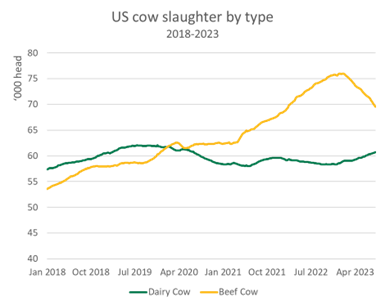

In 2023, the female slaughter rate (FSR) in the United States is 51.5%, suggesting that the US cattle herd is still destocking. At the same time, overall slaughter in the US is down 28% for the year-to-date, as overall female slaughter has declined at roughly the same rate as bull and steer slaughter.

This means that while production in the United States has dropped, it will likely continue falling for the next several years. Parts of the US remain in drought or have not received enough rain to begin repairing pasture, and high cattle prices are incentivising producers to sell cattle to repair balance sheets after several years of relatively low prices.

Source: Steiner consulting, USDA.

Note: Figures expressed as rolling averages

Dairy cow slaughter has remained relatively high, declining only 22% this year, while beef cow slaughter has fallen by 35%. This disparity has implications for Australian exports, as beef cows and dairy cows have distinct positions in the supply chain.

American forequarter cuts from beef breeds compete with Australian exports in North Asia. In contrast Australian beef is often substituted for American dairy cow beef in the US domestic ground beef market.

The considerable reduction in beef cow slaughter, alongside substantial declines in steer slaughter, has begun to affect American export volumes into North Asian markets. US exports to China, Japan and South Korea declined 14.5% year-on-year in June, the most significant drop so far this year.

By comparison, imports of Australian beef to China, Japan and South Korea in June rose 28% year-on-year. Over the past several years, an abundant supply of American beef has pushed US exports well above average, while Australian exports have been relatively low. The reduced supply of US beef is likely to increase demand for Australian beef in North Asia, especially in Japan and South Korea, where Australia and New Zealand are the largest exporters.

Relatively higher slaughter of dairy cows in the US has meant that the trim and leaner beef supply has held up comparatively well. This means that, despite the already substantial 60% increase in Australian beef exports to the US, prospects for manufacturing beef exports to the US are very positive, and demand in the US will likely continue to rise.

Over the next several months, a better picture of international supply dynamics are likely to emerge. Substantial reserves of frozen beef in storage across North Asia have slowed supply chains and tamped down demand, and the US FSR remains in destocking territory. As beef stocks begin to diminish and US female slaughter continues to decline, supply in Australia’s key markets will likely decline and demand for Australian exports will likely increase.

Latest news