Westpac NZ is making changes to its housing and term deposit rates, including cutting advertised home loan rates for the second time in three weeks.

Today’s changes mean Westpac has the joint-lowest advertised special rates of the five major banks on the popular 12 month and 18 month terms, and the outright lowest on the 3 and 4 year terms.

Overall, the bank has reduced its advertised special home loan rates across all terms by between 0.1% and 0.4% since the start of July.

The bank is also decreasing a range of term deposit rates by between 0.1% and 0.3%.

Westpac NZ General Manager of Product, Sustainability and Marketing Sarah Hearn says wholesale rates have fallen and the bank is passing that on to customers.

“This will be welcome news for customers due to re-fix their home loans in the near future,” Ms Hearn says.

“While the shorter terms are very popular at the moment, some homeowners still prefer the option of locking in more certainty with a longer rate, and we’re pleased to now be offering a 5-year advertised special rate below 6%.

“We continue to see fairly low numbers of customers struggling with cost of living challenges, but we know many families are doing it tough. We continue to proactively contact people who may be facing financial difficulty, and we encourage both borrowers and savers to contact their bank if they have concerns about the future.”

Pricing changes are effective Thursday 25 July and are detailed below.

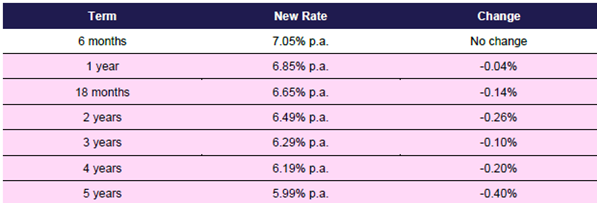

Fixed home loan rates – Special

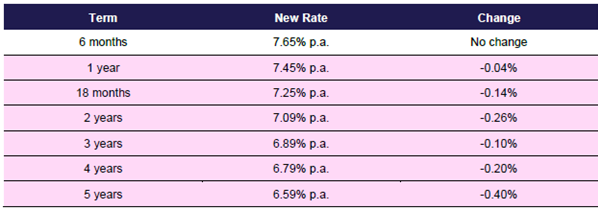

Fixed home loan rates – Standard

*Interest rates are subject to change without notice. Westpac NZ’s lending and eligibility criteria, and terms and conditions apply. A low equity margin may apply.

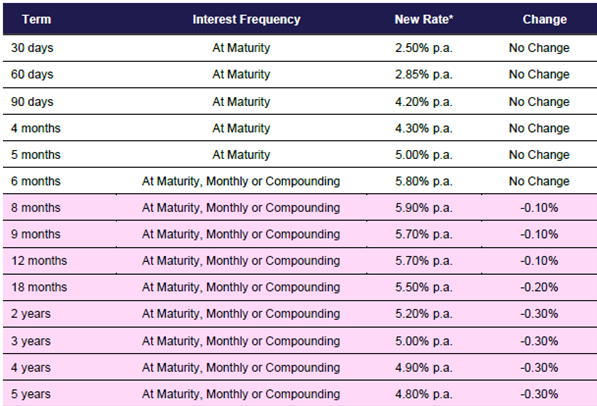

Term deposit rates