This article is part of our Top 10 Trends of 2024. Keep an eye out over the coming weeks to read the rest of the series.

The national sheep flock was built on Merinos and a strong Australian wool sector. More recently, the sector has trended towards dual-purpose and meat breeds, as well as mixed cropping enterprises. This trend has been influenced by input prices, policy decisions, wool and livestock prices, and shifting generational desires.

Australia is now one of the most significant producers and exporters of sheepmeat globally. The most recent export volume data for the 2024 calendar year (359,299 tonnes) was 10% higher than the previous record (set in 2023). Mutton exports rose to 255,098 tonnes, 22% higher than the 2023 record. These production levels over the past 12 months show the sector’s strength in the meat game as turn-off was elevated in a period that was not entirely driven by destocking.

Historically, industry has shown that it can create strong lifts in supply and demand in lamb production. Investments in processing capacity, cold storage and a general lift in carcase weights have boosted the production capability of Australian sheepmeat. The average quarterly lamb production for the past two years has been 155,301 tonnes, 23% up on the previous decade of 126,078 and 61% above the decade prior, which sat below 100,000 tonnes. The expansion of sheepmeat breeds, investments in genetics, and improvements to fertility and production practices have enabled this shift.

The fastest-growing sheep breed type is ‘shedding sheep’. The uptake of shedding genetics has grown in traditionally wool-based regions as an alternate stock option. With lower infrastructure needs, decreased labour requirements and fertility benefits, more shedding genetics in the national flock will lead to higher sheepmeat production capability.

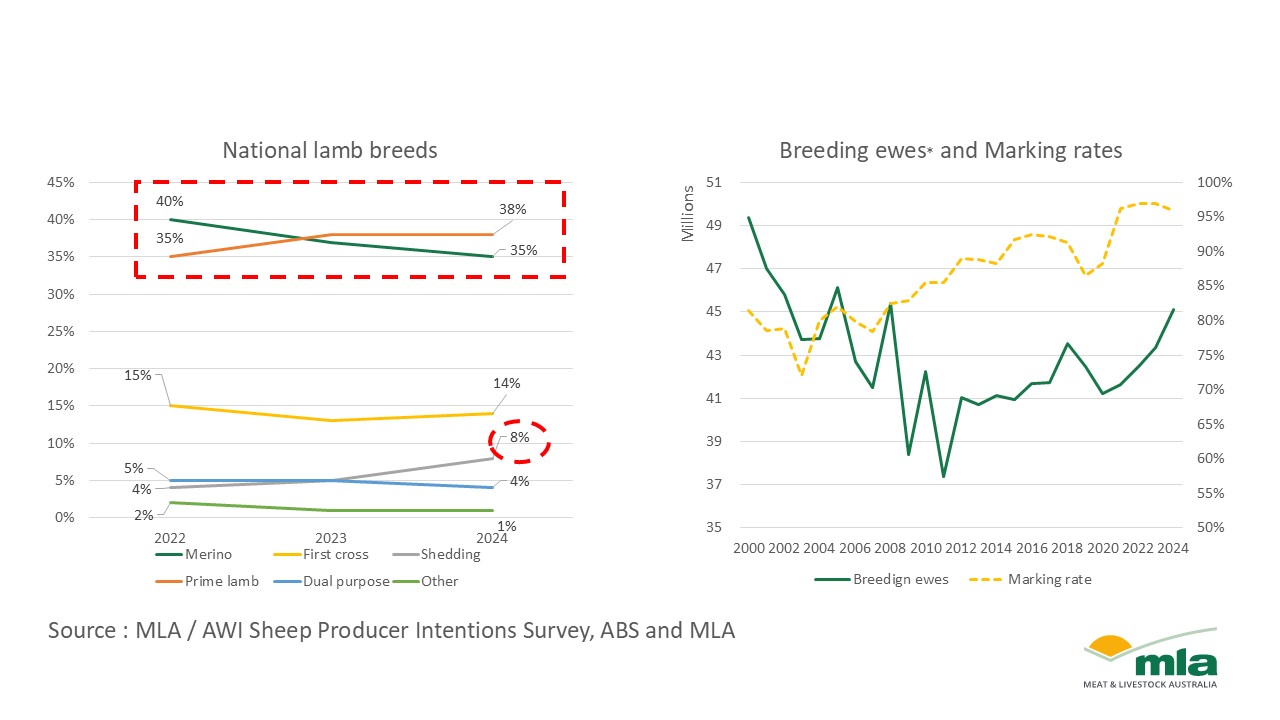

The Meat & Livestock Australia (MLA) and Australian Wool Innovation (AWI) Sheep Producer Intentions Survey collects information from approximately 12% of sheep businesses. Producers provide responses on industry sentiment, flock profile and their future intentions for their flock. From this survey, we gain data on the breed makeup of the national lamb flock.

The first year Merino lambs were not the largest cohort was 2023. Merino lambs made up 37% of the reported lamb drop, whereas prime lambs made up 38%. Figures for 2024 showed this trend continued, with Merinos dropping to 35% and prime lambs remaining level. As the chart below shows, shedding breeds have seen the strongest growth, doubling from a reported 4% of the lamb cohort to 8%. Anecdotally, this has been an extremely popular move in pastoral zones and across hardy Merino country.

Marketing rates have improved due to improvements in production practices. Breed has a strong influence on the national rate and, therefore, the size of the lamb cohort. In the chart below, rates have continued to trend upwards, which is another indication of a move away from Merinos, which traditionally have lower marking rates than other breeds.

While wool’s importance in Australia remains strong, the growth in sheepmeat will continue to have a strong impact on the production and output makeup of the broader food and fibre industry in Australia.

Attribute to: Erin Lukey, MLA Senior Market Information Analyst

MLA makes no representations as to the accuracy, completeness or currency of any information contained in this publication. Your use of, or reliance on, any content is entirely at your own risk and MLA accepts no liability for any losses or damages incurred by you as a result of that use or reliance. No part of this publication may be reproduced without the prior written consent of MLA. All use of MLA publications, reports and information is subject to MLA’s Market Report and Information Terms of Use.

/global-hiv-hepatitis-and-stis-programmes-(hhs)/hiv-antiretrovirals-south-africa.tmb-768v.jpg?sfvrsn=a77e98ec_1)