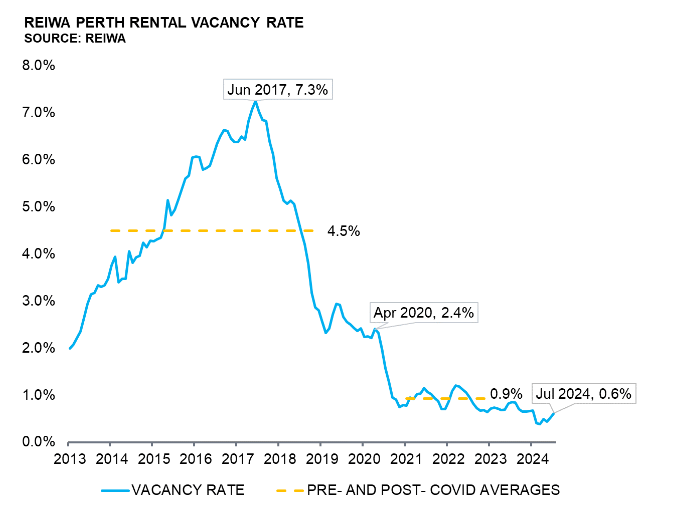

Perth’s vacancy rate rose slightly in July.

REIWA President Joe White said the vacancy rate increased marginally to 0.6 per cent in July, reflecting the slow easing of the rental market.

“Perth has seen a sustained period of extremely low vacancy rates, with the vacancy rate sitting consistently below 1 per cent since August 2022,” he said.

“It dropped to a record low of 0.4 per cent in March 2024, before sitting at 0.5 per cent in April, May and June.

“This month’s figure is a move in the right direction, but it is still very low and vacancies are still filling quickly, particularly for properties in the more affordable price brackets.”

REIWA considers a balanced market to have a vacancy rate between 2.5 and 3.5 per cent. The last time it was 2.5 per cent was September 2019.

Mr White said the market had been experiencing unique and challenging conditions for several years, but there were signs of improvement.

“Rent prices are recording periods of stability, dwellings are taking slightly longer to rent and rental listings are increasing,” he said.

“The changes are a result of a couple of factors.

“Firstly, there have been changes to demand.

“Demand has been self-moderating. We are seeing an increase in the size of tenant households, and people choosing to buy over renting or choosing to remain in, or return to, the family home to avoid the rental roundabout.

“The market also appears to have reached an affordability ceiling. Tenants cannot afford to keep up with rising rent prices. They are either renting with other people to share the cost burden or choosing to rent smaller, more affordable properties.

“The second change has been to supply.

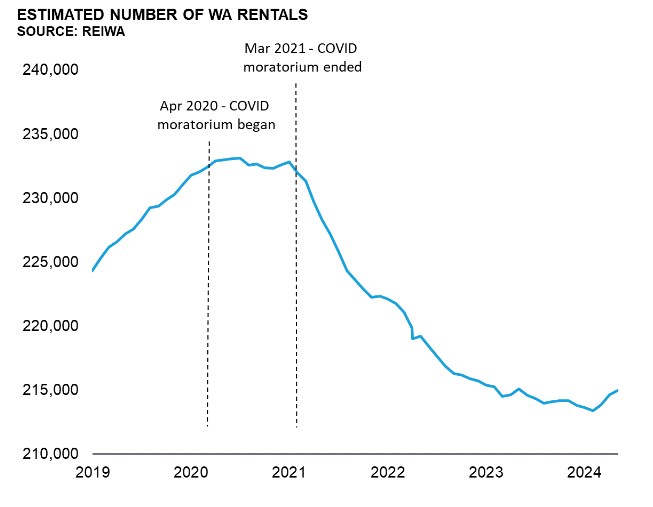

“There has been an uptick in the number of estimated rentals, with new supply coming to the market.

“Investor activity has been increasing over the past 12-18 months and, as well as buying established properties, investors have also been purchasing house and land packages. These new builds are being completed and are starting to come to the market. This is slowly boosting new supply. And there is more in the pipeline.

“In addition, some tenants have finally had their new homes completed and are moving out of their rental, which frees up some existing supply.

“We are still a long way from a balanced market, but the numbers are encouraging.”