VANCOUVER, BC / ACCESSWIRE / December 18, 2024 / Q2 Metals Corp. (TSXV:QTWO)(OTCQB:QUEXF)(FSE:458) (“Q2” or the “Company”) is pleased to report that the previously announced option agreement made between 9219-8845 QC Inc. (” CMH “), Anna-Rosa Giglio (together with CMH, the ” Vendors “) and the Company, as amended and restated December 17, 2024 (the “Agreement”), has closed.

Under the terms of the Agreement, Q2 has acquired the exclusive right and option to acquire a 100% interest in 545 mineral claims (the “Additional Cisco Claims”), which more than triples its mineral claim position at the Cisco Property.

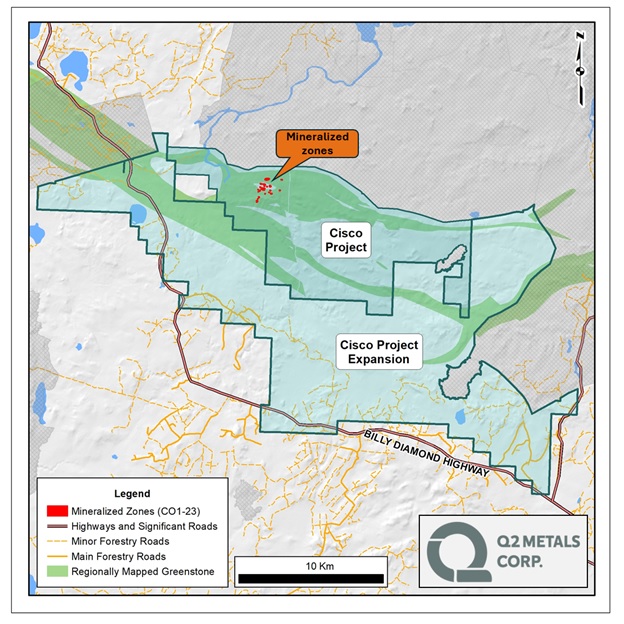

The Cisco Property is now comprised of a total of 767 contiguous mineral claims over 39,389 ha, including more than 30 km of strike length on the Frotet-Evans Greenstone Belt, which hosts the Sirmac and Moblan lithium deposits, located 130 km and 180 km away, respectively. The Additional Cisco Claims are primarily south of the original Cisco Property claims, adding several kilometres of prospective greenstone rocks and providing extensive strategic sites for future development and mining infrastructure scenarios.

To acquire the Additional Cisco Claims, the Company must pay to CMH an aggregate of $2,400,000 over a period of 42 months and complete $1,200,000 of exploration expenditures during that time. Certain of the Additional Cisco Claims are subject to 3% gross metals returns royalty (the ” GMR “) and the remaining Additional Cisco Claims are subject to a 2% net smelter returns royalty (the ” NSR “) and 1% gross metals returns royalty. 2% of the GMR may be repurchased for $3,000,000 and 1% of the NSR may be repurchased for $500,000.