These days we are able to collect a huge amount of data from our international markets. Economic data and other demographics, trade statistics, restaurant and retail spending, the size and scope of technical and economic access barriers, operational and political risk measures and domestic protein consumption and production are just some examples.

All this data is very useful for understanding, evaluating and classifying the many markets Australian red meat has access to and deciding ‘where to play’. But when deciding how to play, nothing is as valuable as the consumer and customer perception data we collect.

Consumer research helps us understand that despite the myriad differences in our many markets – cultural, economic, political and more – there are handy similarities in their perceptions of Australia and Australian red meat. Consumers everywhere crave healthy and delicious food they can trust, and provenance is becoming more important. Mention of ‘Australia’ conjures up an image of clean air, wide-open plains and warm friendly people. We have a strong reputation for being responsible, safe and reliable suppliers, and our red meat is highly regarded for its good taste and consistent quality. This holds equally true in Tokyo or Ho Chi Minh City as in London or Toronto.

Alongside consultation with industry, the research convinced MLA to rethink the distinct logos and creative material for each market and launch the ‘True Aussie (Beef/Lamb/Goat)’ program in 2013. Of course, we must still use local knowledge to tailor programs to specific cultures, but at the core we have one single brand strategy built upon knowledge of the global consumers.

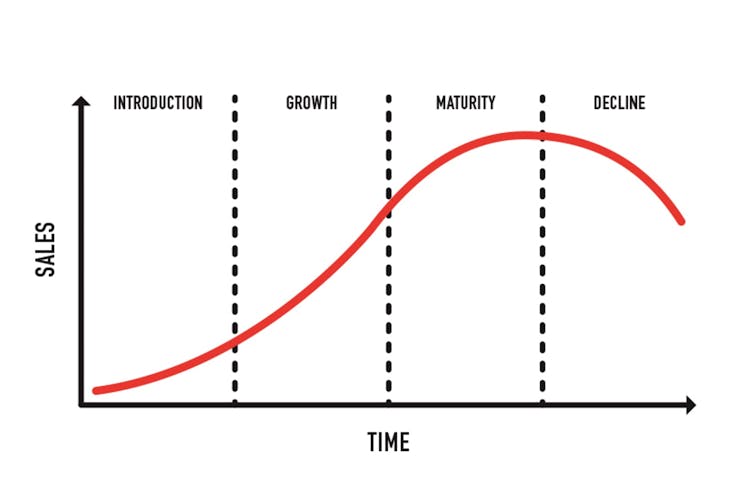

MLA commissions a consumer research tracker every two years, with coverage across key markets in Asia, the Middle East, North America and Europe. The questionnaire covers consumer behaviour and purchasing habits towards the category (beef, lamb, pork, chicken etc.) and the various red meat countries-of-origin present in each market. We are striving for number one status (among imported red meat) in emerging markets, and to entrench our hard-earned position in mature ones. We particularly look at consumer perceptions of Australian beef and lamb against key competitors for metrics such as trust and quality, and we particularly focus on markets that have seen recent changes in market access or the competitive environment.

The 2021 Global Consumer Tracker results indicate that although we maintain a strong position in key markets, the gap is narrowing – chiefly due to reduced exports and subsequent lower market share vs key competitors. We do still retain an advantage, but it is a timely reminder not to take anything for granted. With high prices and lower supply, ‘brand Australia’ must work even harder to demonstrate value for money to consumers faced with an increasing array of options.

If you are an Australian exporter/brand owner and would like to have a consumer insights update, please reach out me and we can arrange with MLA’s global insights and international marketing staff.

Andrew Cox

/who-office-at-the-united-nations-(wun)/un-sc-dg.tmb-768v.jpg?sfvrsn=6720f3fc_1)