Retail spending intentions have dipped while home buying intentions remain high, according to CBA’s latest research.

CBA’s Chief Economist Michael Blythe has today confirmed that household spending intentions stumbled in September after the positive lead reported last month. Nonetheless, the series also highlights some underlying improvement in spending intentions more broadly.

The offers a forward-looking view by analysing actual customer behaviour from CBA’s transactions data, along with household spending intentions from Google Trends searches. This combination adds to insights on prospective household spending trends in the Australian economy.

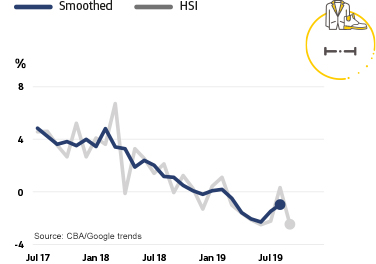

Mr Blythe said: “The latest edition of the HSI series shows a disappointing downturn in retail spending intentions.

“While there were some positive signs in sectors where the tax refunds now flowing would most likely be spent, the overall picture is one of continued consumer caution,” Mr Blythe added.

Mr Blythe suggested the pull back in retail spending intentions was potentially a sign that interest rate cuts are blunting some of the stimulus from income tax refunds.

“Our view for some time now is that monetary policy changes do little to support household activity. While a positive ‘wealth effect’ is emerging from rising home prices, consumers interpret rate cuts from record lows as a sign of economic weakness and keep their wallets shut,” Mr Blythe said.

Nevertheless, the overall message from the various HSI measures is that spending intentions edged higher in Q3 and have now bottomed out.

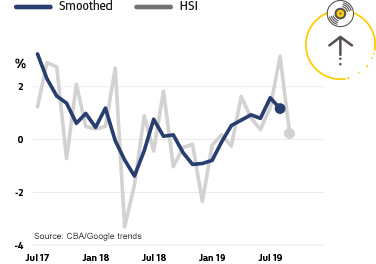

“Spending intentions for entertainment, education and motor vehicles are now pointing up,” Mr Blythe said.

“Also, importantly, the improvement in home buying intentions is holding up – supported by the RBA rate cuts.

“A positive ‘wealth effect’ from the housing market should help support broader economic growth in the year ahead,” Mr Blythe added.

Household Spending Intentions – October 2019 edition

CBA obtains an early indication of spending trends across seven key household sectors in Australia. Apart from home buying, the series covers around 55 per cent of Australia’s total consumer spend across; retail, travel, education, entertainment, motor vehicles, and health and fitness.

| Retail Spending Intentions |

|

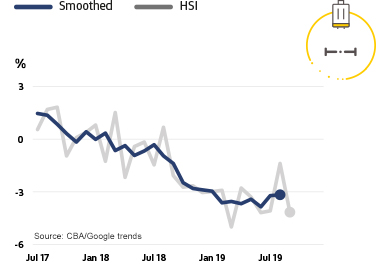

| Travel Spending Intentions |

|

| ³Ô¹ÏÍøÕ¾ Buying Spending Intentions |

|

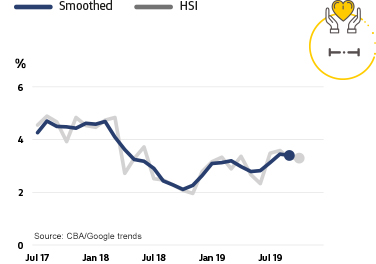

| Education Spending Intentions |

|

| Entertainment Spending Intentions |

|

| Motor Vehicles Spending Intentions |

|

| Health & Fitness Spending Intentions |

|