000 would not have received a tax cut under the original Stage 3 will now receive one

- All 1,394,068 Western Australian taxpayers will receive a tax cut because of the changes to Stage 3

- Taxpayers earning between $45,000 and $120,000 will receive an additional $804 per year – 706,371 taxpayers in WA fit into this bracket

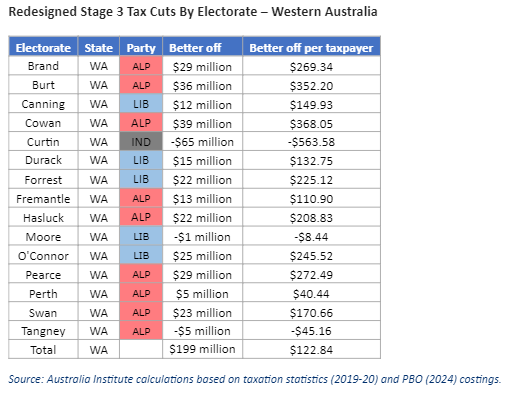

- Western Australian taxpayers will be $199 million better off as a result

- On average, taxpayers in 12 of 15 electorates in WA will be better off under the redesigned Stage 3 than under the old approach

“The Albanese Government’s changes to Stage 3 will see upwards of 440,000 Western Australians receive a tax cut after being completely left out under the original plan,” said Greg Jericho, Chief Economist at the Australia Institute.

“This shows just how unfair the original Stage 3 cuts were, overwhelmingly benefitting those on the highest incomes while so many others missed out. The changes to Stage 3 will benefit those people on lower and middle incomes who are really feeling the pinch of cost-of-living pressures.

“There is strong support for the Albanese government’s decision to restructure these cuts, given the vastly different economic circumstances than when they were legislated. Our research shows two-thirds of people think it is more important to adapt the economic policy to suit the changing circumstances, even if that means going against an election promise.

“Every Western Australian taxpayer will now get a tax cut, rather than hundreds of thousands of people missing out.”

Redesigned Stage 3 Tax Cuts By Electorate – Western Australia