The Eastern States Trade Lamb indicator hit 900c/kg cwt for the first time last week and achieved the same benchmark again on Tuesday.

Lamb prices have stabilised after rising to unprecedented levels, but it remains a challenge to gauge what the next few weeks may hold. Markets could find further price support throughout July before they settle as new season lambs begin to enter the market from August. The rate at which new season lambs enter the market will be pivotal. A repeat of last year, whereby a lag between old and new season lambs hitting the market pinched slaughter supply, would sustain support across all sheep and lamb categories well into spring.

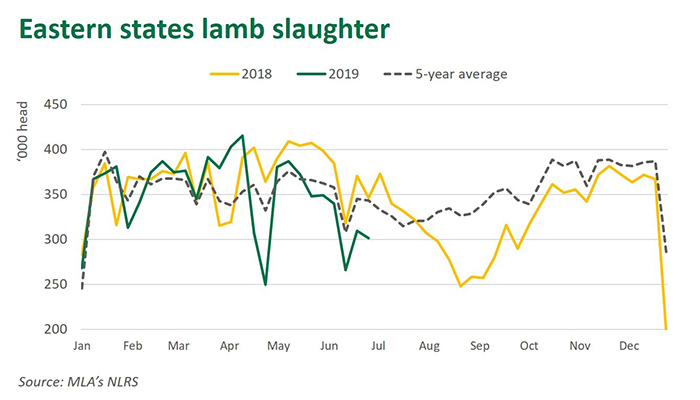

Slaughter numbers in decline

Lamb slaughter numbers have been in contraction and were 13% below year-ago levels last week. As highlighted below, the number of lambs slaughtered has been significantly lower than the five-year average since mid-May. Last year, drought and very high supplementary feed prices delayed the onset of finished young lambs and created a supply deficit, driving prices to a peak in September. Drought conditions persist in many regions however the prevalence of supplementary feeding, given the strong returns, this season may support the timing of finished lambs. That said, the total number of lambs on the ground will be a limiting factor for supply due to a reduced flock and fewer ewes joined, as highlighted in the recent .

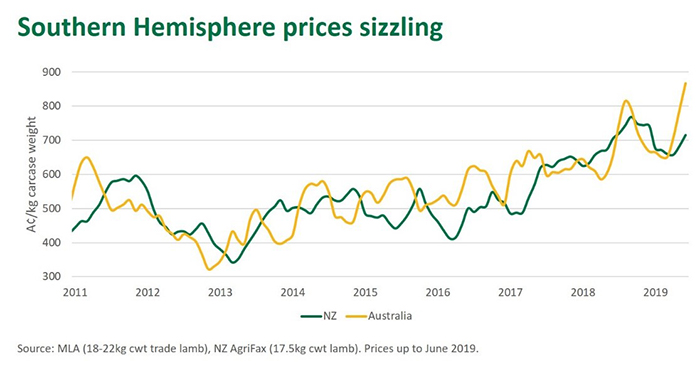

Australia & NZ lamb prices on the up

Lamb supplies in New Zealand will continue to contract in the coming weeks, pressuring prices on the other side of the Tasman too. New Zealand lamb prices are now following the same trajectory to last year, when record lamb returns were achieved in September. The Australian national trade lamb indicator (18-22kg cwt) started its rally much earlier than its New Zealand counterpart this year and, on a currency-adjusted basis, moved to a 21% premium in June.

AgriHQ have reported one large New Zealand processor is offering a fixed NZ900c/kg (equivalent to AUD859c/kg based on current exchange rates) contract to secure lamb supplies in August. Whether the overall market achieves this level will depend on the severity of the winter contraction however New Zealand lamb prices reaching record levels seems a realistic possibility.

Looking ahead

A limited pool of sheepmeat, particularly high quality, combined with growing demand in key markets, namely China and the US, has underpinned robust prices on both sides of the Tasman. Demand fundamentals remain strong despite record prices from key suppliers. Limited availability in the months ahead from the two leading global sheepmeat exporters will sustain pressure on lamb prices, certainly until new season lambs enter the market.

© Meat & Livestock Australia Limited, 2019

More information

To build your own custom report with MLA’s market information tool click .

To view the specification of the indicators reported by MLA’s ³Ô¹ÏÍøÕ¾ Livestock Reporting Service click .