Online learning, and health and fitness spending intentions increase as Australians make changes to their lifestyle amid the coronavirus pandemic

The latest monthly data to the end of March 2020 published by the CBA Global Economic and Markets Research team indicates a clear and sustained response to the efforts to slow the spread of coronavirus, as Australians adapt to a new way of living. CBA Chief Economist Stephen Halmarick says the economic shutdown clearly impacted all HSI indicators, with most spending categories experiencing falls.

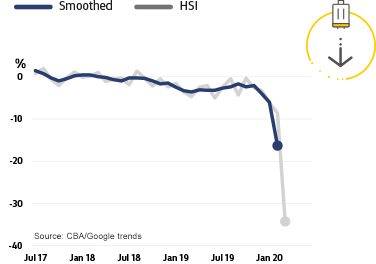

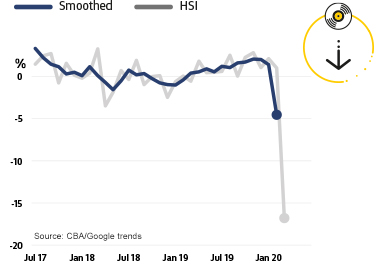

“When we look at spending intentions last month, we can see both entertainment and travel spending intentions declined sharply as the economic shutdown took hold, with both categories witnessing the lowest readings since the series began,” Mr Halmarick said.

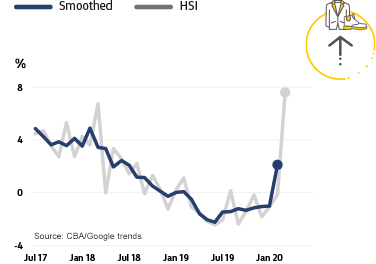

“In contrast, retail, online learning and health and fitness spending intentions saw sharp rises as people prepared themselves for an extended shutdown of many parts of the economy,” Mr Halmarick added.

Mr Halmarick points out that while people were feeling confident with home buying intentions in March, the latest market data indicates residential property prices may fall by up to 10 per cent over the next six months*.

“Looking at our home buying intentions series in March 2020, people were feeling confident with spending intentions sitting close to all-time record highs. Since then we have seen turnover in the housing market decline significantly after public open houses and auctions were banned, with rising job insecurity also being a factor,” Mr Halmarick said.

Mr Halmarick says the latest HSI series also highlights how some Aussies are remaining focused on learning new skills online.

“After a large fall in February 2020, education spending intentions increased in March – as online and virtual schooling and higher education began to dominate,” Mr Halmarick said.

The series also showed shopping for a new car or commercial vehicle declined as people limited their discretionary activities, with the recovery previously seen in motor vehicle spending intentions stalling in March.

The HSI series offers a forward-looking view by analysing actual customer behaviour from CBA’s transactions data, along with household search activity from Google Trends. This combination adds to insights on prospective household spending trends in the Australian economy.

Monthly Household Spending Intentions

Retail Spending Intentions

|

Travel Spending Intentions

|

³Ô¹ÏÍøÕ¾ Buying Spending Intentions

|

Education Spending Intentions

|

Entertainment Spending Intentions

|

Motor Vehicles Spending Intentions

|

Health & Fitness Spending Intentions

|